STRK vs STRF: Understanding Strategy’s preferred share offerings

Strategy has expanded its financial offerings with two distinct preferred stock vehicles: Series A Perpetual Strike Preferred Stock (STRK) and Series A Perpetual Strife Preferred Stock (STRF). Each targets different investor profiles while helping Strategy continue its Bitcoin acquisition strategy.

TL;DR

- STRK targets total return investors with an 8% fixed dividend and convertibility into common stock, offering both income and growth potential.

- STRF appeals to pure yield investors with a 10% fixed cash-only dividend and no conversion, emphasizing income stability.

- These preferred shares help diversify capital raising, reducing pressure on Strategy’s common stock and offering flexibility in varying market conditions.

- Both instruments include a self-correcting yield mechanism, where falling prices increase effective yields and attract new buyers.

- Strategy integrates these offerings into its capital structure to support continued Bitcoin acquisition while managing debt and operational obligations.

STRK and STRF: key differences and target investors

STRK: Total return focus

STRK is designed for investors seeking both income and potential capital appreciation:

- 8% fixed annual dividend: Provides consistent income based on a $100 liquidation preference

- Convertibility feature: Can be converted into Strategy’s common stock

- Equity upside exposure: Benefits from potential appreciation in Strategy’s share price

The convertibility option is particularly important as it creates a unique dynamic where STRK becomes increasingly attractive if Strategy’s common stock rises significantly. This makes STRK a hybrid instrument that appeals to investors who want both stability and growth potential.

STRK attracts investors seeking “total return” - a combination of yield plus capital appreciation. These investors want:

- Some downside protection through the 8% dividend

- Participation in Strategy’s potential upside through conversion rights

- Bitcoin exposure with less volatility than common stock

- A blend of income and growth potential

These investors are comfortable with some equity market exposure while still prioritizing more stability than pure common stockholders would experience.

STRF: Pure yield focus

STRF is structured for investors primarily concerned with maximizing reliable income:

- 10% fixed annual dividend: Higher yield than STRK

- Cash-only dividend payments: Must be paid in cash rather than stock

- Escalating penalties for missed payments: If Strategy fails to pay dividends, the rate increases by 1% per quarter up to 18%

- No direct convertibility: Focuses purely on income rather than equity upside

The higher 10% yield makes STRF particularly attractive in today’s market where quality high-yield investments are scarce. The cash-only dividend requirement provides payment certainty that appeals to income-focused investors.

STRF appeals to “true yield investors” - those focused exclusively on generating reliable income. These typically include:

- Long-duration, steady investors like pension funds

- Income-focused portfolios requiring predictable cash flows

- Conservative institutions seeking Bitcoin exposure with minimal price volatility

- Investors who prioritize yield stability over growth potential

Strategic benefits for capital raising

Strategy’s decision to offer both products creates several advantages for its capital raising strategy.

Addressing different market conditions

Having multiple financial instruments allows Strategy to raise capital efficiently under different market conditions:

- When Bitcoin and Strategy stock are performing strongly, convertible bonds and ATM equity offerings might be optimal

- During more uncertain markets, the high-yield STRF can attract capital when other instruments are less attractive

- STRK serves as a middle ground, appealing to investors seeking both income and growth exposure

Reducing pressure on common stock

A significant benefit of these preferred offerings is how they shift selling pressure away from Strategy’s common stock:

- When raising capital through ATM offerings on common stock, increased supply can temporarily pressure share prices

- By using preferred shares, Strategy can raise capital without immediate pressure on common stock

- This shifts the inorganic selling pressure to the preferred securities instead of the common stock

Self-correcting yield mechanism

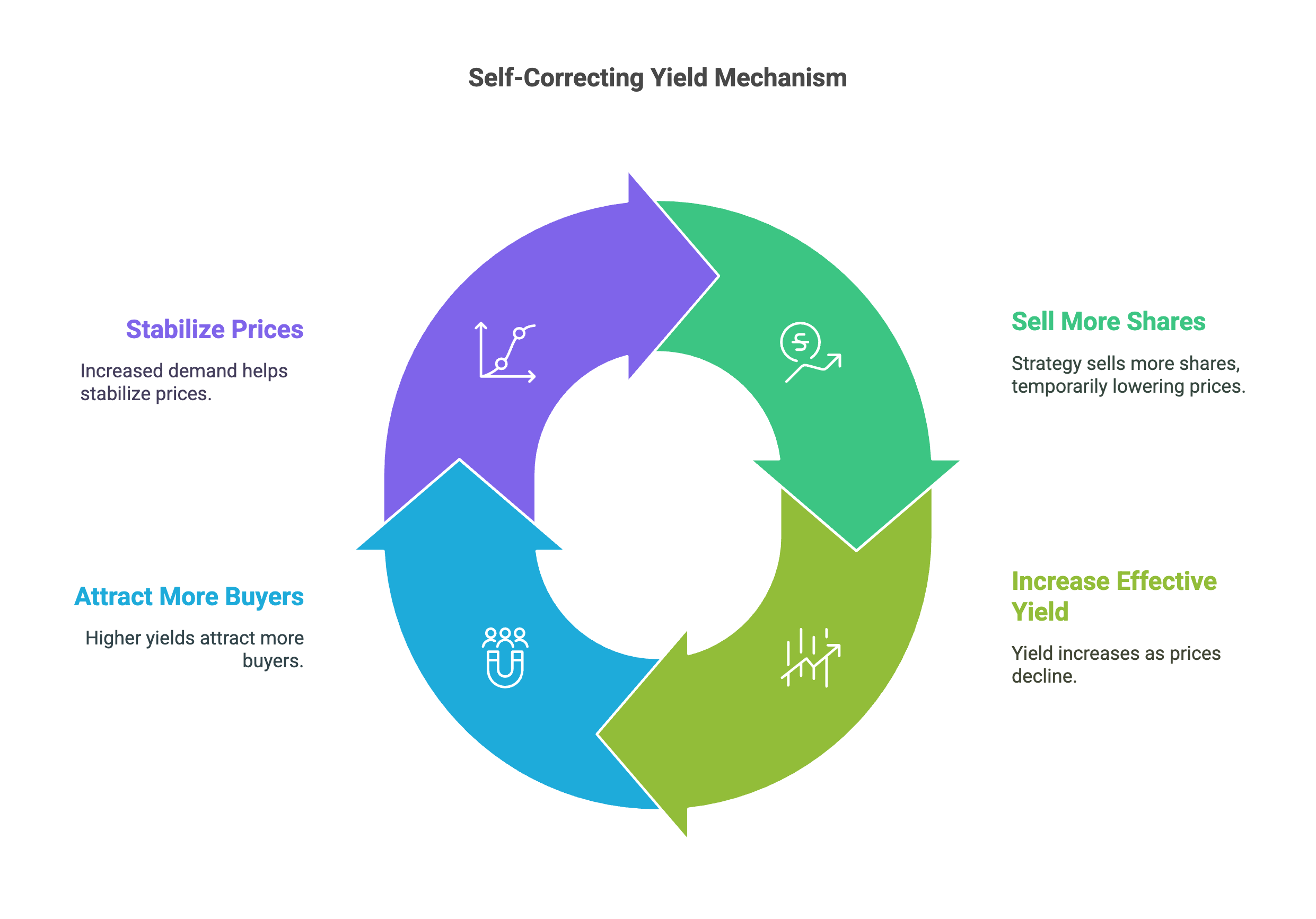

Both preferred share offerings benefit from a natural market-balancing feature based on their yield:

- If Strategy uses the ATM to sell more STRK or STRF, temporarily pushing down their prices

- The effective yield automatically increases as prices decline

- Higher yields attract more buyers to the security

- This creates a self-correcting mechanism that helps stabilize prices

Financing considerations

Strategy’s preferred shares create new financial obligations that must be managed alongside the company’s existing debt and operational considerations.

Cash flow implications

The dividend obligations create fixed expenses that Strategy must account for:

- The company’s software business has historically generated approximately $60-70 million in free cash flow annually

- STRK’s 8% dividend and STRF’s 10% dividend represent significant cash obligations

- If fully subscribed, these preferred shares could require dividend payments that exceed the free cash flow from operations

Strategy can address any shortfall through:

- Additional capital raising through various instruments

- Limited ATM usage of common stock

- Other potential financing methods

Capital structure strategy

The preferred shares fit into Strategy’s broader capital structure strategy:

- Preferred shares sit between debt instruments like convertible bonds and common equity

- In the capital stack hierarchy: convertible bonds come first, then STRF, then STRK, and finally common stock

- This layered approach helps Strategy manage its overall leverage while continuing to acquire Bitcoin

Conclusion: Innovative financial engineering

Strategy’s STRK and STRF offerings represent sophisticated financial engineering that serves multiple purposes:

- They create new funding vehicles targeting different investor segments

- They provide the company with capital raising flexibility across market conditions

- They allow Strategy to continue its Bitcoin acquisition without direct pressure on common stock

- They position the company to operate effectively regardless of market conditions

By creating financial instruments that appeal to both total return seekers and pure yield investors, Strategy is expanding the ways traditional investors can gain Bitcoin exposure while generating current income. This innovation demonstrates Strategy’s evolution from simply accumulating Bitcoin to becoming a sophisticated financial institution capable of creating Bitcoin-backed financial products for a wide range of investors.

For investors considering these instruments, the choice between STRK and STRF ultimately depends on investment priorities - whether seeking both growth and income (STRK) or maximizing reliable yield (STRF). Both represent unique ways to participate in Strategy’s Bitcoin treasury story without directly owning Bitcoin or common stock.