The golden era of Bitcoin securitization

We are witnessing a transformative period in financial markets—the dawn of what can rightfully be called the golden era of Bitcoin securitization. Much like the emergence of mortgage-backed securities in the 1970s revolutionized housing finance, Bitcoin is now becoming the foundation for an expanding ecosystem of financial products that are reshaping how investors gain exposure to digital assets.

This evolution is creating unprecedented opportunities for investors who understand both traditional finance and Bitcoin’s unique properties, while establishing new pathways for capital to flow into the digital asset ecosystem.

TL;DR

- A surge in Bitcoin-based financial instruments—including convertible bonds, preferred shares, and ETFs—is transforming how investors access digital assets.

- The movement mirrors the revolution of mortgage-backed securities, suggesting enormous growth potential and institutional integration for Bitcoin.

- Portfolio diversification within Bitcoin is now possible, offering instruments with different risk-return profiles including yield, growth, and volatility exposure.

- Bitcoin’s volatility is now an asset, enhancing the value of convertibles and options, and drawing sophisticated market participants.

- Institutions are embracing Bitcoin exposure via regulated financial products, solving mandate barriers and unlocking major capital inflows.

The birth of Bitcoin-based financial instruments

For most of Bitcoin’s existence, investment options were limited to direct ownership or, more recently, futures contracts. Today, however, we’re seeing an explosion of sophisticated financial instruments built on Bitcoin, creating what can be described as a “Bitcoin orchestra” of products with varying risk-return profiles.

Leading this transformation is Strategy (formerly known as MicroStrategy), which has pioneered several innovative approaches to Bitcoin-based finance:

- Convertible bonds: Zero or near-zero interest bonds that give holders the option to convert to equity at predetermined prices

- Preferred shares: Both STRK (8% yield) and STRF (10% yield) preferred stock offerings that provide fixed income with Bitcoin exposure

- Leveraged products: ETFs like MSTU that offer amplified Bitcoin exposure

Meanwhile, other players have entered the market with complementary offerings such as Bitcoin ETFs, yield-generating products, and options-based vehicles. Each instrument provides a different risk-return profile, creating a spectrum of choices that simply didn’t exist even a few years ago.

Parallels to the mortgage-backed securities revolution

The current Bitcoin securitization trend bears striking resemblance to the birth and growth of mortgage-backed securities in the 1970s. What began as a small market for pooled mortgages grew to approximately $60 billion within a decade, and then expanded dramatically in subsequent decades to become a multi-trillion dollar market.

This historical parallel suggests several insights:

- Early skepticism: Just as many were initially skeptical of mortgage-backed securities, today’s Bitcoin securitization faces similar doubts

- Dramatic growth potential: The current market size likely represents just the beginning of a much larger trend

- Capital attraction: These new instruments are bringing in capital from investors who previously had no exposure to Bitcoin

- Institutionalization: Financial products are helping legitimize Bitcoin as an institutional asset class

The creation of mortgage-backed securities fundamentally changed how housing finance worked. Similarly, Bitcoin securitization is poised to transform how digital assets integrate with traditional financial markets.

Creating financial harmony through Bitcoin diversification

One of the most fascinating aspects of this Bitcoin securitization era is how it enables diversification within a single asset class. Traditionally, creating a balanced portfolio required buying fundamentally different assets—stocks for growth, bonds for income, commodities for inflation protection, and so on.

Now, Bitcoin alone can serve as the underlying asset for an entire portfolio of varied risk profiles:

- Growth exposure: Direct Bitcoin or Strategy common stock

- Income generation: STRK or STRF preferred shares yielding 8-10%

- Leveraged returns: Products like MSTU offering amplified upside with greater risk

- Moderate volatility: Options-based products that generate income while maintaining Bitcoin exposure

This creates the possibility of a “Bitcoin orchestra” where various instruments play different roles but harmonize around the central theme of Bitcoin. An investor could theoretically construct a complete portfolio with varying time horizons, risk tolerances, and income needs—all built on Bitcoin’s foundation.

The volatility advantage

Bitcoin’s inherent volatility, often cited as a liability, is actually becoming one of its greatest assets in this new paradigm. Pioneering companies like Strategy are harnessing this volatility as a core component of their financial engineering.

For example:

- Convertible bond pricing: Higher volatility makes the conversion option more valuable, allowing issuers to secure more favorable terms

- Options premium: Bitcoin’s price movements create lucrative options pricing that can be monetized through covered calls and other strategies

- Trading opportunities: The volatility creates arbitrage opportunities that attract sophisticated market participants, increasing market liquidity

This “volatility as vitality” approach represents a fundamental shift in thinking. Rather than attempting to eliminate volatility through complex hedging strategies, these new instruments embrace it as a feature rather than a bug.

Institutional capital inflows

The securitization of Bitcoin is also solving a critical challenge for institutional adoption. Many institutions have specific mandate restrictions that prevent direct Bitcoin purchases, but allow investments in regulated securities like bonds, preferred shares, and ETFs.

Strategy’s convertible bonds, for instance, are particularly attractive to fixed income funds that want Bitcoin exposure but cannot hold the asset directly. Similarly, the STRK and STRF preferred shares appeal to yield-seeking investors who would never consider buying Bitcoin outright.

This creates a bridge between traditional capital and the Bitcoin ecosystem—one that allows billions in institutional money to gain Bitcoin exposure through vehicles that fit within existing investment mandates and risk frameworks.

Yield generation in a new paradigm

Perhaps most revolutionary is how these new Bitcoin securities are addressing the yield question. Traditional finance has always challenged Bitcoin on its lack of yield—unlike stocks with dividends or bonds with interest, Bitcoin itself generates no cash flow.

The current wave of securitization is changing that narrative by creating yield-bearing instruments built on Bitcoin:

- Preferred shares offering 8-10% fixed dividends

- Options-based products generating income through covered call strategies

- Lending platforms backed by Bitcoin collateral

This addresses one of the primary objections from traditional finance about Bitcoin’s role in a portfolio, potentially accelerating adoption by income-focused investors who previously dismissed Bitcoin entirely.

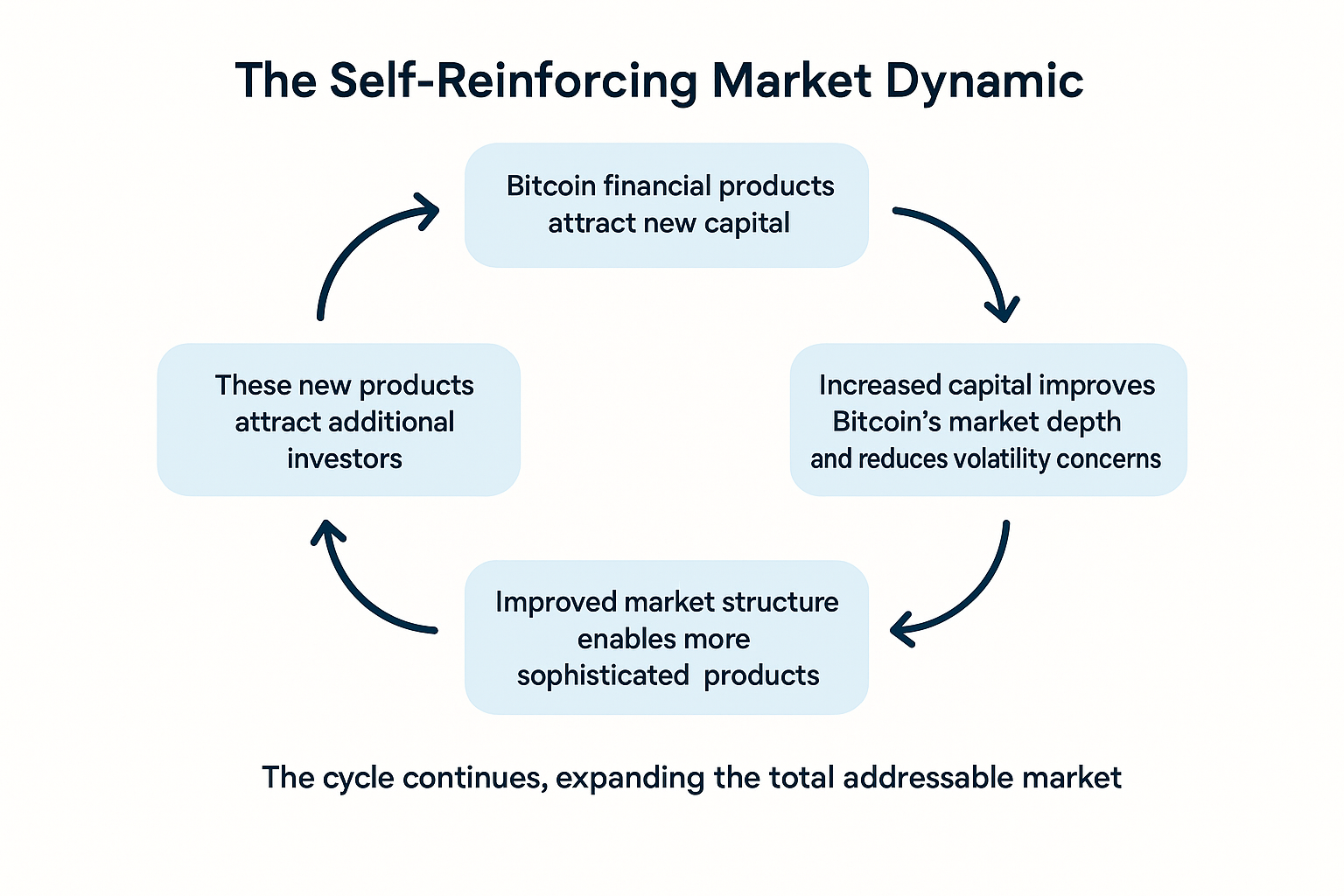

The self-reinforcing market dynamic

What makes this Bitcoin securitization era particularly powerful is its self-reinforcing nature. As more products emerge, more capital flows into the Bitcoin ecosystem, which increases Bitcoin’s price and market stability, which in turn makes more sophisticated products viable, attracting still more capital.

This creates a virtuous cycle where:

- Bitcoin financial products attract new capital

- Increased capital improves Bitcoin’s market depth and reduces volatility concerns

- Improved market structure enables more sophisticated products

- These new products attract additional investors

- The cycle continues, expanding the total addressable market

Strategy exemplifies this dynamic. With 538.200 Bitcoin on its balance sheet valued at USD 50.156 bln, the company has created a market capitalization of USD 92.25 bln. This premium valuation ( 1.840x to NAV) enables it to raise more capital to acquire additional Bitcoin, further strengthening its position.

Future directions

As this Bitcoin securitization era unfolds, several trends are likely to emerge:

- Expanded product range: More companies will likely create Bitcoin-based securities with varying risk-return profiles

- Deeper options markets: As liquidity improves, options strategies will become more sophisticated

- Yield competition: Different vehicles will compete on yield metrics, potentially driving innovation

- Cross-collateralization: Bitcoin assets may become collateral for products in other markets

- Integration with traditional finance: Bitcoin-based securities will increasingly appear in mainstream portfolios

The most significant development may be how these trends combine to make Bitcoin a fundamental building block of the financial system rather than an alternative to it.

Conclusion: positioning for the future

We are still in the early chapters of Bitcoin’s securitization story. The current products, innovative as they are, likely represent just the beginning of what will become a much larger and more sophisticated market.

For investors, this presents both opportunity and challenge. Understanding the mechanics of these new instruments, their risk-return profiles, and their place in a broader portfolio requires financial literacy in both traditional and digital assets.

However, those who can navigate this emerging landscape have the potential to benefit from what history may ultimately record as one of the most significant financial innovations of our era—the transformation of Bitcoin from a novel digital asset into the foundation of an entirely new financial ecosystem.

The golden era of Bitcoin securitization is just beginning, and its ultimate impact may be far greater than most currently anticipate.