GameStop follows Strategy’s Bitcoin playbook with $1.3 billion convertible note offering

In a surprising move that merges meme stock energy with sophisticated financial engineering, GameStop has announced plans to raise approximately $1.3 billion through convertible notes with the explicit purpose of purchasing Bitcoin. This strategic pivot places the video game retailer directly in the footsteps of Strategy (formerly known as MicroStrategy), which has pioneered the corporate Bitcoin treasury model since 2020.

The announcement sent ripples through both traditional finance and cryptocurrency communities, as GameStop appears to be implementing a version of what many have come to call the “Sailor Playbook,” named after Strategy’s Executive Chairman Michael Saylor.

TL;DR

- GameStop is issuing $1.3 billion in zero-coupon convertible notes to purchase Bitcoin, echoing Strategy’s successful treasury strategy.

- The company aims for a 31% leverage ratio, closely aligned with Strategy’s 20–30% target, reflecting detailed financial modeling.

- Key differences include GameStop’s potentially tactical motivations, such as increasing stock volatility and options market interest rather than full corporate transformation.

- GameStop’s highly engaged retail investor community could amplify the move’s impact, similar to the dynamic seen with Strategy’s followers.

- This marks a significant moment in corporate Bitcoin adoption, signaling mainstream acceptance of Bitcoin in treasury strategies by diverse public companies.

The convertible note strategy: following Strategy’s blueprint

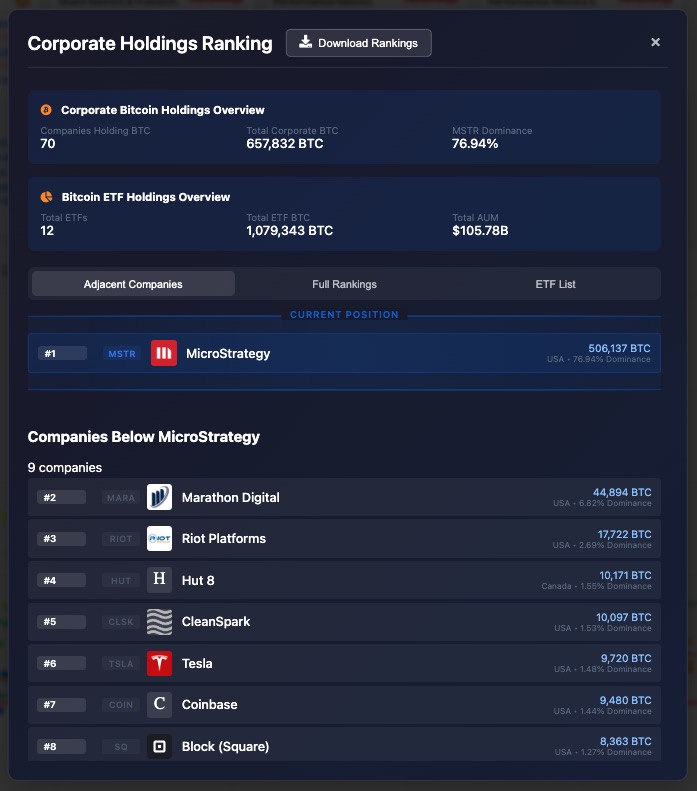

GameStop’s convertible note offering bears similarities to Strategy’s approach to Bitcoin acquisition, suggesting an attempt to replicate a model that has transformed Strategy from a business intelligence software company into the world’s largest corporate holder of Bitcoin, with current holdings of over 500,000 BTC.

Key similarities include:

-

Zero-coupon convertible notes: GameStop is structuring these notes with 0% interest, matching Strategy’s preferred approach when market conditions permit. GameStop appears to be taking advantage of access to 0% capital, a tactical opportunity in the current market environment.

-

Target leverage ratio: If GameStop deploys all planned capital, their leverage ratio would be approximately 31%—close to Strategy’s stated target range of 20-30%. As the transcript analyst noted, “if they deployed all their cash they took in the 1.3 bought Bitcoin put the 1.3 liability on the balance sheet it works them out to about a 31% leverage ratio.”

-

Financial engineering focus: Rather than simply deploying existing cash reserves, GameStop is utilizing financial engineering to optimize its capital structure, just as Strategy has done through multiple convertible bond offerings.

Notable differences:

While the financial mechanisms appear similar, GameStop’s corporate context differs significantly from Strategy’s:

-

Different motivations: While Strategy’s Bitcoin strategy represents a complete transformation of the company, GameStop may be taking a more tactical approach. Some analysts suggest GameStop’s primary motivation could be to “use Bitcoin to ramp up the volatility on their stock” and “increase the open interest in the options Market.”

-

Market positioning: Strategy has become one of the top publicly traded companies by trading volume, ranking in the top 10 for the last 147 days in a row, despite a much lower market cap ranking. GameStop may be looking to create similar trading dynamics.

-

Community dynamics: GameStop brings what analysts describe as a “pretty rabid” and “loud” investor community. In social media engagement rankings, Strategy ranked fourth while GameStop was fifth, indicating both companies have highly engaged investor bases.

The convertible bond mechanics: what to expect

For those unfamiliar with convertible bond offerings, GameStop’s process will likely follow patterns established by previous corporate issuances. Understanding these dynamics is crucial for GameStop investors who may experience confusing price action in the coming days.

The process typically unfolds as follows:

-

Pricing period begins: Investment banks identify institutional buyers (primarily hedge funds and convertible arbitrage desks) for the convertible notes.

-

Initial selling pressure: These buyers establish short positions in GameStop stock during the pricing period, often creating temporary downward pressure on the share price.

-

Conversion price determination: The final conversion price is set at a premium to the volume-weighted average price during this period—often 35-55% above the reference price.

-

Gamma trading activity: After issuance, convertible buyers engage in “gamma trading”—adjusting their short positions based on GameStop’s price movements. If the stock rises, they increase shorts; if it falls, they reduce them.

This creates an interesting dynamic where the bonds can actually become a source of buying pressure during downturns, as arbitrage desks buy back their short positions when the stock trades below the conversion price.

Market positioning and potential impact

GameStop’s entry into the Bitcoin market comes at an interesting moment, with Bitcoin currently trading around $87,000 after a pullback from all-time highs. This positions the company to potentially acquire Bitcoin at favorable prices if their timing proves prescient.

With a $1.3 billion commitment, GameStop would instantly become one of the largest corporate Bitcoin holders—still far behind Strategy’s holdings of over 500,000 Bitcoin, but significant nonetheless.

For context, if GameStop’s initiative is well-received, it could potentially develop a premium valuation as investors price in future Bitcoin acquisition potential, similar to what has happened with Strategy.

Strategic implications for GameStop

Beyond the immediate financial engineering aspects, GameStop’s Bitcoin strategy could serve multiple strategic purposes:

-

Increasing stock volatility: As some analysts have suggested, GameStop may be looking to use Bitcoin to increase volatility in their stock, which could create opportunities in the options markets.

-

Brand alignment: The gaming community that forms GameStop’s core audience is naturally aligned with Bitcoin’s technological narrative. Gamers understand digital scarcity (they’ve been trading virtual items for years) and generally view traditional finance with skepticism.

-

Market differentiation: As one of the first major retailers to adopt Bitcoin, GameStop distinguishes itself from competitors in a crowded space.

-

Capital markets engagement: The strategy has already reignited interest in GameStop stock, creating liquidity and attention that can be leveraged for future capital raising if needed.

The retail investor community factor

GameStop’s investor community has been described as “pretty rabid” and “loud” by market analysts. This engaged community has helped GameStop maintain significant social media presence, ranking fifth in corporate social media engagement, just behind Strategy at fourth place.

This community engagement creates a powerful communication channel that can amplify corporate messaging and potentially create momentum around new initiatives like Bitcoin acquisition.

The photo opportunity between GameStop leadership and Michael Saylor that circulated before the announcement may have been a deliberate signal to this community, foreshadowing the Bitcoin strategy.

Different companies, different approaches

While GameStop appears to be following elements of Strategy’s playbook, the two companies may have different objectives in mind.

Strategy has completely transformed into a Bitcoin acquisition vehicle with a software business attached. The company’s primary focus is on accumulating as much Bitcoin as possible, now holding over 500,000 Bitcoin.

GameStop, on the other hand, seems to be taking a more tactical approach. Rather than a complete transformation, GameStop may be using Bitcoin as a tool to create market dynamics favorable to its stock, while continuing its broader business initiatives.

Volatility implications and options market activity

One of the most intriguing aspects of GameStop’s Bitcoin strategy is how it might impact option market activity around the stock. By adding Bitcoin exposure to the mix, GameStop is essentially introducing a new volatility driver that could reignite interest in options trading.

Strategy has embraced volatility as a core element of its business model, with Executive Chairman Michael Saylor famously stating “volatility is vitality.” This approach has allowed Strategy to remain one of the top 10 most actively traded stocks for 147 consecutive days despite having a much lower market capitalization ranking.

Bitcoin’s inherent volatility, combined with the leveraged nature of convertible debt, creates a perfect storm for options traders interested in GameStop:

-

Increased implied volatility: As GameStop’s stock becomes more sensitive to Bitcoin price movements, options premiums could increase significantly.

-

Covered call opportunities: Long-term shareholders might find lucrative opportunities to generate income by selling covered calls against their positions.

-

Complex volatility plays: Sophisticated traders might construct option strategies designed to profit from the correlation (or lack thereof) between GameStop and Bitcoin prices.

Conclusion: a new phase in corporate Bitcoin adoption

GameStop’s $1.3 billion Bitcoin play represents one of the boldest corporate treasury moves since Strategy’s initial 2020 announcement. But the true significance goes beyond the dollar amount.

What we’re witnessing is the beginning of a new phase in Bitcoin adoption, where the corporate treasury playbook pioneered by Strategy is being adopted and adapted by companies with different histories and business models.

GameStop’s move suggests that Bitcoin treasury strategies are no longer viewed as fringe experiments but as legitimate options for companies seeking to optimize their balance sheets in an inflationary environment. The carefully calibrated 31% leverage ratio indicates that GameStop’s management has studied Strategy’s approach in detail.

For Bitcoin enthusiasts, this represents validation from yet another public company. For GameStop investors, it adds a fascinating new dimension to the company’s story. And for Wall Street traditionalists, it’s yet another sign that the rules of corporate finance are being rewritten before our eyes.

Whether GameStop’s Bitcoin strategy will ultimately be remembered as a stroke of genius or a costly distraction remains to be seen. But one thing is certain: a significant new player has entered the corporate Bitcoin space, following a path blazed by Strategy but potentially taking it in new and interesting directions.