How Strategy plans to fund its growing preferred stock dividend obligations

The dividend obligation challenge

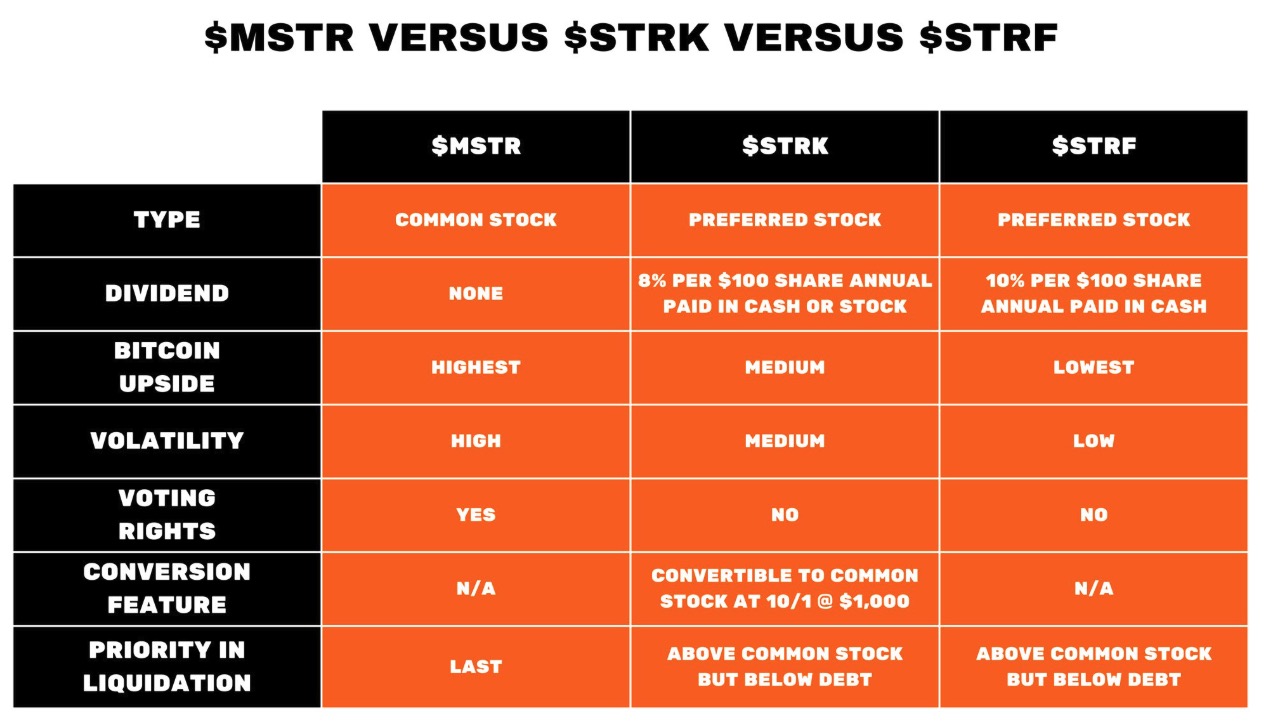

Strategy has been introducing innovative financial instruments to the market, primarily its preferred share offerings: the 8% Series A Perpetual Strike Preferred Stock (STRK) and the recently announced 10% Series A Perpetual Strife Preferred Stock (STRF). While these offerings expand Strategy’s capital-raising capabilities, they also create significant dividend obligations the company must address.

The STRK offering has already raised approximately $584 million, while the proposed STRF offering aims to raise approximately $722.5 million at a 10% yield. These preferred shares create a substantial annual dividend obligation:

- STRK: 8% yield (approximately $46.7 million annually before any ATM)

- STRF: 10% yield (approximately $72.25 million annually before any ATM)

Combined, these obligations would total around $120 million annually, which exceeds Strategy’s historical free cash flow from operations, typically around $60-70 million per year.

TL;DR

- Strategy will start with $120 million in annual dividend obligations from STRK and STRF preferred shares, exceeding historical free cash flow.

- It could cover these using operational cash flow and targeted ATM offerings of common stock, taking advantage of high liquidity.

- The company’s strategy relies on Bitcoin appreciation and the long-term break-even benefits of early Bitcoin acquisition funded by preferred offerings.

- Preferred shares feature self-correcting yields, making them attractive even in down markets and offering more stability than common stock ATMs.

- Strategy’s diversified capital structure targets different investor profiles and is part of a broader strategic transformation toward Bitcoin-centric financial services.

Operational cash flow from the software business

Strategy’s legacy software business has historically generated approximately $60-70 million in free cash flow annually. However, 2024 saw restructuring costs and one-time expenses related to rebranding efforts, which affected cash flow figures. While this operational cash flow provides a foundation, it appears insufficient to cover the full dividend obligations from both preferred offerings.

Strategic use of ATM offerings on common stock

One of Strategy’s most powerful tools is its ability to conduct at-the-market (ATM) offerings using its common stock. Strategy’s stock is exceptionally liquid - one of the most actively traded stocks on the market. This liquidity enables the company to raise capital efficiently through small, strategic ATM offerings.

Unlike the massive ATM offerings conducted in Q4 2024, funding dividend obligations would require significantly smaller raises. Strategy could theoretically fund these obligations with very brief periods of ATM usage - possibly just a few minutes worth. Most investors focus on stock momentum rather than dissecting every component of Strategy’s financial approach, which allows the company to execute these smaller raises with minimal market disruption.

The break-even calculation

The economic calculation for Strategy centers on the initial Bitcoin yield from these offerings versus their long-term dividend costs. When Strategy issues preferred shares and uses the proceeds to purchase Bitcoin, it generates an immediate Bitcoin yield that’s significantly higher than what they could achieve through convertible bonds.

The question becomes: at what point does the cumulative dividend cost exceed the value created by that initial Bitcoin acquisition?

This break-even point depends on how the common stock performs. If the share price rises significantly, it will take fewer shares to fund dividend obligations, potentially pushing this break-even point 50-70 years out, depending on modeling assumptions. In some scenarios, there may never be a crossover point where the cumulative dividend costs exceed the initial benefit.

Risk management and contingency planning

Bitcoin price volatility considerations

Strategy’s ability to fund these obligations is partially dependent on Bitcoin’s performance. During severe market downturns, the company’s share price typically declines, potentially making ATM offerings less efficient as a funding mechanism.

However, the preferred shares have been designed to function in various market conditions. Strategy has created a financial structure that allows it to operate effectively regardless of market conditions, which represents a powerful strategic advantage.

Self-correcting yield mechanisms

The preferred share offerings have inherent self-balancing mechanisms that make them uniquely suitable for Strategy’s approach. If the market price of STRK or STRF declines, their effective yields increase, attracting more buyers. This creates a natural market correction mechanism where higher yields draw in new demand, stabilizing the price.

This creates a “self-correcting vehicle” that differs significantly from ATM offerings on common stock. When using an ATM on common shares, price declines don’t automatically create a countervailing force to attract new buyers, but with preferred shares, the increasing yield serves this function.

The strategic vision behind preferred offerings

Products for different market conditions

Strategy has purposefully created multiple capital-raising options to function in any market environment. In challenging conditions for the common stock when Bitcoin’s price is depressed, convertible bonds and common stock ATMs may offer unfavorable economics. However, a 10% fixed income product like STRF can still attract investors seeking yield.

This diversified approach means Strategy always has access to capital, regardless of market conditions.

Targeting different investor profiles

The two preferred offerings target distinct investor groups:

- STRK: Appeals to “total return” investors seeking both yield and potential equity upside

- STRF: Targets true yield investors seeking long-duration, stable returns, such as pension funds

By creating products tailored to different investor preferences, Strategy expands its potential capital sources beyond what would be available through common stock or convertible bonds alone.

Future evolution of Strategy’s approach

While current dividend obligations present a challenge, Strategy’s financial engineering appears to be part of a broader transformational strategy. The company’s current activities may be building blocks for a larger long-term vision rather than representing the final form of its business model.

This perspective frames the preferred offerings not as an end goal but as part of an evolving business transformation that could eventually include Bitcoin-backed financial services or other innovations that generate additional revenue streams.

Conclusion

Strategy’s approach to funding its dividend obligations relies primarily on three mechanisms:

- operational cash flow from its software business,

- strategic ATM offerings on its common stock,

- and potentially future revenue streams from Bitcoin-related financial services.

The sustainability of this approach depends on multiple factors, including Bitcoin’s performance, Strategy’s trading liquidity, and market sentiment. However, the company has created a diversified capital structure specifically designed to function across different market conditions, giving it multiple options for meeting its growing dividend commitments.

Strategy has positioned itself to operate effectively regardless of market conditions, creating a powerful strategic foundation for its continued Bitcoin acquisition strategy.