Strategy’s ambitious projections: The road to 1 million Bitcoin in 2025

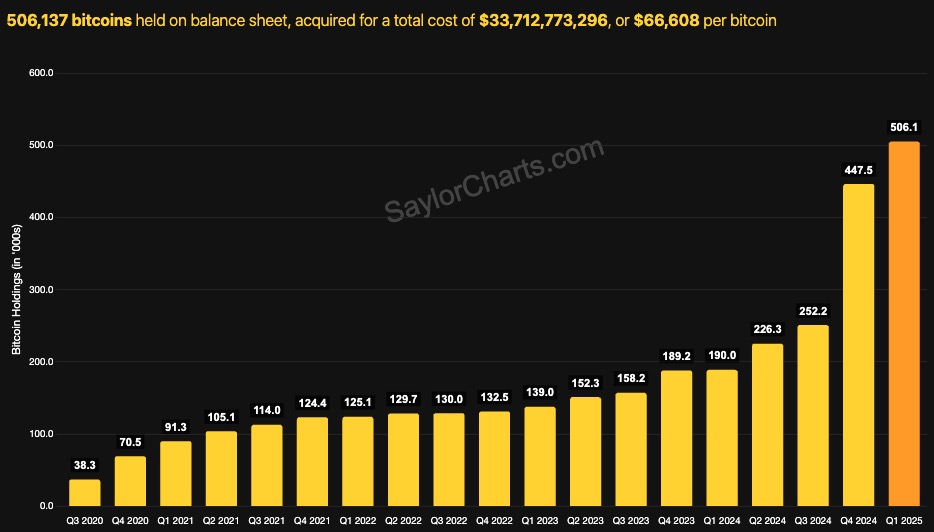

With 538.200 Bitcoin already under its belt, Strategy (formerly known as MicroStrategy) has firmly established itself as the undisputed heavyweight champion of corporate Bitcoin adoption. But if you think they’re satisfied with their current position, think again. The company that turned “volatility is vitality” from a catchy phrase into a revolutionary business model is just getting started.

TL;DR

- Strategy aims to accumulate up to 1 million Bitcoin by end of 2025, building on its 153% growth in holdings from the previous year.

- Two new instruments, STRK and STRF, enable rapid, low-friction capital raising from the bond market, with attractive yields and strong investor appeal.

- These preferred offerings feature a self-adjusting yield mechanism that makes them resilient and sustainable even in volatile markets.

- Signals from corporate adoption, favorable government positions, and underpriced market conditions echo the setup before Bitcoin’s 2020 bull run.

- The next evolution includes Bitcoin-backed lending products like mortgages and commercial financing, solving the “hold or use” dilemma for Bitcoin holders.

From half a million to a million: The 2025 accumulation roadmap

Industry analysts are projecting a staggering expansion of Strategy’s Bitcoin holdings before the champagne bottles pop for next New Year’s. Conservative estimates suggest the company will reach approximately 650,000 Bitcoin by December 2025, while the more bullish projections point toward the psychologically significant milestone of 1 million Bitcoin.

The base case among market observers lands at around 750,000 Bitcoin by year-end - representing a 50% increase from Strategy’s current holdings of 538.200 Bitcoin. In Bitcoin terms, that’s not just moving the needle; it’s bending it into a pretzel.

These projections might seem ambitious until you consider Strategy’s recent history. The company more than doubled its Bitcoin holdings in 2024 alone—a 153% increase in just twelve months. Given this track record, suddenly those “ambitious” projections start looking rather reasonable.

What’s making this accelerated accumulation possible? Two revolutionary financial instruments with names that sound like they were plucked from a fantasy novel: Strike and Strife.

STRK and STRF: Financial alchemy transforming bonds into Bitcoin

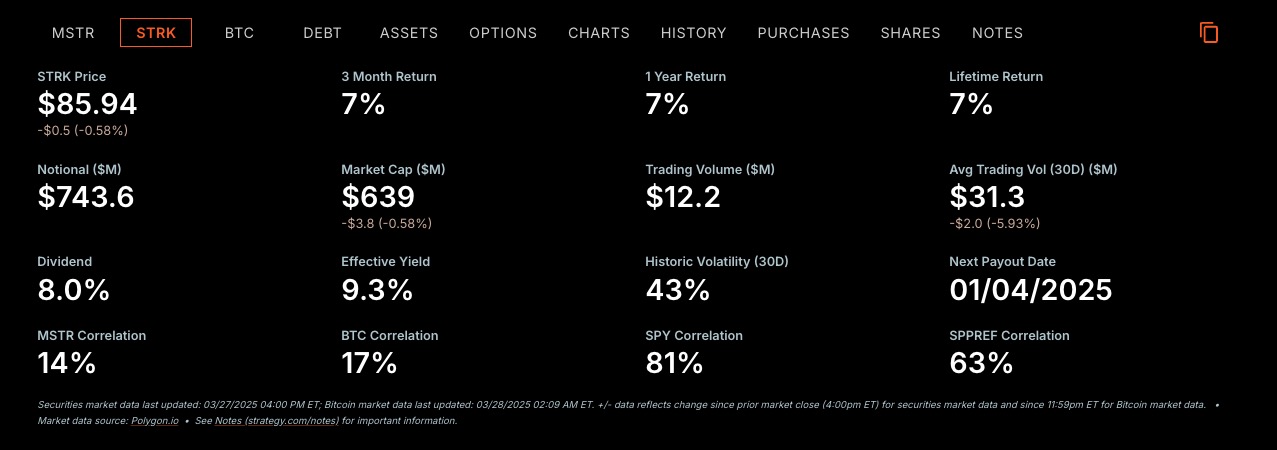

Strategy’s recent introduction of two preferred stock offerings—8% Series A Perpetual Strike Preferred Stock (STRK) and 10% Series A Perpetual Strife Preferred Stock (STRF)—represents nothing short of financial wizardry.

These instruments are designed to tap into the $300 trillion global bond market, effectively acting as a high-powered pump that accelerates the flow of capital from traditional fixed income into Bitcoin. It’s like Strategy built a financial pipeline from Wall Street directly into the Bitcoin network.

STRF in particular has turned heads in financial circles. Offering an effective yield of 10%, it significantly outperforms traditional fixed-income investments in today’s market. Despite this attractive return, the risk remains relatively low given Strategy’s strong balance sheet and conservative debt-to-Bitcoin NAV ratio.

What makes these instruments truly revolutionary is how they reduce friction in capital raising. Unlike traditional convertible notes that require months of preparation and negotiation, STRK and STRF allow Strategy to raise capital on demand, sometimes even same-day, whenever market conditions look favorable. This mechanism transforms the capital raising process from “sucking capital through a straw to opening up a river,” as one analyst colorfully put it.

These financial innovations effectively take traditional debt instruments and repackage them in Bitcoin wrapping paper—making these investments more accessible and attractive to traditional fixed-income portfolio managers who might otherwise never consider anything related to cryptocurrency.

The self-healing financial mechanism

Perhaps the most elegant feature of these preferred offerings is their “self-healing” nature. If excessive use of Strategy’s at-the-market (ATM) offerings drives prices down, the effective yield automatically increases, making the offering more attractive to yield-hungry investors and naturally correcting the price.

It’s like a financial thermostat—if the temperature drops too low, the heat automatically kicks in until balance is restored. This creates a sustainable mechanism for continuous capital raising that simply wasn’t available before Strategy pioneered it.

With a market capitalization of USD 92.25 bln and Bitcoin net asset value of USD 50.156 bln, Strategy trades at a premium of 2.069x to its Bitcoin holdings. This premium reflects the market’s confidence in the company’s ability to continue executing its acquisition strategy effectively.

Bitcoin at an inflection point: Echoes of Q3 2020

The current Bitcoin market bears striking parallels to Q3 2020—a period that preceded Bitcoin’s dramatic rise from around $10,000 to over $60,000 in subsequent months.

Similar signals today suggest we’re approaching another inflection point:

-

Corporate adoption playbook: Strategy has established a proven roadmap for corporate Bitcoin treasury adoption that other companies are beginning to follow.

-

Administration signals: Recent executive orders and the appointment of Bitcoin-friendly officials in key positions suggest increasing legitimacy for Bitcoin at the governmental level.

-

Nation-state interest: There are indications that governments are quietly evaluating whether they need to begin accumulating Bitcoin reserves.

-

Disconnect between news and price: Despite increasingly positive news, Bitcoin’s current price of USD 87.000 (as of writing this article) hasn’t yet fully reflected these developments—creating a potential opportunity for those who recognize this disconnect.

The current news cycles and regulatory developments strongly suggest that increased adoption is the likely path forward, not retreat. Strategy, with its current Bitcoin holdings representing 2.56% of the total supply, is positioned to benefit enormously from this next wave of adoption.

The next frontier: Lending products and credit solutions

Looking beyond simple accumulation, lending products and credit-wrapped solutions represent the next frontier in Bitcoin adoption.

While many individuals and institutions understand the value proposition of Bitcoin, a common concern remains: “I accumulate all this Bitcoin, now what do I do with it? Am I just supposed to hold it indefinitely?”

The solution lies in developing sophisticated lending products that allow Bitcoin holders to access the value of their holdings without selling:

-

Bitcoin-collateralized mortgages: Allowing homebuyers to use Bitcoin as collateral for real estate purchases.

-

Commercial real estate financing: Using Bitcoin holdings to secure favorable terms on commercial property investments.

-

Low-rate lending: Creating pathways for Bitcoin holders to borrow at rates comparable to traditional finance options, rather than the high rates currently typical in crypto lending.

When Bitcoin holders can borrow at more competitive rates, it will solve one of the final psychological barriers to Bitcoin adoption: the ability to utilize the value of accumulated Bitcoin while continuing to hold the asset itself.

This development could trigger a significant conversion of capital from traditional assets like real estate into Bitcoin due to Bitcoin’s superior liquidity and resistance to monetary debasement.

Beyond the price ticker: The transformation of global finance

We are witnessing nothing less than a historic transformation in global finance. With Strategy potentially accumulating up to 1 million Bitcoin by year-end, new financial instruments tapping into the multi-trillion-dollar bond market, and sophisticated credit solutions emerging, Bitcoin appears poised for its next major growth phase.

This isn’t simply market mania—it represents a transition to a new economic paradigm. Bitcoin adoption appears to be approaching a “hockey stick moment” where growth could accelerate dramatically.

For investors and observers, the key takeaway is clear: the most significant developments in the Bitcoin ecosystem are happening quietly, behind the headline price movements. While many are fixated on daily price fluctuations, Strategy is methodically constructing the infrastructure for the next wave of adoption.

With a current Bitcoin yield of +10.97% year-to-date and average acquisition cost of USD 67,766 per Bitcoin, Strategy has demonstrated an ability to efficiently accumulate Bitcoin even amid market volatility. This efficiency, combined with innovative financial engineering, positions the company to potentially achieve what seemed impossible just a few years ago: a corporate Bitcoin treasury counting a million coins.

Whether they reach that ambitious target or not, one thing is certain—Strategy has rewritten the rules of corporate finance and created a new model that others will inevitably follow. The Bitcoin revolution isn’t coming; it’s already here, and Strategy is leading the charge.