Mastering options strategies on Bitcoin-related securities

The explosive growth of Bitcoin-related securities has created a fertile environment for options trading unlike anything previously seen in financial markets. With extraordinary volatility profiles and unique market dynamics, securities like Strategy (formerly MicroStrategy) present both unprecedented opportunities and substantial risks for options traders.

This article examines key strategies, considerations, and lessons learned from options trading on Bitcoin-related securities, providing insights for both experienced traders and those considering these approaches for the first time.

TL;DR

- Covered calls on Bitcoin-related equities are highly lucrative due to extreme implied volatility, but must be carefully structured to avoid missing upside during explosive rallies.

- ETFs like MSTY and IMST offer differing covered call strategies, balancing income generation against upside participation depending on market conditions.

- Successful options trading in this sector requires timing based on implied volatility, not price predictions, and benefits from systematic approaches.

- Risk management is crucial: proper strike selection, position sizing, and rolling techniques can reduce the danger of losing exposure during rapid price increases.

- Traders must accept and manage opportunity costs, balancing premium income against the risk of forfeiting major upside gains.

The covered call opportunity on Bitcoin equities

Covered calls—selling call options against shares you already own or LEAPS—have emerged as one of the most popular strategies for Bitcoin-related equities. This approach generates income through premium collection while potentially sacrificing some upside in exchange for immediate returns.

Why Bitcoin equities offer unique covered call potential

Bitcoin-related stocks like Strategy present unique opportunities for covered call strategies due to several factors:

- Extreme implied volatility: Strategy often trades with implied volatility levels approaching 100% or higher, creating exceptionally rich option premiums. Remember the volatility is vitality for Strategy.

- Predictable volatility cycles: Bitcoin tends to move through periods of consolidation followed by explosive moves, creating opportunities to time covered call sales

- Premium asymmetry: The premiums available on Bitcoin equities far exceed those on traditional stocks, even for strikes far out-of-the-money

For perspective, a covered call on Strategy might generate premiums 5-10 times higher than similar positions on more stable stocks like Apple or Microsoft for equivalent strike distances. This premium differential creates compelling opportunities for income generation.

Practical approaches to covered call implementation

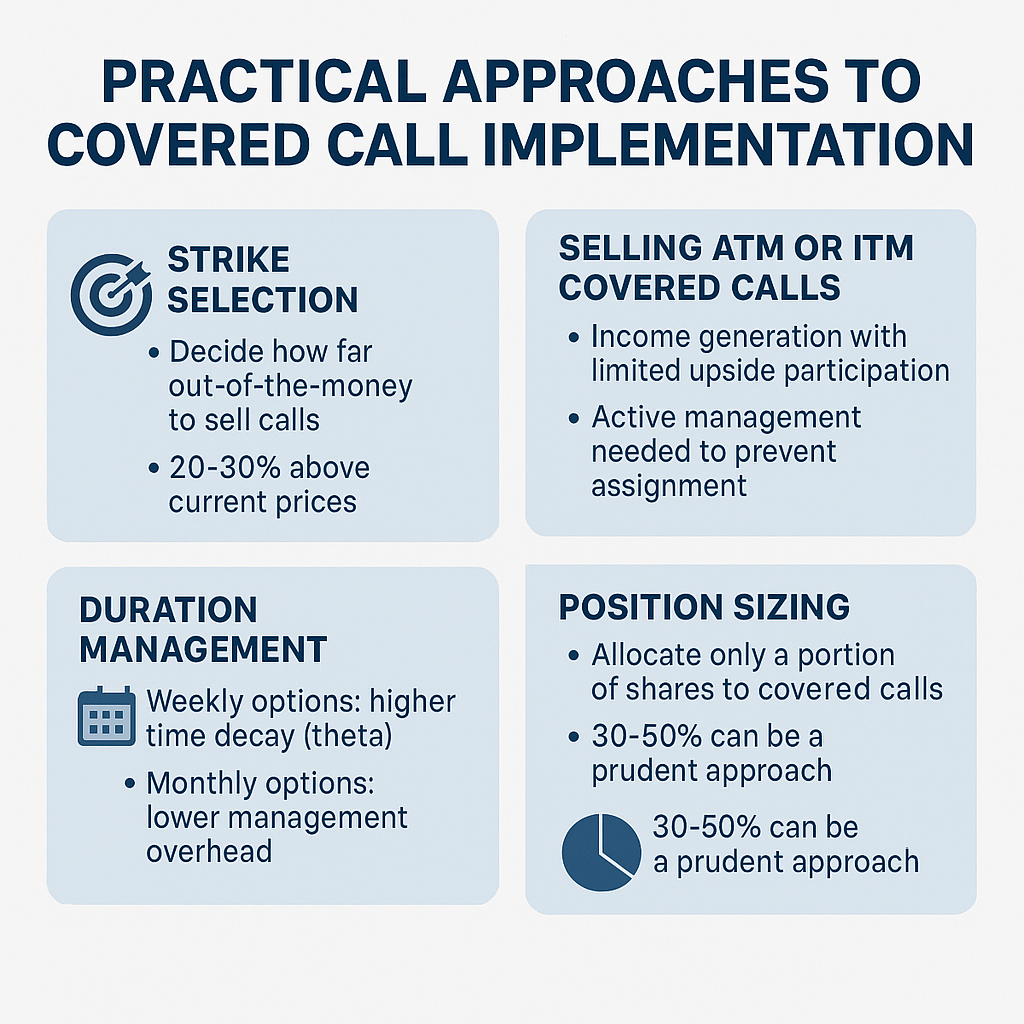

When selling covered calls on Bitcoin-related securities, several strategic choices impact both risk and return potential:

Strike selection: Deciding how far out-of-the-money to sell calls represents a critical tradeoff. Selling closer to current prices generates more premium but increases the likelihood of having shares called away during strong upward moves. Many experienced traders opt for strikes 20-30% above current prices, balancing premium collection against reasonable upside retention.

Selling ATM or ITM covered calls: Some experienced traders focus on covered calls purely for income generation while accepting limited upside participation. This strategy involves selling at-the-money (ATM) or even in-the-money (ITM) calls to maximize premium collection—what traders often call capturing the “juice.” This approach provides a significant downside cushion through the large premiums received, while still allowing profits from gradual price increases.

These traders acknowledge Bitcoin and Strategy will likely appreciate long-term but respect the stock’s extreme volatility rather than trying to predict precise price movements. The strategy requires active management with weekly rolling of positions (buying back calls and selling new ones) to prevent assignment on ITM calls, necessitating sufficient working capital to execute these rolls effectively. While potentially sacrificing explosive upside moves, the compound effect of consistent premium collection can generate substantial returns over time.

Duration management: Weekly options offer maximum time decay (theta) but require constant management. Monthly contracts reduce management overhead but typically provide less favorable return profiles on an annualized basis. The ideal approach depends on your trading style and time availability.

Position sizing: Allocating only a portion of your shares to covered calls (perhaps 30-50%) can be a prudent approach. This allows you to benefit from premium collection while retaining unlimited upside on your remaining position.

Volatility considerations and premium collection

The extreme volatility of Bitcoin-related securities drives option premiums, making volatility management central to successful options trading in this sector.

Understanding implied volatility cycles

Implied volatility on Bitcoin equities follows distinct patterns that experienced traders can leverage:

- Volatility expansion during price increases: When Bitcoin prices surge, implied volatility often rises simultaneously, creating ideal conditions for selling options

- Volatility compression during consolidations: During sideways price action, implied volatility tends to decrease, creating better entry points for buying options

- Pre-event volatility inflation: Implied volatility typically increases before significant events (earnings, Bitcoin halving, major announcements)

Monitoring implied volatility levels relative to historical ranges can help identify optimal entry and exit points for options positions. For example, selling covered calls when implied volatility ranks above the 75th percentile historically tends to produce superior results compared to selling during low-volatility periods.

Premium collection strategies beyond covered calls

While covered calls represent the most common approach, other premium collection strategies can be effective:

Cash-secured puts: Selling puts at prices where you’d be willing to purchase shares can generate income while potentially acquiring shares at a discount.

Credit spreads: Vertical call or put spreads can limit risk while still capturing significant premium in high-volatility environments.

Iron condors: In rare periods of Bitcoin price consolidation, these structures can capitalize on time decay while defining maximum risk parameters.

Comparative approaches: MSTY vs. IMST

The launch of options-based ETFs like MSTY (YieldMax Strategy Option Income Strategy ETF) and IMST (Bitwise Strategy Covered Call Income Strategy ETF) has created alternatives to direct options trading. These products employ different approaches to capturing Bitcoin equity volatility.

Product structure and strategy differences

MSTY and IMST differ in significant ways:

MSTY approach: Generally employs more aggressive at-the-money covered call strategies, maximizing current income generation at the expense of upside potential. This product tends to be more income-focused than directionally bullish on Strategy stock.

IMST approach: Typically employs further out-of-the-money covered calls with longer durations, seeking to balance income generation with upside participation. This more conservative approach may sacrifice some immediate yield for greater participation in Bitcoin price appreciation.

Performance considerations

Tracking the performance of these products reveals instructive patterns:

During strong bull markets, the more conservative approach (IMST) tends to outperform, as the upside retention allows for greater participation in price increases. During flat or declining markets, the more aggressive approach (MSTY) often delivers superior returns through higher premium collection.

The key insight is that no single approach is universally superior—optimal strategy selection depends on your market outlook and income requirements.

Risk management when selling covered calls

While covered calls are often positioned as a conservative strategy, they carry significant risks in the volatile Bitcoin equity space.

The challenge of “face-ripping” rallies

Bitcoin-related equities can experience extraordinary upward price movements in compressed timeframes. Strategy stock has demonstrated the capacity to increase 50-100% within weeks or even days during strong Bitcoin bull markets.

These “face-ripping” rallies create a unique risk for covered call sellers: the potential to miss life-changing upside moves. This risk is particularly acute when selling covered calls on 100% of your position, as you may find yourself forced to deliver shares precisely when the most significant gains are occurring.

Practical risk mitigation approaches

Several risk management techniques can help address this challenge:

Position limits: Allocate only a portion of your shares to covered call strategies, allowing uncapped upside on the remainder.

Strike discipline: Set strike prices at levels where you’d genuinely be comfortable selling, not simply based on premium attractiveness.

Rolling techniques: When facing calls that may be exercised during strong upward moves, consider rolling to higher strikes and later expirations, accepting reduced premium to maintain position exposure.

IV-based management: Reserve covered call selling for periods of elevated implied volatility, and suspend the strategy during low-volatility periods when premiums don’t adequately compensate for forgone upside.

After strong upward performance: Reserve covered call selling only after a period of strong share price upward movement. MSTR is very volatile. It will not go up in a straight line. Buying back the calls after the share price had a strong move lower is also possible.

Advanced timing considerations

Timing represents perhaps the most challenging aspect of options trading on Bitcoin-related securities.

Volatility-based timing approaches

Rather than attempting to time price movements directly (notoriously difficult), many successful traders time their options activities based on volatility conditions:

Selling during high IV: The most favorable times to sell options typically occur when implied volatility ranks in the upper quartile of its historical range.

Buying during low IV: Conversely, purchasing options becomes more attractive when implied volatility falls to historical lows.

This approach acknowledges the reality that while predicting price direction is extremely difficult, identifying relative volatility extremes is more manageable.

Recognizing the limitations of timing

Even sophisticated traders must accept that perfect timing remains elusive. Bitcoin markets can maintain elevated volatility for extended periods, or experience sudden volatility expansions that defy historical patterns.

This reality suggests a more systematic approach: implementing consistent options strategies based on predetermined criteria, rather than attempting to perfectly time each trade based on subjective market assessments.

The opportunity cost reality

Every options strategy involves opportunity costs—potential gains forgone in exchange for certain benefits. This tradeoff is particularly pronounced with Bitcoin-related securities due to their extreme volatility and upside potential.

Quantifying the opportunity cost

The mathematics of covered calls make this tradeoff explicit. When you sell a call option, you receive immediate premium but cap your potential gain at the strike price. If the underlying security experiences a significant upward move beyond your strike price, the opportunity cost becomes substantial.

For example, if you sell a $400 call on Strategy when the stock is trading at $300, receiving a $15 premium, and the stock subsequently rises to $600, your opportunity cost is $185 per share ($600 potential price - $400 strike - $15 premium received).

Strategic opportunity cost management

Rather than viewing opportunity cost as something to be eliminated (impossible), effective traders manage it as part of their overall strategy:

Diversification of approaches: Using multiple options strategies across different timeframes can reduce reliance on any single approach.

Hybrid strategies: Combining covered calls with long call positions at higher strikes (sometimes called “collars” or modified collars) can provide income while maintaining exposure to extreme upside scenarios.

Opportunity cost budgeting: Deliberately allocating a certain percentage of your position to income generation while preserving the remainder for unlimited upside.

Lessons for Bitcoin equity options traders

The unique characteristics of Bitcoin-related securities create a distinct set of lessons for options traders in this space:

1. Volatility is both opportunity and threat

The extraordinary volatility that makes these options so profitable also creates the risk of missing significant upside moves. This dual nature requires more nuanced strategies than those used in traditional markets.

2. Mechanical approaches can outperform discretionary ones

The emotional challenges of trading highly volatile assets often lead to poor decision-making. Systematic, rule-based approaches to options trading frequently outperform discretionary strategies by removing emotional biases.

3. Position sizing matters more than entry timing

Given the unpredictability of Bitcoin price movements, how much of your position you allocate to options strategies often matters more than precisely when you enter those positions.

4. Long-dated options may offer superior risk-reward

While weekly options can generate higher annualized returns on paper, longer-dated options (LEAPs) often provide better real-world outcomes by reducing transaction costs and management overhead.

Conclusion: Building a sustainable options approach

Options trading on Bitcoin-related securities offers compelling opportunities for enhanced returns, but requires careful consideration of risk parameters and strategic tradeoffs.

The most successful approaches tend to share common characteristics:

- Consistency: Following systematic rules rather than chasing optimal timing

- Diversification: Employing multiple strategies across timeframes

- Risk calibration: Aligning position sizes with potential volatility

- Opportunity cost awareness: Explicitly acknowledging the tradeoffs involved

For investors willing to master these concepts, options strategies can potentially enhance returns while managing the extreme volatility inherent in Bitcoin-related securities. The key lies not in finding the “perfect” strategy, but in implementing an approach aligned with your investment goals, risk tolerance, and time commitment.

As the Bitcoin securitization ecosystem continues to evolve, options strategies will likely remain a powerful tool for sophisticated investors seeking to optimize their exposure to this transformative asset class.