Strategy’s Market Position and Growth Trajectory

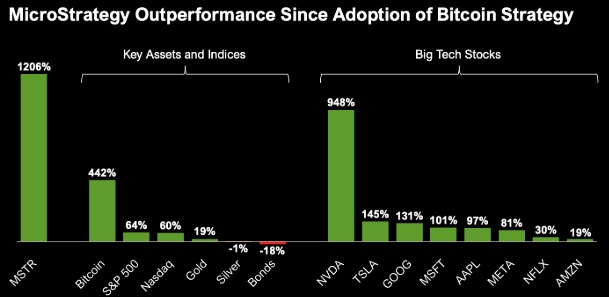

Strategy (formerly known as MicroStrategy) has transformed from a business intelligence software company into the world’s largest publicly traded Bitcoin treasury company. This transformation has not only redefined the company’s business model but has also dramatically impacted its market behavior and future potential. This article examines Strategy’s current market position and explores projections for its growth trajectory in the coming years.

TL;DR

- Strategy has evolved from a business intelligence company into a Bitcoin treasury powerhouse, fundamentally shifting its business model and market dynamics.

- The company maintains exceptionally high trading volume, ranking among the top 10 most traded equities despite being only the 120th largest by market capitalization.

- Financial engineering strategies, including convertible bond issuances and leveraged exposure to Bitcoin, drive its continuous accumulation of BTC.

- If Bitcoin reaches $1 million per coin, Strategy’s holdings could be worth $750 billion to $1 trillion, positioning it among the world’s most valuable companies.

- Key risks include Bitcoin price volatility, competition from ETFs, and execution risks, but Strategy’s innovative capital strategy and index inclusion potential provide strong growth catalysts.

Current market position and trading dynamics

Top-tier trading volume

One of the most striking aspects of Strategy’s market presence is its consistent ranking among the most actively traded equities in the market. For approximately 70-75 consecutive days, Strategy has maintained its position as one of the top 10 publicly traded equities by volume. This extraordinary trading activity occurs despite the company ranking only around 120th in terms of market capitalization among publicly traded companies.

This discrepancy between trading volume rank and market cap rank highlights the unique market dynamics surrounding Strategy’s stock. While larger companies by market capitalization may have more stable trading patterns, Strategy attracts disproportionate trading activity due to its connection to Bitcoin and its leveraged exposure to cryptocurrency price movements.

Trading strategies driving volume

The extreme volatility in Strategy’s share price has created a fertile environment for various trading strategies:

- Arbitrage trading: Traders frequently arbitrage between Strategy and Bitcoin ETFs like ibit, capitalizing on price discrepancies

- Convertible bond hedging: Significant trading volume comes from convertible bond traders hedging their positions

- Long-short strategies: Traders execute strategies between MSTR and MSTY (the 2x leveraged version)

- Options strategies: Strategy’s deep options market enables sophisticated traders to implement complex volatility-based strategies

As one market analyst noted: “Strategy has basically been a top 10 publicly traded equity by volume for about the last 70 days in a row. When you look at where they rank in the publicly traded leaderboard, they’re 120th largest publicly traded company now. You start to compare that right and you’re like wait, what’s going on here? The reason for that is the volatility in the Strategy share price.”

This volatility creates both challenges and opportunities. While it can lead to significant price swings, it also attracts market participants who thrive in volatile conditions, contributing to Strategy’s liquidity and market presence.

Strategy’s growth trajectory projections

Path to surpassing major tech companies

Despite being currently ranked around 120th by market capitalization, there are compelling arguments suggesting Strategy could eventually surpass some of today’s technology giants. While such predictions might seem ambitious, they’re based on several key factors:

- Bitcoin’s long-term value proposition: If Bitcoin continues its adoption trajectory and price appreciation, Strategy’s substantial holdings ( 538.200 BTC) would increase dramatically in value

- Continuous accumulation strategy: Unlike static Bitcoin holders, Strategy actively acquires more Bitcoin over time through financial engineering

- Index inclusion benefits: Strategy’s inclusion in major indices creates self-reinforcing capital flows that strengthen its market position

Market analysts have suggested that while this outcome isn’t likely in the immediate future, a timeline of 8-12 years could see Strategy ascend to become one of the world’s most valuable companies.

Bitcoin price as the primary driver

The fundamental catalyst for Strategy’s potential ascent relies heavily on Bitcoin’s price performance. With Strategy holding 538.200 Bitcoin (approximately 2.56% of the total supply), significant Bitcoin price appreciation would directly impact the company’s valuation.

Looking at longer time horizons:

- If Bitcoin reaches $1 million per coin, Strategy’s current holdings alone would be valued at approximately $499 billion

- With continued acquisition, Strategy could potentially hold 750,000 to 1 million Bitcoin within a decade

- At $1 million per Bitcoin, this would represent a $750 billion to $1 trillion asset base

Comparing potential valuation to current market leaders

To understand the scale of this potential growth, consider that Strategy currently trades alongside companies like CVS and Chipotle in terms of market capitalization. The disparity between these businesses highlights a key question: does a company holding 2.56% of Bitcoin’s supply deserve a higher valuation than retail pharmacy chains or restaurant operations?

As one analyst observed: “When I look at Strategy’s market cap and I see them trading around CVS and Chipotle, my only response to that is it’s going higher. Bitcoin is more valuable than $5 guacamole—that’s like going higher.”

Factors driving future growth

Capital markets flywheel

Strategy has engineered a self-reinforcing growth mechanism through its financial operations:

- The company raises capital through various means (convertible bonds, equity offerings)

- This capital is used to purchase more Bitcoin

- As Bitcoin’s price increases, Strategy’s market cap grows

- The higher market cap enables more efficient capital raising

- The cycle repeats, creating a powerful flywheel effect

This mechanism allows Strategy to compound its Bitcoin holdings over time, potentially accelerating its market cap growth beyond traditional corporate growth rates.

Index inclusion momentum

Strategy’s market position has been strengthened by its inclusion in the NASDAQ 100. This inclusion has attracted passive investment flows from index funds.

However, the potential inclusion in the S&P 500 represents a significantly larger opportunity. With approximately ten times more assets tracking the S&P 500 compared to the NASDAQ 100, such inclusion could trigger massive capital inflows, further strengthening Strategy’s market position.

Volatility as a strategic advantage

Unlike most companies that view price volatility as a negative factor, Strategy has transformed volatility into a strategic asset. The company’s high volatility enables it to:

- Issue convertible bonds with favorable terms due to the valuable embedded options

- Attract trading volume that enhances market liquidity

- Create opportunities for financial engineering that other companies cannot access

This approach to volatility represents a fundamental innovation in corporate finance that could drive Strategy’s growth over the coming years.

Timeline for potential valuation milestones

While precise timelines are inherently speculative, market analysts have outlined a potential growth trajectory for Strategy:

- Next 12 months: Potential S&P 500 inclusion if Bitcoin price exceeds $96,500 by the end of March 2025

- 2-3 years: Continued Bitcoin accumulation and capital structure optimization

- 5-7 years: Significant market cap expansion as Bitcoin adoption increases

- 8-12 years: Potential to reach valuation levels comparable to today’s leading technology companies

The key catalyst for this timeline would be Bitcoin continuing its adoption curve and price appreciation, combined with Strategy’s efficient execution of its Bitcoin acquisition strategy.

Challenges and considerations

Despite the optimistic growth projections, several factors could impact Strategy’s trajectory:

Bitcoin price volatility

While Strategy has demonstrated resilience during Bitcoin price fluctuations, sustained bear markets could challenge the company’s growth momentum. During the 2022-2023 crypto winter, Strategy’s ability to raise capital was constrained, limiting its Bitcoin accumulation during a period of depressed prices.

Competition from Bitcoin ETFs

The emergence of Bitcoin ETFs provides investors with alternative vehicles for Bitcoin exposure. While Strategy offers different value propositions through its financial engineering and leveraged exposure, ETFs represent competition for investment capital seeking Bitcoin exposure.

Execution risk

Strategy’s growth depends on continued successful execution of its Bitcoin acquisition strategy. Any significant missteps in capital raising, debt management, or market timing could impact investor confidence and the company’s premium valuation.

Conclusion: A unique growth story unfolding

Strategy represents one of the most fascinating corporate transformation stories in modern finance. From a business intelligence software company to potentially one of the world’s most valuable companies, Strategy’s journey challenges conventional assumptions about corporate growth trajectories.

The company’s current market position—consistently ranking among the most actively traded equities despite a mid-tier market cap—reflects the unique dynamics surrounding its Bitcoin treasury strategy. If Bitcoin continues its adoption curve and Strategy maintains its execution excellence, the company’s growth potential over the next decade appears substantial.

For investors, Strategy offers a leveraged bet on Bitcoin’s future through a sophisticated corporate structure with access to capital markets. While traditional valuation metrics struggle to capture Strategy’s potential, the company’s market behavior suggests that participants increasingly recognize the possibility of exceptional long-term growth.

As one market analyst summarized: “When eight to ten years from now Bitcoin’s trading consistently at a million dollars plus and Strategy’s got 750,000 to a million Bitcoin on their balance sheet, I think it’s going to be one of the only valuations that really makes sense.”