Strategy’s Evolution: the foundation of the world’s first Bitcoin bank

Introduction: a vision beyond Bitcoin accumulation

Strategy has established itself as the world’s largest corporate holder of Bitcoin, with over 538.200 BTC valued at approximately USD 50.156 bln. Under the leadership of Michael Saylor, the company has consistently executed its Bitcoin acquisition strategy while maintaining a reasonable debt-to-Bitcoin NAV ratio.

However, as Saylor himself has suggested, merely accumulating Bitcoin may be just the beginning.

“The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company,” he has stated in various interviews.

This vision points toward a transformation that could see Strategy evolve from simply holding Bitcoin to actively monetizing it through financial services.

This article explores how Strategy could leverage its substantial Bitcoin position to develop a suite of financial products and services, effectively becoming the world’s first true Bitcoin bank. By examining historical parallels from traditional finance and considering Bitcoin’s unique properties, we can envision a path forward that could create substantial value beyond simple Bitcoin appreciation.

TL;DR

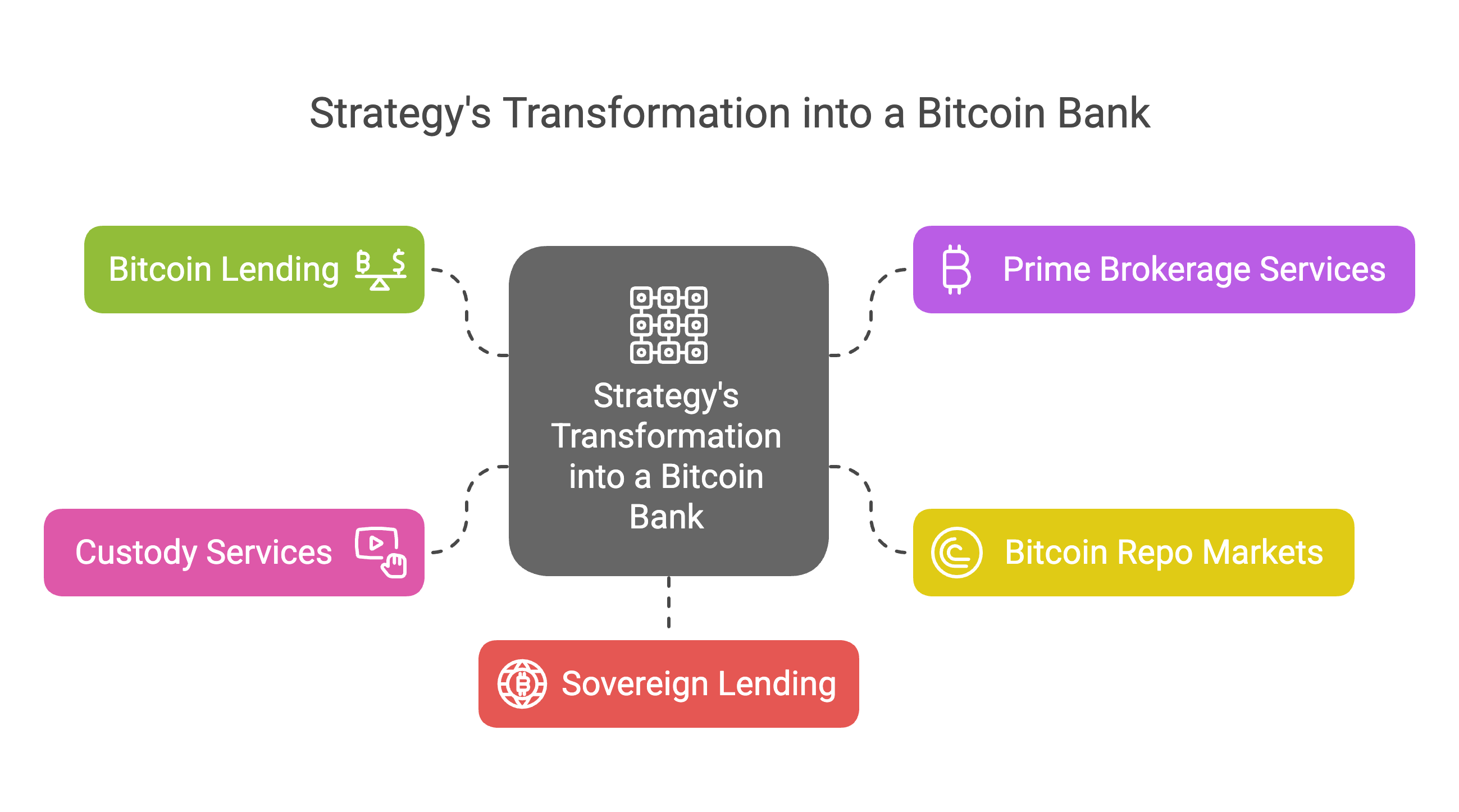

- Strategy could evolve from a Bitcoin treasury to a full-service Bitcoin bank, offering services like lending, custody, prime brokerage, and repo markets.

- By lending a portion of its Bitcoin, Strategy can generate yield and transform its treasury into a revenue engine, potentially earning hundreds of millions annually.

- The firm could become the premier prime broker for Bitcoin institutions, offering loans, OTC trading, and risk tools with superior trust and regulatory standing.

- Launching a Bitcoin repo market would provide short-term liquidity to exchanges and trading desks, while creating recurring low-risk revenue.

- Strategy could offer sovereign Bitcoin loans, acting as a lender to nation-states adopting Bitcoin—echoing the role of early central financiers like J.P. Morgan.

From holding to yield: monetizing a digital gold reserve

While accumulating Bitcoin has been Strategy’s primary focus, the logical next step would be generating yield from these holdings. Traditional financial institutions don’t simply hold assets—they put them to work.

BlackRock, for instance, lends out securities in its ETFs to earn additional income, sometimes lending as much as 90% of holdings.

Strategy could implement a similar model with its Bitcoin reserves:

Potential Yield Generation Strategy

-

Institutional Lending Program: Strategy could lend a portion of its Bitcoin to vetted institutional borrowers (hedge funds, trading firms, other corporations) at competitive interest rates.

-

Collateralized Lending: These loans would be over-collateralized, typically requiring borrowers to post 110-150% of the loan value in stablecoins or other assets.

-

Risk-Adjusted Rates: Interest rates would vary based on borrower creditworthiness, collateral quality, and loan duration, potentially ranging from 3-8% annually.

Revenue Potential

With its current holdings of 538.200 BTC, Strategy could generate substantial income even with conservative lending practices:

- If Strategy lent 20% of its holdings (approximately 100,000 BTC) at an average yield of 5%, it would earn 5,000 BTC annually (worth over $400 million at current prices).

- This income would compound over time as the earned Bitcoin could be added to the lending pool.

This approach would transform Strategy from a static holder to an active yield generator, potentially creating a revenue stream that rivals or exceeds its software business. Unlike traditional fractional reserve banking, Bitcoin’s transparency and 24/7 settlement capabilities could allow Strategy to maintain this operation with significantly lower risk.

Prime Brokerage: Banking for Bitcoin Institutions

In traditional finance, prime brokerage services provided by firms like Goldman Sachs and Morgan Stanley are essential for institutional trading operations. These services include securities lending, leverage provision, trade execution, and custody.

Strategy could establish itself as the premier Bitcoin prime broker, serving crypto-native funds, family offices, and corporations seeking Bitcoin exposure.

Potential Prime Brokerage Services

-

Bitcoin Lending Desk: Strategy could lend BTC to funds requiring Bitcoin for trading strategies, arbitrage, or short positions.

-

Collateralized Fiat Loans: Offering USD or stablecoin loans against Bitcoin collateral, allowing clients to obtain liquidity without selling their Bitcoin.

-

OTC Trading Services: Facilitating large Bitcoin trades with minimal market impact, leveraging Strategy’s deep liquidity.

-

Risk Management Tools: Providing analytics and hedging instruments for institutional Bitcoin holders.

Competitive Advantage

Strategy’s substantial Bitcoin holdings give it a natural advantage in this market:

- Capital Efficiency: Its large Bitcoin base allows it to service multiple large clients simultaneously.

- Counterparty Trust: As a publicly traded company with transparent Bitcoin holdings, Strategy offers greater counterparty assurance than many crypto-native firms.

- Regulatory Compliance: Strategy’s established compliance framework provides institutional comfort compared to less regulated alternatives.

The prime brokerage model has proven extremely profitable in traditional finance. Goldman Sachs, for example, has generated hundreds of millions in quarterly revenue from fixed-income financing alone. Strategy could capture similar economics in the Bitcoin ecosystem, earning fees, interest spread, and trading revenue.

Bitcoin Repo Markets: Creating a Liquidity Engine

Repurchase agreements (repos) are a cornerstone of traditional financial markets, providing critical short-term liquidity. In these arrangements, one party sells an asset to another with an agreement to repurchase it later at a slightly higher price, effectively creating a collateralized overnight loan.

Strategy could pioneer a Bitcoin repo market, becoming the primary liquidity provider for short-term Bitcoin needs.

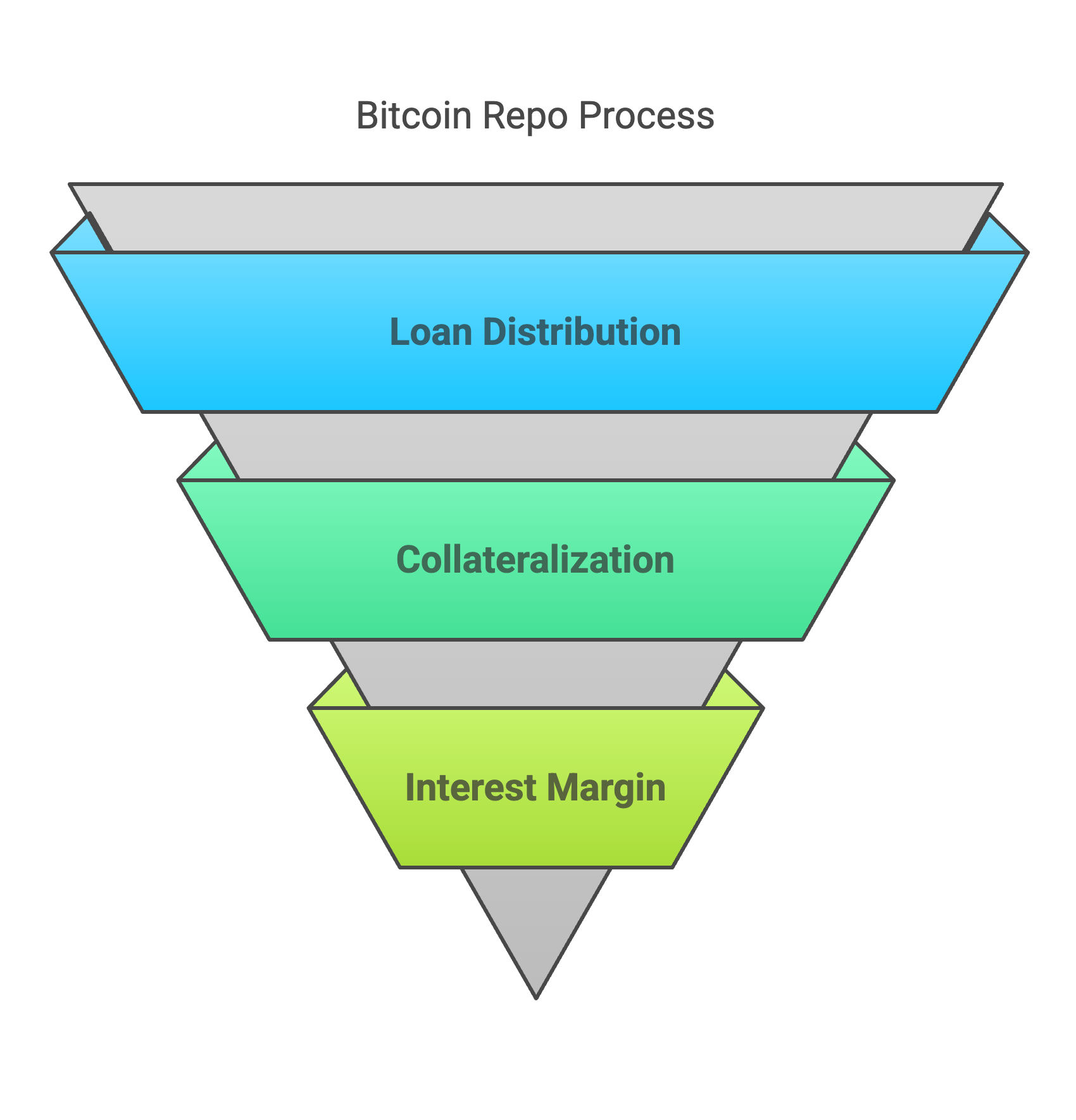

How Bitcoin Repos Would Work

-

Overnight Bitcoin Loans: Strategy would lend Bitcoin to counterparties (exchanges, trading firms) on a very short-term basis (often overnight).

-

Collateralized Structure: These loans would be fully collateralized with stablecoins or high-quality liquid assets.

-

Small Interest Margin: Strategy would earn a small interest spread on each transaction, typically measured in basis points for overnight loans.

Market Benefits

A robust Bitcoin repo market facilitated by Strategy would:

- Provide essential liquidity to exchanges and market makers

- Reduce volatility by ensuring market participants can access Bitcoin when needed

- Create a reference rate for Bitcoin short-term lending, potentially becoming a benchmark for the industry

While individual repo transactions generate modest returns, the volume can be substantial. In traditional finance, the U.S. Treasury repo market sees trillions in daily volume. Even at a much smaller scale, a Bitcoin repo market could generate significant cumulative revenue for Strategy while strengthening the overall Bitcoin financial ecosystem.

Custody-as-a-Service: Safeguarding Digital Wealth

Strategy has already demonstrated its ability to secure hundreds of thousands of Bitcoin. This expertise could be monetized by offering institutional-grade custody services to other organizations that want Bitcoin exposure without the technical challenges of self-custody.

Bitcoin Custody Service Elements

-

Cold Storage Security: Leveraging multi-signature arrangements, hardware security modules, and geographical distribution of keys.

-

Insurance Coverage: Providing comprehensive insurance against theft, loss, or operational failures.

-

Governance Controls: Implementing customizable governance frameworks for client funds, including multi-party approval processes.

-

Audit and Compliance: Regular third-party audits and compliance reporting to satisfy client risk management requirements.

Revenue Model

The custody business typically operates on a fee-based model, with traditional custodians charging anywhere from a few basis points to 0.5-1% of assets under custody annually. With Bitcoin custody being a specialized service, Strategy could potentially command premium pricing:

- A 0.5% annual custody fee on 100,000 BTC under management would generate 500 BTC in annual revenue.

- This service scales efficiently, with significant operational leverage once the security infrastructure is established.

Custody services also create opportunities for additional revenue streams by offering complementary services to clients whose assets are already in Strategy’s care, such as lending or treasury management.

Sovereign Bitcoin Lending: Nation-Scale Finance

As more nations explore Bitcoin adoption following El Salvador’s lead, a natural opportunity emerges for large-scale Bitcoin lending at the sovereign level. Strategy, with its substantial holdings, could position itself as a lender to countries seeking to build Bitcoin reserves or infrastructure.

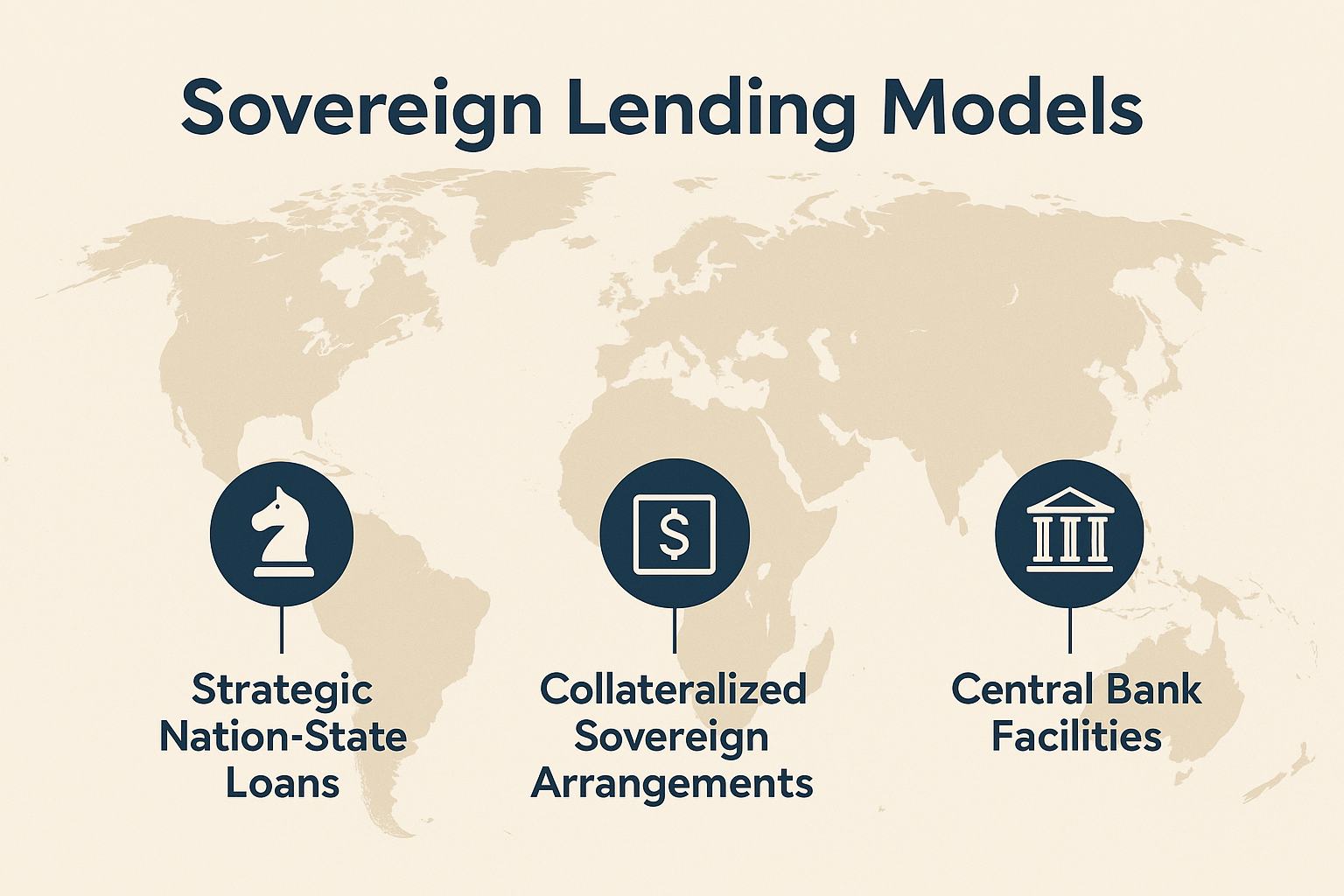

Sovereign Lending Models

-

Strategic Nation-State Loans: Multi-year Bitcoin loans to countries adopting Bitcoin as legal tender or adding it to national reserves.

-

Collateralized Sovereign Arrangements: Loans secured by future tax revenues, mineral rights, or other sovereign assets.

-

Central Bank Facilities: Bitcoin liquidity facilities for central banks exploring Bitcoin reserve strategies.

Historical Parallels

This approach has historical precedent. Before modern central banking was fully established, powerful financiers like J.P. Morgan sometimes acted as lenders of last resort to governments. Strategy could play a similar role in the emerging Bitcoin economy, but with a focus on facilitating Bitcoin adoption rather than crisis management.

Sovereign lending typically commands higher interest rates due to the scale and duration of commitments. A sovereign Bitcoin loan might earn 6-10% annually, representing a significant revenue opportunity while also advancing Bitcoin adoption globally.

Yield transforms perceived liabilities into financial leverage

Another key piece of the puzzle is Strategy’s preferred stock obligations—namely the quarterly dividends owed on STRK and STRV, its Series A and Series B preferred shares. These structured equity instruments were designed to raise capital without diluting common shareholders, but they come with recurring payout obligations that some market participants currently view as a drag on future cash flow.

That perception changes entirely the moment Strategy demonstrates yield-generating capabilities from its Bitcoin holdings.

If Strategy can consistently generate income through institutional Bitcoin lending, repo operations, custody fees, or structured credit products, then those preferred dividends become not a liability, but smart financial leverage. What once looked like a risk to the balance sheet will be reframed as a disciplined capital strategy—issuing fixed dividend instruments to acquire an appreciating, revenue-generating asset.

Preferred equity in traditional finance is often used to fund income-producing operations. Once Strategy proves that its Bitcoin treasury produces reliable cash flow, servicing STRK and STRV becomes trivial. Even better, it opens the door for more creative capital raises—such as Bitcoin-yield-backed preferred stock or hybrid fixed income instruments tailored for institutional buyers.

In short, yield de-risks the capital stack. The market stops asking, “How will they service these dividends?” and starts recognizing that these dividends were the fuel that helped build the Bitcoin bank in the first place.

Wall Street hasn’t priced the Bitcoin bank—yet

Today, the market values MSTR with a modest premium over its Bitcoin holdings—trading at a market NAV (mNAV) around 2x. This means investors are willing to pay about double the per-share Bitcoin value, largely viewing MSTR as a leveraged Bitcoin proxy. But this view is not only backward-looking—it’s blind to the true scope of what Strategy is becoming.

This isn’t just a company with a large Bitcoin balance sheet. It’s the emerging financial infrastructure layer for Bitcoin itself. The market is completely missing the optionality embedded in Strategy’s business model:

- Bitcoin lending with the potential to generate billions in annual yield

- Repo-style liquidity markets where Strategy becomes the lender of last resort

- Prime brokerage services tailored to institutional crypto clients

- Custody-as-a-service for corporations, DAOs, sovereigns, and high-net-worth entities

- Bitcoin-backed bonds and structured products, opening doors to trillions in fixed income capital

- Sovereign-scale lending where Strategy plays the role of IMF for the Bitcoin standard

- Treasury services for the decentralized economy

In traditional finance, institutions that dominate even one of these verticals—like BlackRock (asset management), JPMorgan (custody + prime), or Goldman Sachs (structured credit)—command trillion-dollar valuations. Strategy is laying the groundwork to span them all, but with the hardest monetary asset ever created at its core.

Yet, today’s mNAV doesn’t account for any of this. There’s no premium priced in for future yield, no forward revenue multiple, and no reflexivity adjustment. Investors are being offered early-stage equity in the world’s first Bitcoin-native bank, and it’s still being priced like a proxy ETF.

Conclusion: the market hasn’t caught up—but it will

The transformation of Strategy from a business intelligence firm into the world’s first Bitcoin bank is not a speculative fantasy—it’s already underway. With every BTC added to its balance sheet, with every capital raise, with every new financial capability built on top of its reserves, Strategy is evolving into an institutional pillar of the Bitcoin economy.

And yet, the market remains stuck in the past—pricing MSTR shares as if this is just a high-beta Bitcoin play. That oversight is profound.

Just as early investors mispriced Amazon when it shifted from a bookstore to a cloud empire, or misjudged Apple before the iPhone ecosystem took over the world, today’s valuation of MSTR fails to reflect the seismic shift in what Strategy is building.

It’s not just a vault.

It’s not just a balance sheet.

It’s a new kind of bank.

And at today’s valuation, the opportunity is hiding in plain sight—for now.