The Bitcoin revolution in corporate finance: how Strategy is leading the way

In the staid world of corporate finance, where MBA playbooks have remained largely unchanged for decades, one company has torn up the rulebook. Strategy (formerly known as MicroStrategy) has pioneered a revolutionary approach to corporate finance by prioritizing Bitcoin accumulation on its balance sheet—and the results speak for themselves.

TL;DR

- Most companies underperform market benchmarks due to a focus on income statement strategies rather than making their balance sheets productive.

- Strategy has achieved market-beating performance by accumulating Bitcoin, turning it into the best-performing US company in the last five years.

- Bitcoin now benefits from improved accounting standards, institutional legitimacy, and a supportive regulatory climate, enabling more corporate adoption.

- Strategy’s valuation premium is justified through models based on future Bitcoin gains, potentially supporting a valuation of $500 billion to $1 trillion.

- The company’s model is replicable, offering a pathway for other firms to transform stagnant balance sheets into high-performance assets using Bitcoin.

The problem with corporate America

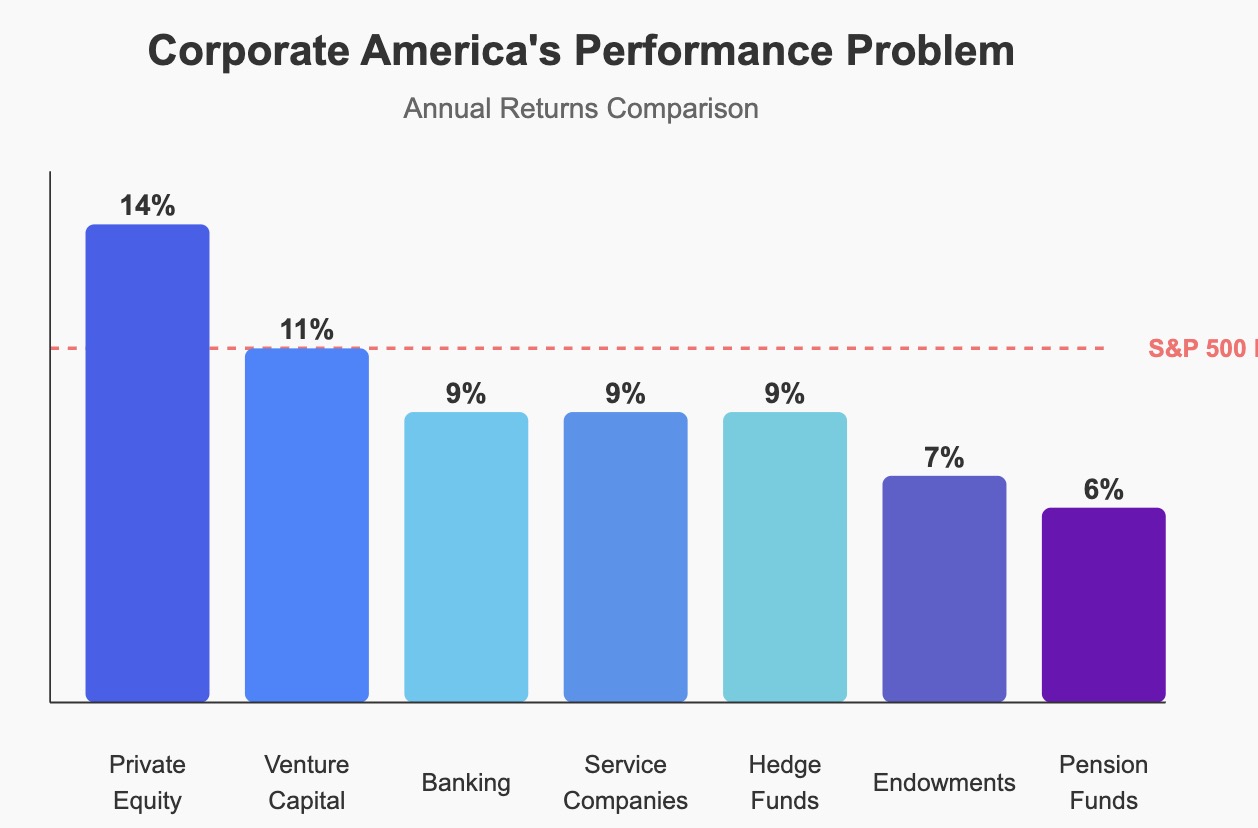

Corporate America has a performance problem. While the S&P 500 averages around 11% annual returns, the vast majority of American companies fall well short of this benchmark. The Russell 1000 (the next 1,000 largest companies after the S&P 500) consistently underperforms the S&P 500. The Russell 2000 delivers only half the returns of the S&P 500. And the remaining companies? They typically grow at GDP rates—a paltry 2.5%.

It’s not just corporations that struggle. Even the vaunted masters of the financial universe can’t consistently beat the market:

- Private equity: 14% (one of the few outperforming the S&P 500)

- Venture capital: 11% (matching the S&P 500)

- Banking: 9%

- Service companies: 9%

- Hedge funds: 9% (all those PhDs for market-average returns?)

- Endowments: 7%

- Pension funds: 6%

The business school blind spot

The root of this underperformance might lie in business education itself. Approximately 90% of business school curricula focus on income statement strategies: build better products, acquire customers, expand margins, maximize earnings per share—the traditional playbook that’s been taught for generations.

Meanwhile, a mere 10% of business education addresses balance sheet management—how to make your money work for you. As the old adage goes: smart people create wealth by making money off their money. Universities do it with endowments. Nations do it with sovereign wealth funds. So why aren’t more corporations doing it?

The treasury tragedy

Most corporate treasuries are stuck in a low-return paradigm. Traditional treasury investments deliver underwhelming results:

- Gold: 10% (over the last decade)

- Silver: 2%

- US Treasury bills: -6%

With these dismal options, it’s little wonder that most corporations don’t view their balance sheets as strategic assets. But Bitcoin has changed the equation.

Strategy’s Bitcoin revolution

Strategy currently holds 538.200 Bitcoin, worth approximately USD 50.156 bln. This bold approach has made it the best-performing company in the United States over the last five years, outperforming the entire NASDAQ, S&P 500, and even the vaunted “Magnificent 7” tech giants.

Bitcoin’s performance in every 10-year period since its inception has been extraordinary. Even its “worst” 10-year period (2013-2023) delivered 50% gains, with the best period achieving a staggering 223% return.

Strategy has proven that focusing on the balance sheet—specifically, Bitcoin accumulation—can create unprecedented shareholder value.

A replicable strategy for corporate transformation

What makes Strategy’s approach revolutionary is that it’s replicable. Other companies like Metaplanet and Semler Scientific have adopted similar Bitcoin treasury strategies and have outperformed both Bitcoin itself and the broader market indices.

This isn’t just a lucky break; it’s a fundamental rethinking of corporate finance that challenges the income-statement-focused groupthink that dominates American business education.

Breaking free from business orthodoxy

Traditional markets operate 252 days a year, 6.5 hours a day—just 19% of the time. Bitcoin operates 100% of the time. Corporations report earnings quarterly; Strategy shows its results daily (updating them every 15 seconds on its website). Credit ratings update annually and often ignore Bitcoin’s impact. Accounting policies change only every five years.

This mismatch between traditional financial frameworks and Bitcoin’s revolutionary potential has created an opportunity for forward-thinking companies willing to break from orthodoxy.

The changing landscape for corporate Bitcoin adoption

Three recent developments have made corporate Bitcoin adoption more viable:

-

New accounting standards: Companies can now recognize Bitcoin at fair value on their balance sheets, removing a significant reporting obstacle.

-

Institutional acceptance: The approval of Bitcoin ETFs and the involvement of major players like BlackRock and Fidelity have legitimized Bitcoin as an institutional asset class.

-

Favorable regulatory environment: The current administration has adopted a more supportive stance toward Bitcoin and digital assets, reducing regulatory uncertainty.

The premium question

Strategy trades at a premium to its net asset value—currently 1.840x (basic) and 2.069x (diluted). Critics argue this premium is unjustified, but there are multiple ways to value Strategy:

- Sum of parts (net asset value): Simply the value of Bitcoin holdings plus other assets minus liabilities.

- Discounted cash flow: The present value of all future cash flows.

- Multiple over income metrics: Applying appropriate multiples to Bitcoin yield and Bitcoin gains.

Using the third approach, if Strategy generates $10-15 billion in Bitcoin gains annually and trades at a 40-50x multiple (similar to high-growth tech companies), one could justify a valuation of $500 billion to $1 trillion—far above its current market cap.

The future of corporate finance

For companies with low growth and high cash, Bitcoin represents an escape from mediocrity.

For high-growth, cash-rich companies, it represents a way to supercharge already strong performance.

For all companies, it offers a path to “make money off your money”—the fundamental principle behind wealth creation that’s surprisingly absent from most corporate strategies.

Bitcoin doesn’t just provide financial freedom; it offers freedom from average performance and freedom from outdated financial orthodoxy. As more corporations recognize this potential, we may be witnessing the beginning of a fundamental transformation in corporate finance—one Bitcoin at a time.

While traditionalists may scoff, the numbers don’t lie. Strategy’s balance sheet-focused approach has delivered extraordinary results, challenging decades of business school wisdom with a simple yet revolutionary idea: perhaps the best product a company can build is a Bitcoin-focused balance sheet.