Strategy’s path to S&P 500 inclusion: Key dates and earnings requirements

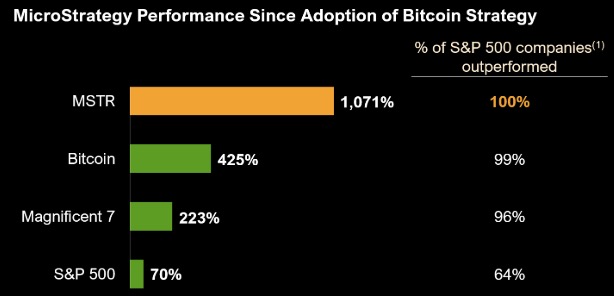

The potential inclusion of Strategy (formerly known as MicroStrategy) in the S&P 500 index represents a significant milestone for both the company and the broader Bitcoin ecosystem. With Strategy currently holding 538.200 Bitcoin valued at approximately USD 50.156 bln, its addition to this prestigious index would mark a watershed moment for institutional Bitcoin adoption. This article examines the key requirements, dates, and Bitcoin price thresholds that could determine when Strategy might join the S&P 500.

TL;DR

- Strategy must report positive earnings over the trailing four quarters to qualify for S&P 500 inclusion, which may require a Bitcoin price of approximately $97,000.

- New FASB fair value accounting rules mean Strategy’s Bitcoin holdings are marked to market each quarter, directly impacting earnings.

- Key inclusion dates in 2025 are June 20, September 19, and December 19, with announcements typically occurring 1-2 weeks prior.

- Bitcoin price movements will dictate Strategy’s ability to meet earnings thresholds, influencing its potential inclusion timeline.

- S&P 500 inclusion could trigger institutional buying, as index funds would be required to purchase Strategy shares, potentially increasing demand and share price.

Understanding the FASB fair value accounting impact

The implementation of new FASB fair value accounting rules has fundamentally changed how Strategy reports its Bitcoin holdings. Under these rules, Bitcoin is now marked at its fair value both at acquisition and at the end of each quarter. This accounting treatment has significant implications for Strategy’s earnings reports:

- When Strategy acquires Bitcoin, it is recorded at its fair value at the time of purchase

- At the end of each quarter, all Bitcoin holdings are marked to their fair value at that point

- The difference between acquisition price and quarter-end price is recorded in earnings

- Price appreciation or depreciation of previously held Bitcoin from the beginning to the end of the quarter is also reflected in the income statement

This accounting approach means that Bitcoin price movements directly impact Strategy’s reported earnings per share (EPS), a critical metric for S&P 500 inclusion.

The earnings requirement for S&P 500 inclusion

For Strategy to be included in the S&P 500, it needs to demonstrate positive earnings over the trailing four quarters. Currently, Strategy has reported negative earnings for the previous three quarters, which means this quarter’s earnings must be sufficient to offset those losses and turn the trailing four-quarter total positive.

Analysis suggests that a Bitcoin price of approximately $97,000 would be required to generate sufficient earnings to erase the previous three quarters of negative results. With Bitcoin currently trading at USD 93,192.00, this threshold remains within reach but would require further price appreciation before the end of the current quarter.

It’s important to note that Strategy doesn’t necessarily need to achieve positive earnings this quarter. If the Bitcoin price doesn’t reach the required threshold in the current period, the company could potentially qualify in subsequent quarters if Bitcoin continues its upward trajectory.

Key dates for potential S&P 500 inclusion in 2025

The S&P 500 index undergoes rebalancing and inclusion reviews four times per year. For 2025, the relevant dates are:

- June 20, 2025 - First potential inclusion date (third Friday in June)

- September 19, 2025 - Second potential inclusion date (third Friday in September)

- December 19, 2025 - Third potential inclusion date (third Friday in December)

If Strategy meets the earnings criteria in the current quarter, it could be eligible for inclusion on June 20th. However, if the required Bitcoin price is not reached, the company would then target the September or December dates.

The announcement timing factor

The S&P 500 committee typically announces new inclusions one to two weeks before the actual inclusion date. Based on the 2025 inclusion schedule, potential announcement dates would be:

- For June inclusion: Approximately June 6-11, 2025

- For September inclusion: Approximately September 5-12, 2025

- For December inclusion: Approximately early December 2025

These announcement periods represent potentially significant catalysts for Strategy’s stock price, as index funds and ETFs tracking the S&P 500 would need to purchase shares to align with the upcoming index changes.

Impact of Bitcoin price movements on inclusion timeline

Strategy’s qualification for S&P 500 inclusion is inextricably linked to Bitcoin’s price performance. With Bitcoin currently (article written on 17 march 2025) trading at USD 93,192.00, the company needs approximately a 16.9% increase to reach the estimated $97,000 threshold for positive trailing earnings.

The flexibility of having multiple potential inclusion dates throughout the year provides some breathing room if Bitcoin doesn’t reach the necessary levels this quarter. As long as Bitcoin continues its long-term upward trend, Strategy has multiple opportunities to qualify for inclusion in 2025.

Investment implications of potential inclusion

The path to S&P 500 inclusion has significant implications for investors in Strategy. If the company is added to the index, it would trigger substantial buying from passive index funds that track the S&P 500. These funds would be required to purchase Strategy shares proportional to its weight in the index, potentially driving up the share price.

This dynamic creates a strategic consideration for investors positioning themselves ahead of potential inclusion announcements. The timing of these announcements, particularly in relation to option expiration dates, may influence investment strategies for those seeking leveraged exposure to potential inclusion-related price movements.

Conclusion

Strategy’s potential inclusion in the S&P 500 index represents a significant milestone in the company’s evolution from a software provider to the world’s largest corporate Bitcoin holder. The implementation of FASB fair value accounting rules has created a clear pathway for inclusion, contingent on Bitcoin price performance.

With multiple potential inclusion dates throughout 2025, Strategy has several opportunities to meet the necessary earnings criteria. For investors and market observers, understanding the relationship between Bitcoin’s price movements, Strategy’s reported earnings, and the S&P 500 inclusion timeline provides valuable context for monitoring this developing situation.

As Strategy continues to execute its Bitcoin acquisition strategy, holding 538.200 Bitcoin valued at USD 50.156 bln, its journey toward potential S&P 500 inclusion will remain closely tied to Bitcoin’s price performance and the broader institutional adoption of digital assets.