The Strategic Bitcoin Reserve: according to Michael Saylor

On March 4, 2025, President Trump established a Strategic Bitcoin Reserve by executive order, declaring that “America will be the Bitcoin superpower.” This move signals a fundamental shift in America’s approach to digital assets and national security. Michael Saylor, one of the most prominent Bitcoin advocates, offered his perspective on why this decision could be worth between $3 trillion and $106 trillion to the United States over the next 20 years.

TL;DR

- America’s Strategic Bitcoin Reserve is designed to secure digital supremacy and national security.

- Bitcoin is digital capital, property, and energy, offering a secure store of value immune to inflation and decay.

- The U.S. could generate trillions by leveraging Bitcoin through lending, financing, and economic growth.

- Bitcoin is a digital defense system, creating a secure, tamper-proof financial infrastructure resistant to cyber threats.

- The race for Bitcoin dominance is a national imperative, with the U.S. facing economic and security risks if it falls behind.

Understanding Bitcoin’s strategic importance

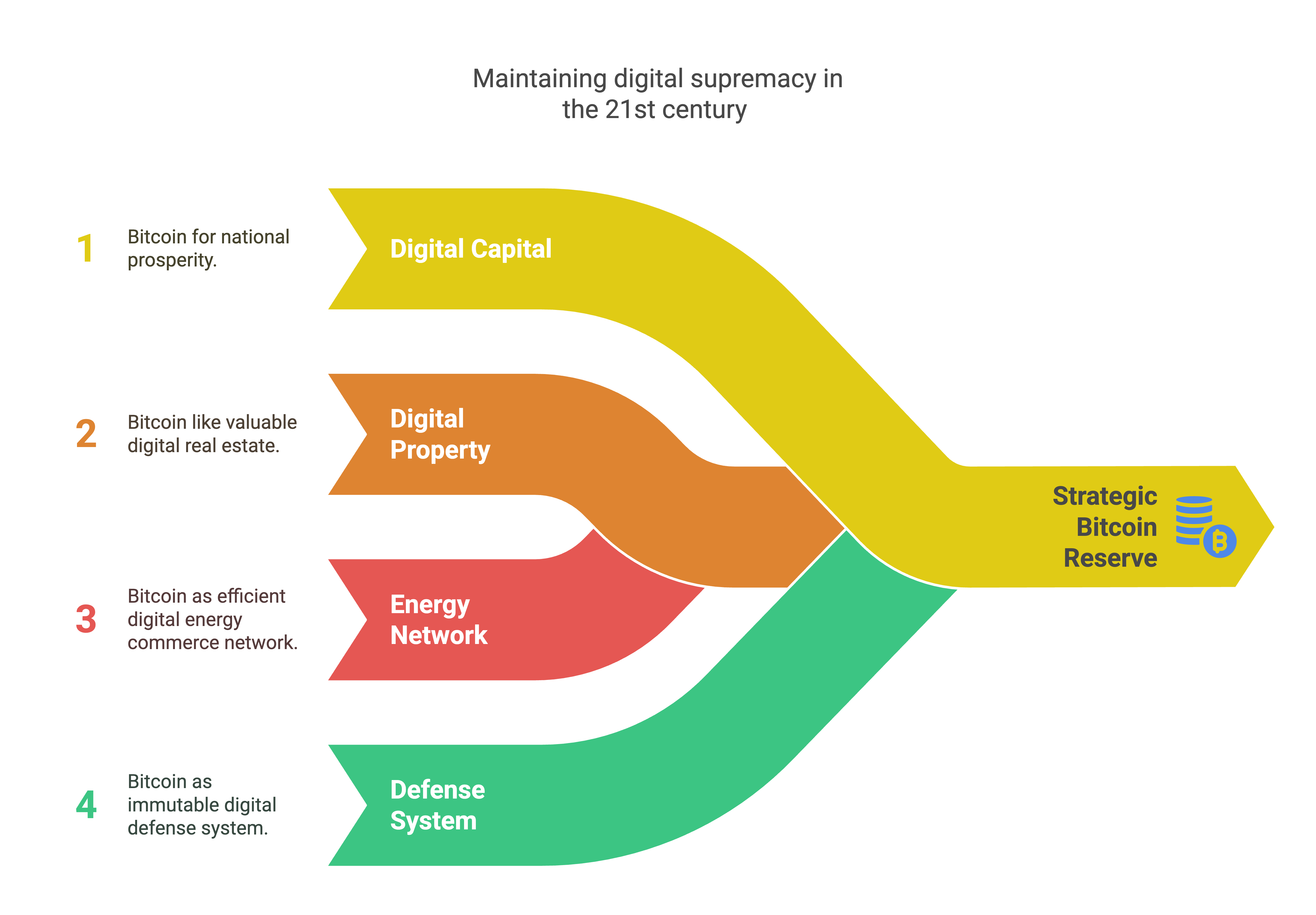

The Strategic Bitcoin Reserve might sound like a simple stockpile of an asset to casual observers. However, as Saylor explains, it represents much more: a strategy for achieving and maintaining United States digital supremacy in the 21st century.

Saylor frames Bitcoin through multiple metaphors to illustrate its strategic value:

Bitcoin as digital capital

At its most basic level, the Strategic Bitcoin Reserve represents a stockpile of what Saylor calls “the apex asset of the human race.” But unlike traditional stockpiled assets like gold, oil, or uranium, Bitcoin offers unique advantages for national prosperity.

Saylor’s company, Strategy (formerly known as MicroStrategy), demonstrates this potential. Over just 48 months, it has grown from having $250 million in assets to nearly $45 billion by accumulating Bitcoin. This exponential growth illustrates the potential value creation that could occur at a national scale.

Bitcoin as digital property

Moving beyond the simple stockpile metaphor, Saylor presents Bitcoin as digital property. He draws a parallel to owning real estate in Manhattan: “If you owned 5% of Manhattan and your family owned it for a hundred years and someone said how are you going to pay your bills, you wouldn’t say we’re just going to sell it. You would say we’re going to rent it, we’re going to develop it, we’re going to put a building on top of it, a business on top of it, or we’re going to finance it.”

Similarly, Bitcoin can be leveraged, rented, or financed. Saylor predicts that in 20 years, the United States could generate $10 trillion per year by renting, developing, or financing the assets in a Strategic Bitcoin Reserve.

Bitcoin as a digital energy network

The most profound metaphor Saylor offers is Bitcoin as a digital energy network. Unlike information networks, Bitcoin conserves energy in cyberspace: “I can send a billion dollars from me to you. I lose it, you have it. That is the conservation of energy in cyberspace.”

This conservation property makes Bitcoin uniquely valuable for digital commerce. Saylor envisions “trillions of dollars of digital commerce” flowing over the Bitcoin network, with “40,000 banks settling with each other in real time, moving billions, tens of billions, or hundreds of billions of dollars an hour over a pure digital network.”

Bitcoin as a digital defense system

Perhaps most critically for national security, Saylor portrays Bitcoin as a digital defense system: “When we have open digital energy flowing, it is a commerce network, but when we reverse that digital energy into a shield, it becomes a defense system.”

He emphasizes that Bitcoin’s transactions, messages, and authentications are “unstoppable, uncorruptable, immutable, immune to tampering by any known cyber threat.” This provides a “wall of digital energy” that can protect U.S. commercial, military, and financial systems.

Even advanced AI systems cannot break through this protection: “The AIs don’t know how to hack Bitcoin. They can spoof you out of your money. They can convince you that they’re someone they’re not. There’s no way to trick an 800 exahash digital wall that’s based on modern encryption.”

The global wealth transformation

Saylor presents Bitcoin adoption as a fundamental transformation of global wealth. He estimates that approximately $450 trillion of the world’s $900 trillion in wealth is held as a long-term store of value. This capital suffers approximately $10 trillion in annual damage from “entropy, inflation, chaos, and the future” through various risks and forms of decay.

Bitcoin offers a solution by eliminating these risks:

- No financial risk of currencies, bonds, or stocks

- No physical risk of real estate and property

- No counterparty risk of traditional financial systems

Saylor characterizes this as “the greatest digital transformation of the 21st century,” worth “half of everything.” He explains:

-

Digital capital is stronger, faster, and smarter capital “It’s everything you don’t like about the building stripped away, and you’ve got an invisible, indestructible, immortal, teleportable building.”

-

Bitcoin is global capital People worldwide who want U.S. security and values but can’t physically relocate can move their money into the Bitcoin network.

-

Bitcoin is immortal capital With a lifespan potential of 1,000 years compared to 10-100 years for other assets.

-

Bitcoin is ethical capital “It’s the only thing in this world you can truly own… everything else you have in this world, you own at the pleasure of someone more powerful than you, until they decide to take it away from you.”

Bitcoin as the world’s most powerful network

Saylor describes the Bitcoin network as the world’s most powerful in terms of both computational and economic power:

- 800 exahash of computational power, exceeding the electrical capacity of the U.S. Navy

- $1 trillion of real money already flowed into the network

- Global, fault-tolerant, and unstoppable

- A “Newtonian network” that attracts capital like a gravitational force

“Bitcoin is the brightest thing in the financial universe,” Saylor declares. “It’s the most interesting. It’s growing stronger. It’s growing hotter. It’s growing denser as it draws the capital of the world into its orbit.”

This network is drawing in multiple forms of capital:

- Physical capital (buildings being sold)

- Financial capital (low-grade bonds, foreign currencies)

- Foreign capital (Russian warehouses, natural gas rights)

- Antiquated capital (20th century assets)

- Smart capital (forward-looking investors)

- Digital capital (AI economy that requires instant settlement)

The mathematical projections

Saylor references an open-source model called “Bitcoin 2024” that projects Bitcoin’s growth trajectory. The model assumes:

- Bitcoin is currently 22 basis points of the global economy (~$2 trillion)

- Growth will decelerate from 60% to 20% annually over 20 years

- Average annual return of 29% over 20 years

This base case forecasts a Bitcoin price of $13 million per coin or a $280 trillion network in 20 years.

Importantly, Saylor emphasizes that “Bitcoin is not a threat to the dollar. The dollar is currency; Bitcoin is capital.” He clarifies that the dollar competes against other currencies (M2 money supply), while Bitcoin competes against property, equity, and bonds. Currently at less than 1% of global capital, Bitcoin could potentially grow to 133% of capital by 2045 according to his projections.

Why America should be the Bitcoin superpower

Saylor presents Bitcoin superiority as a national security imperative: “You cannot remain a sovereign nation if you lose control of your airspace, outer space, or cyberspace.”

Just as a superpower must control air routes with Air Force bases and military aircraft, and sea lanes with naval bases and ships, it must also control cyber channels for both information and digital energy (value transfer).

“Cyber power requires Bitcoin miners operating ASICs, throwing up a wall of digital energy, and you want to hope that more than 50% of that is controlled by you or your allies,” Saylor explains.

As artificial intelligence advances, “digital intelligence requires digital energy, which has to be secured by digital power in order to engage in digital commerce.” The unit of digital energy is the satoshi (Bitcoin’s smallest unit), and the unit of digital power is the exahash.

The national benefits of a Bitcoin strategy

Saylor outlines several concrete benefits for America in embracing Bitcoin:

-

Ownership of the 21st century economy - As capital moves from 20th century assets to digital assets, the U.S. can position itself to control this transition.

-

Strengthening the dollar - By backing the U.S. dollar with Bitcoin reserves, America can enhance the dollar’s position as the world’s primary reserve currency. Saylor notes that “the only monetary asset that is competitive to the dollar” is Bitcoin.

-

Attracting foreign capital - A Bitcoin-friendly U.S. would become a magnet for global capital, as investors worldwide seek the security of the Bitcoin network combined with U.S. legal protections.

-

Empowering Americans - U.S. companies and institutions holding Bitcoin will “outlast, outperform, and outlive their competitors,” enriching American shareholders and beneficiaries.

-

Becoming the world’s banker - With the appropriate digital assets framework, the U.S. can export Bitcoin (representing American values like sovereignty, sound money, and property rights) and digital currencies to the world.

The Strategic Bitcoin Reserve Act

Saylor references Senator Lummis’s Bitcoin Act, which proposed acquiring one million Bitcoin over five years “in a programmatic, disciplined fashion, transparent to all.” He presents several potential acquisition strategies with their projected outcomes:

- Current Executive Order (200,000 BTC) - Worth $3 trillion over 20 years

- Lummis Plan (1-1.2 million BTC) - Worth $16 trillion

- Double Max Plan (2 million BTC) - Worth $33 trillion

- Triple Max Plan (4 million BTC) - Worth $73 trillion

- Superpower Plan (>4 million BTC) - Worth $106 trillion

Saylor recommends acquiring Bitcoin “consistently daily between now and 2099” (when 99% of Bitcoin will have been mined), calling this the “digital gold rush” with just 10 years remaining to secure a dominant position.

The financial impact of these strategies ranges from neutralizing the national debt (Lummis Plan) to creating a global superpower (Superpower Plan). Saylor compares this opportunity to the Louisiana Purchase, where the United States acquired 78% of its territory for just $40 million.

The risk of inaction

Saylor concludes with a stark warning about the consequences of allowing another nation to claim the title of “Bitcoin superpower”:

“If we don’t claim it, we give them control of the network. We give them all the wealth in the world. We risk being impoverished and imperiled by a hostile nation that controls all the world’s digital energy.”

Drawing historical parallels, he warns against clinging to outdated technologies when new paradigms emerge: “You could have clung to your glass beads when the world went to the gold standard. You could have clung to your steam engines when the world went to internal combustion.”

Saylor frames the choice as one between “prosperity or poverty in the 21st century,” declaring that “Bitcoin is manifest destiny for America.”

Conclusion

The establishment of a Strategic Bitcoin Reserve represents a pivotal moment in American economic and national security strategy. Through Saylor’s analysis, we see Bitcoin not merely as a financial asset but as digital capital, property, energy, and defense infrastructure critical to America’s future prosperity and security.

If his projections are even partially correct, the decision to establish a Strategic Bitcoin Reserve could rank among the most consequential economic decisions in American history, potentially generating trillions in national wealth while securing America’s position in the digital economy of the 21st century.

As Saylor puts it, this is “the once-in-a-century opportunity” that will determine America’s place in the digital future. The race for Bitcoin supremacy has officially begun.