Twenty One Capital: A new Bitcoin treasury company enters the arena

Jack Mallers, Tether, and SoftBank Group launch Twenty One Capital through a SPAC merger, positioning it as a potential competitor to Strategy with 42,000 Bitcoin at launch

Jack Mallers, Tether, and SoftBank Group launch Twenty One Capital through a SPAC merger, positioning it as a potential competitor to Strategy with 42,000 Bitcoin at launch

An in-depth analysis of options trading approaches for Bitcoin-related securities, covering covered calls, volatility considerations, and risk management techniques.

An exploration of the current financial revolution as Bitcoin becomes the foundation for an expanding ecosystem of securities and investment products.

Exploring how companies are leveraging Bitcoin treasury strategies beyond accumulation, including strategic transformation, productive Bitcoin assets, and evolving operations to a Bitcoin standard

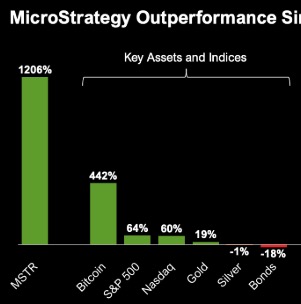

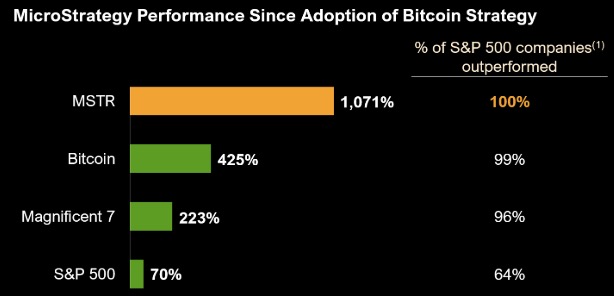

How one company is defying conventional corporate wisdom by building a Bitcoin-focused balance sheet that's outperforming traditional business models and the entire market

An in-depth analysis of key risks in corporate Bitcoin treasury strategies and how companies like Strategy are mitigating these challenges through non-recourse debt and careful leverage management

A comprehensive analysis of YieldMax MSTR Option Income Strategy ETF (MSTY), its unique synthetic exposure approach, distribution mechanics, and performance considerations

An analysis of GameStop's move into Bitcoin acquisition and how it mirrors Strategy's established approach to leveraging convertible debt for Bitcoin accumulation

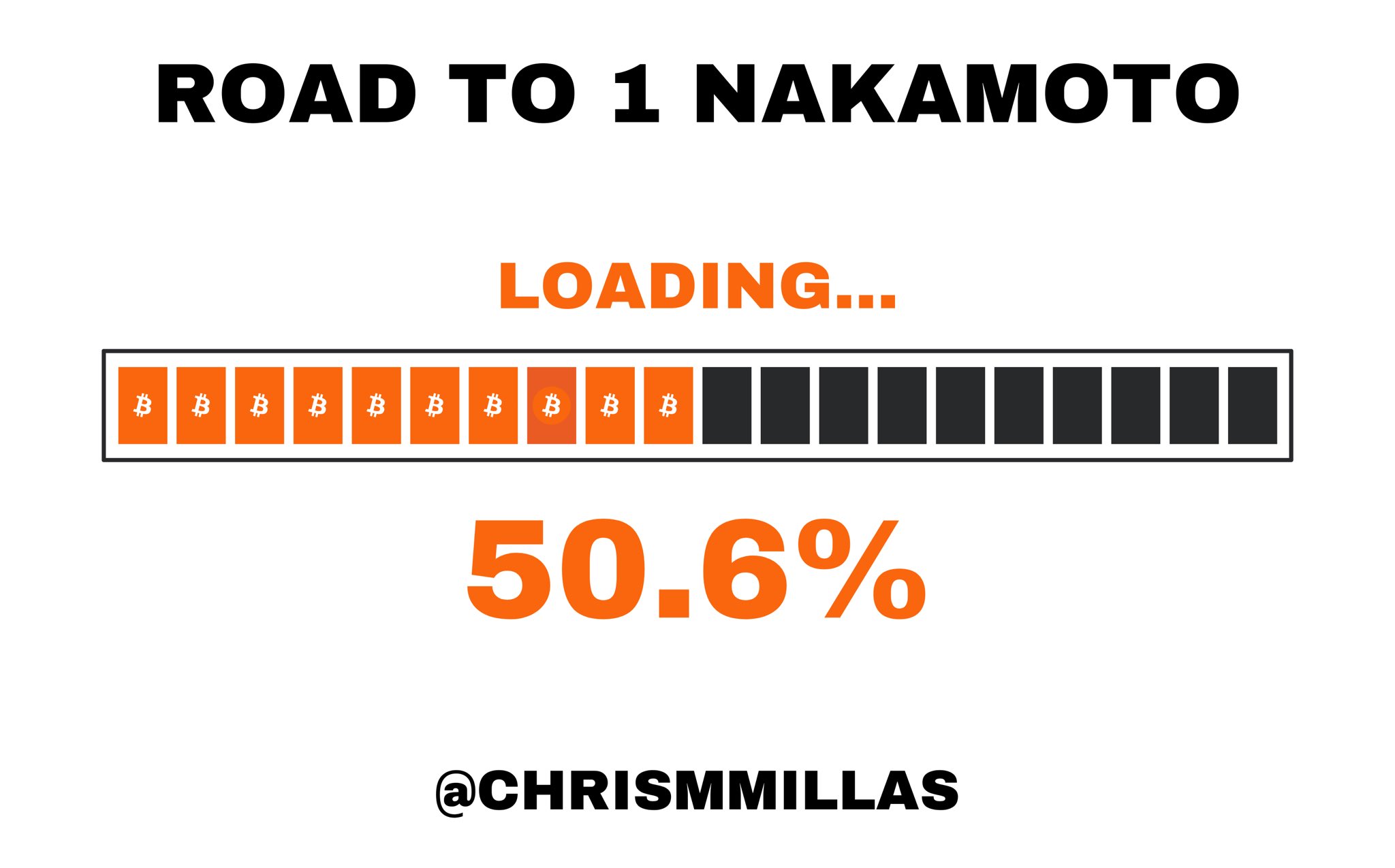

Analyzing Strategy's bold Bitcoin accumulation plans, the revolutionary impact of STRK and STRF offerings, and how these financial innovations could reshape the market in 2025

An in-depth analysis of how Strategy could transform from a Bitcoin treasury company into the world's first true Bitcoin bank through innovative financial services

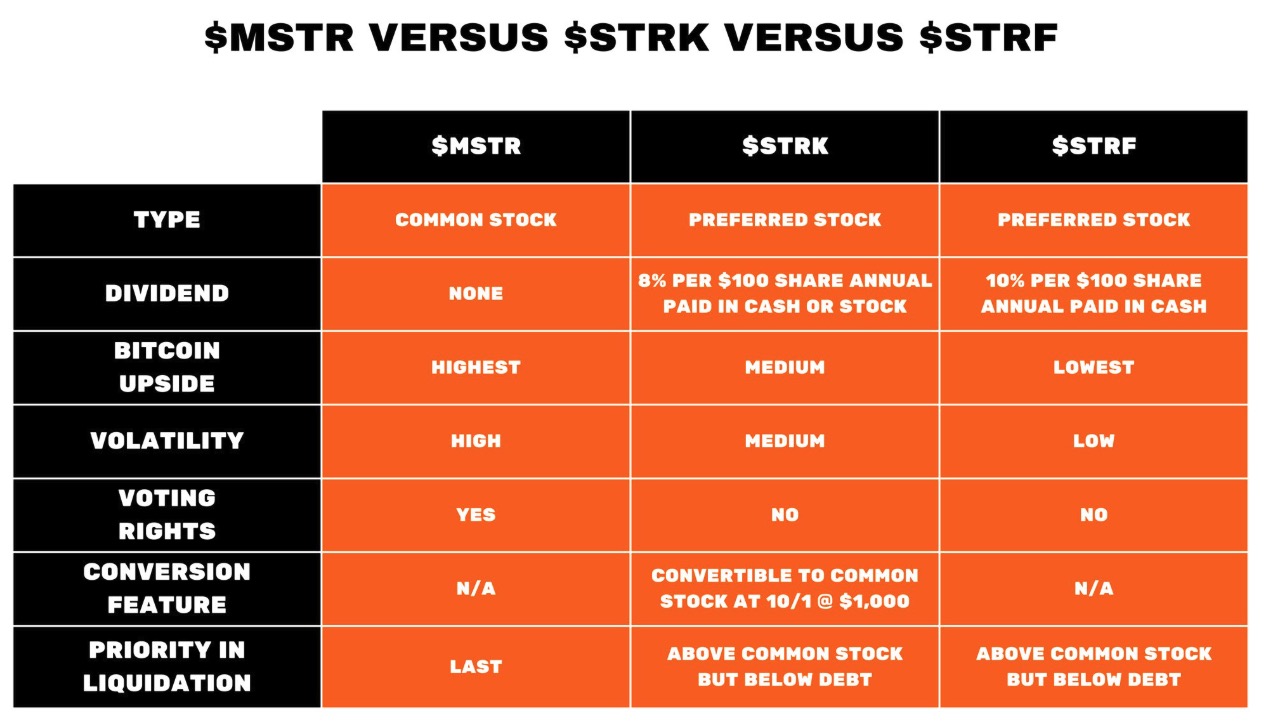

An in-depth look at Strategy's newest preferred share offerings, their unique features, and significance for investors.

A detailed comparison of Strategy's STRK and STRF preferred shares, examining how these innovative financial instruments target different investor profiles while advancing the company's Bitcoin strategy

How Strategy has transformed Bitcoin's volatility from a perceived liability into a strategic asset that powers its financial engineering and capital markets advantage

An analysis of Strategy's approach to meeting its growing dividend obligations from STRK and STRF preferred shares while continuing its Bitcoin acquisition strategy

A balanced analysis of recent criticisms about Strategy's STRF preferred stock offering and claims that Michael Saylor's Bitcoin accumulation strategy poses systemic risks.

An in-depth analysis of how Strategy's potential S&P 500 inclusion could trigger unprecedented capital flows and potentially lead to a $1 trillion valuation, driven by Bitcoin's performance and changing accounting standards.

An analysis of Strategy's current market positioning, trading dynamics, and potential for significant market cap growth in the coming years as it continues its Bitcoin treasury expansion.

An analysis of the divide between traditional financial metrics and Strategy's innovative Bitcoin acquisition model, revealing why current valuation frameworks fail to capture the company's true potential

The world's largest Bitcoin treasury company plans to issue 5 million shares of Series A Perpetual Strife Preferred Stock with a 10% fixed dividend yield, aiming to raise capital for further Bitcoin acquisition

Strategy conducts its first-ever Bitcoin purchase through the STRK preferred stock ATM program, signaling a new phase in its Bitcoin acquisition strategy

A point-by-point examination of the Financial Times article about Strategy's Bitcoin acquisition model, correcting misunderstandings and providing accurate context

A detailed analysis of Strategy's potential inclusion in the S&P 500 index, examining critical earnings requirements, inclusion dates, and the impact of Bitcoin price movements

Michael Saylor's vision for a Strategic Bitcoin Reserve as a cornerstone for United States digital supremacy in the 21st century, presenting Bitcoin as digital capital, property, and defense system worth potentially trillions to the nation.

Strategy has launched a massive $21 billion at-the-market offering for its 8.00% Series A Perpetual Strike Preferred Stock, expanding its capital raising capabilities for further Bitcoin acquisition

Analysis of US government's executive order to create a Bitcoin reserve and crypto stockpile from existing holdings, with insights from David Sacks on budget-neutral accumulation strategies and future plans.

A detailed analysis of common criticisms against Strategy's Bitcoin accumulation model, examining concerns about sustainability, debt structure, and the 'Ponzi scheme' narrative

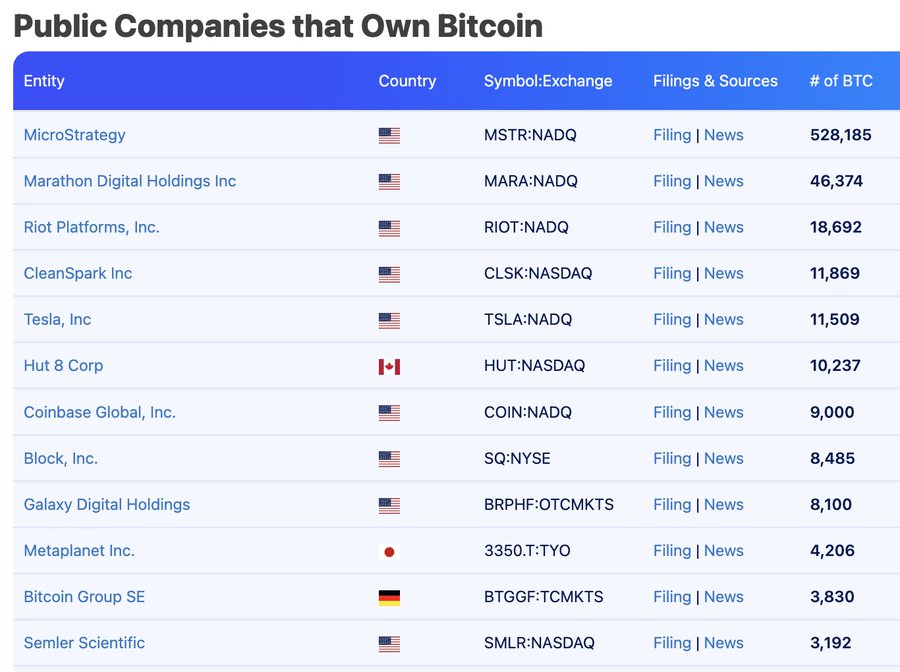

Exploring how Zipf's Law predicts the future distribution of corporate Bitcoin holdings and why Strategy is poised to maintain exponential dominance over other corporate holders

Exploring the powerful mental models that explain Strategy's unprecedented approach to Bitcoin accumulation, from being the Amazon of fixed income to transforming digital energy

Why Strategy's innovative Bitcoin accumulation model, financial engineering techniques and positioning will make it the premier corporate Bitcoin treasury company in the world

An analysis of Michael Saylor's views on the potential U.S. Strategic Crypto Reserve, Bitcoin as a national asset, and its role in America's economic future

A deep dive into Jack Mallers' perspective on Bitcoin, exploring its role as money, its relationship with time, and its reliance on energy for trustless security.

An in-depth exploration of Bitcoin's role in shaping the future of digital sovereignty, economic freedom, and national prosperity