Understanding Strategy through mental models

To truly comprehend Strategy’s revolutionary approach to Bitcoin accumulation and corporate finance, we need to look beyond traditional financial metrics. The company’s transformation from a business intelligence software provider to the world’s largest corporate holder of Bitcoin with 538.200 BTC (valued at USD 50.156 bln) represents a paradigm shift that requires new mental frameworks.

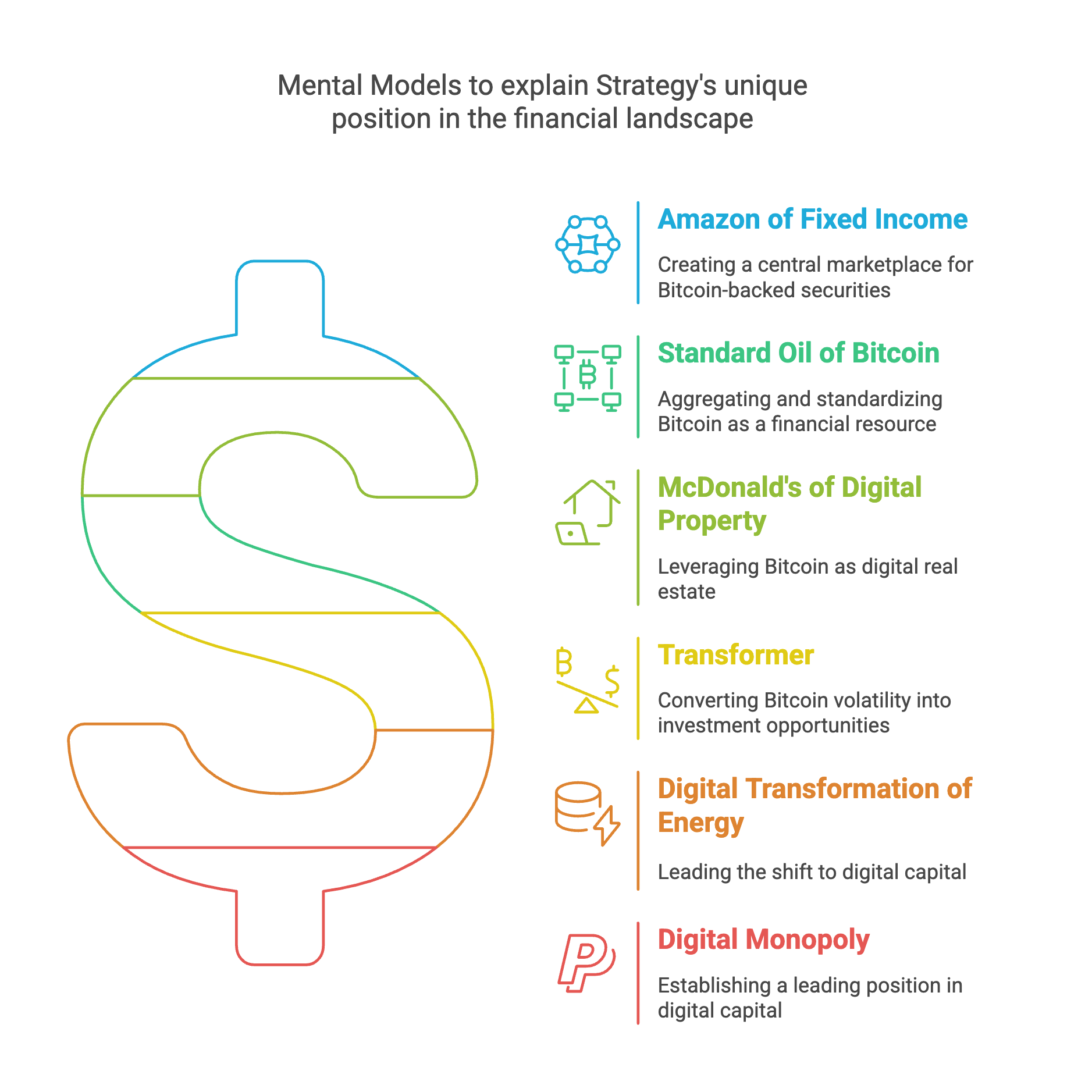

Let’s explore the powerful mental models that help explain Strategy’s unique position in the financial landscape and why its approach may be more transformative than many investors realize.

TL;DR

- Strategy is positioning itself as the Amazon of fixed income, creating a marketplace for Bitcoin-backed financial products, much like Amazon did for e-commerce.

- It is following a Standard Oil-style aggregation strategy, accumulating Bitcoin as the dominant financial asset for the digital era.

- Similar to McDonald’s real estate focus, Strategy treats Bitcoin as digital property, leveraging it for long-term value creation.

- By transforming Bitcoin volatility into structured financial products, Strategy offers investment options catering to different risk profiles.

- Leading the digital transformation of energy, Strategy converts fiat capital into high-frequency digital energy, pioneering a new financial paradigm.

Model 1 - Strategy as the “Amazon of fixed income”

Just as Amazon revolutionized retail by creating a comprehensive platform for commerce, Strategy is positioning itself to become the dominant platform for fixed income products backed by Bitcoin.

Creating a marketplace for Bitcoin-backed securities

Amazon’s success came from aggregating consumer products at scale, making it the go-to destination for virtually any purchase. Similarly, Strategy is becoming the central marketplace for financial products backed by Bitcoin. Through its innovative approach to convertible bonds, ATM offerings, and preferred shares like STRK, Strategy is creating a diverse ecosystem of financial instruments that appeal to different investor classes.

Michael Saylor, Strategy’s Executive Chairman, has explicitly stated: “We want to be the Amazon of fixed income.” This vision entails Strategy becoming the primary platform where investors can access a range of Bitcoin-backed financial products, from zero-coupon convertible bonds to dividend-yielding preferred shares.

Scale and dominance

Amazon’s platform grew stronger with scale, creating network effects that made it increasingly difficult for competitors to challenge its position. Strategy is pursuing a similar path in the Bitcoin financial ecosystem. With 538.200 Bitcoin representing 2.56% of the total supply, Strategy has established a scale advantage that makes it challenging for other corporations to compete effectively.

The fixed income market is currently worth approximately $100 trillion globally. If Strategy can capture even a small percentage of this market with Bitcoin-backed products, it could become one of the most significant financial institutions of the digital age.

Model 2 - Strategy as the “Standard Oil of Bitcoin”

The comparison to Standard Oil, John D. Rockefeller’s petroleum giant from the early 20th century, provides another useful lens for understanding Strategy’s ambitions.

Aggregation of a critical resource

Just as Standard Oil aggregated crude oil as an essential energy resource for the industrial age, Strategy is aggregating Bitcoin as a critical financial resource for the digital age. Standard Oil’s control of oil refining and distribution allowed it to standardize the industry and create enormous value in the process.

Similarly, Strategy is standardizing corporate Bitcoin adoption through its financial engineering approach. By continuously accumulating Bitcoin and demonstrating effective treasury management strategies, Strategy is creating a blueprint for other corporations to follow.

Redefining an industry

Standard Oil fundamentally redefined the energy industry of its time. Strategy appears to be pursuing a similar transformation of the financial industry by shifting the paradigm from traditional fiat-based treasury assets to Bitcoin-based holdings.

As the thesis notes: “Today, it is impossible to imagine life without oil. Tomorrow, it will be impossible to imagine life without Bitcoin.” Strategy’s pioneering role in this transition positions it to potentially capture extraordinary value as the shift accelerates.

The company’s target leverage ratio of approximately 25% (with current debt-to-Bitcoin NAV ratio at ) suggests a conservative approach that may allow it to maintain its dominance sustainably, unlike Standard Oil’s eventual regulatory challenges.

Model 3 - Strategy as the “McDonald’s of digital property”

The McDonald’s business model comparison offers yet another valuable perspective on Strategy’s operations.

Real estate strategy parallel

McDonald’s success is often attributed not just to selling hamburgers but to its sophisticated real estate strategy. The company acquires prime physical real estate and leverages these assets to generate consistent cash flows.

Strategy is applying a similar model to digital real estate. Just as McDonald’s acquires and leverages physical properties, Strategy acquires and leverages Bitcoin—the premier form of digital property. This perspective helps explain why Strategy never intends to sell its Bitcoin; like McDonald’s valuable real estate holdings, Bitcoin represents the foundational asset upon which the entire business model is built.

Franchising the model

McDonald’s growth was accelerated through franchising, allowing for scale without proportional capital investment. While Strategy hasn’t directly franchised its approach, it has created a model that other corporations can emulate. As more companies adopt Bitcoin treasury strategies, Strategy’s pioneering role and expertise position it as the leader in this emerging field.

The company’s Bitcoin yield (currently at +10.97% year-to-date) demonstrates the effectiveness of this approach in generating value from its digital property holdings.

Model 4 - Strategy as a “Transformer”

Perhaps the most innovative mental model for understanding Strategy is viewing it as a transformer that converts Bitcoin volatility into tailored risk-reward profiles for different investor classes.

Harnessing volatility as an asset

While many see Bitcoin’s volatility as a liability, Strategy has brilliantly transformed this characteristic into one of its greatest assets. By issuing convertible bonds with embedded optionality, Strategy effectively “sells volatility” to the market, using the proceeds to acquire more Bitcoin.

This transforms what traditional finance considers a negative (volatility) into a positive, productive asset. As the thesis states: “MicroStrategy is a transformer that converts Bitcoin volatility into tailored risk-reward profiles to suit the unique goals of different baskets of investors.”

Creating customized exposure

Traditional investment vehicles offer limited customization in terms of risk and reward profiles. Strategy, however, has created a spectrum of investment options through its capital structure:

- Common stock (MSTR): Provides leveraged upside exposure to Bitcoin with a current implied volatility of

- Convertible bonds: Offer downside protection with capped but significant upside potential

- Preferred stock (STRK): Provides an 8% yield with potential participation in Bitcoin’s price appreciation

This transformer model allows Strategy to appeal to a broader range of investors than would be possible with a single investment vehicle, expanding its total addressable market.

Model 5 - Strategy leading the “Digital transformation of energy”

The final mental model presents Strategy as a pioneer in the digital transformation of energy, providing perhaps the most visionary framework for understanding the company’s long-term impact.

Converting low-frequency to high-frequency energy

Strategy’s Bitcoin accumulation can be viewed as capturing “low-frequency energy” from the analog world (fiat currency) that is decreasing in value and transmuting it into “high-frequency energy” in the digital world (Bitcoin) that is increasing in value.

As the thesis eloquently states: “Strategy aggregates and leverages impure fiat and transmutes it into pure Bitcoin.” This energy transformation perspective helps explain why Strategy’s approach is fundamentally different from traditional corporate treasury operations.

Creating a new form of capital

By leading this transformation, Strategy is helping to create an entirely new form of capital—one that is digital, decentralized, and increasingly valuable in the information economy. The company’s Bitcoin accumulation strategy, with its current holdings of 538.200 BTC, positions it at the forefront of this transformation.

Michael Saylor has described this process: “It’s not a money glitch. It’s a digital transformation of the capital markets.” This transformation is occurring as Strategy converts traditionally depreciating treasury assets (cash) into an appreciating digital asset (Bitcoin).

Model 6 - The unifying model: Strategy as a digital monopoly

These mental models converge around a central theme: Strategy is establishing itself as the premier monopoly in digital capital. Just as previous tech giants created monopolies in their respective domains—Amazon in commerce, Apple in devices, Google in information, Facebook in social relationships—Strategy is creating a monopoly in digital capital.

The company’s current Bitcoin per share metrics ( 0.00200135 BTC BTC per basic share) and its consistent Bitcoin yield growth demonstrate the effectiveness of this monopolistic approach. With a market capitalization of USD 92.25 bln and Bitcoin holdings valued at USD 50.156 bln, Strategy trades at a premium of 2.069xx to its underlying Bitcoin value—a reflection of the market’s recognition of its monopolistic advantages.

Conclusion: The power of mental models

Understanding Strategy through these mental models—as the Amazon of fixed income, the Standard Oil of Bitcoin, the McDonald’s of digital property, a transformer of volatility, and a leader in digital energy transformation—provides a comprehensive framework for appreciating the company’s revolutionary approach.

Rather than viewing Strategy through the traditional lens of a software company that happens to hold Bitcoin, these models reveal a much more ambitious vision: a company that is fundamentally redefining corporate finance, treasury management, and capital markets for the digital age.

As Strategy continues to execute its Bitcoin accumulation strategy (currently holding 538.200 BTC), these mental models will likely become increasingly relevant for understanding its evolving role in the global financial ecosystem. For investors, these frameworks provide valuable context for evaluating Strategy’s long-term potential beyond traditional financial metrics.