Why traditional finance struggles to understand Strategy’s value

The financial world is running around with its collective head spinning, trying to determine the appropriate valuation for Strategy (formerly known as MicroStrategy). As Bitcoin approaches mainstream adoption and Strategy continues its aggressive Bitcoin accumulation strategy, a fundamental disconnect has emerged between traditional financial analysis and the company’s innovative business model. This divide creates both challenges and opportunities for investors attempting to value what might be the most fascinating corporate transformation in modern finance.

TL;DR

- Traditional financial metrics fail to capture Strategy’s value due to its unique Bitcoin acquisition strategy and financial engineering.

- Unlike Bitcoin ETFs, Strategy actively acquires Bitcoin, increasing its Bitcoin per share through capital markets activities.

- Forward-looking valuation suggests Strategy’s value is based on Bitcoin’s future price trajectory and market adoption, not just current holdings.

- Financial engineering techniques, such as convertible debt and accretive dilution, enhance Strategy’s ability to accumulate Bitcoin efficiently.

- Strategy’s potential inclusion in major market indices like the S&P 500 could drive additional passive investment inflows, reinforcing its valuation premium.

The valuation disconnect

Traditional financial analysis relies on metrics like price-to-earnings ratios, cash flow projections, and growth rates to determine a company’s value. These frameworks, developed over decades for industrial and digital businesses, simply don’t translate well to Strategy’s Bitcoin-focused model. While Strategy does maintain its legacy software business, the company has essentially transformed into a Bitcoin treasury company, leveraging sophisticated financial engineering to accumulate Bitcoin at an unprecedented scale.

This transformation has created three distinct perspectives on Strategy’s valuation:

-

Traditional finance view: Many analysts insist Strategy should trade at or near its net asset value (NAV), essentially treating it as a Bitcoin ETF with minimal premium.

-

Bitcoin maximalist view: Some Bitcoin-focused investors view any company structure as unnecessary overhead, preferring direct Bitcoin holdings.

-

Integrated perspective: A smaller group understands how Strategy bridges traditional finance and Bitcoin through innovative capital markets strategies, creating unique value beyond simple Bitcoin exposure.

The third perspective provides the most accurate framework for valuing Strategy, but remains underrepresented in mainstream financial analysis.

Mistaken ETF comparison

A common misconception is treating Strategy as equivalent to a Bitcoin ETF like BlackRock’s IBIT. This comparison fundamentally misunderstands several critical differences:

Price mechanisms

Bitcoin ETFs have a built-in arbitrage mechanism that ensures they trade very close to their net asset value. Authorized participants can create or redeem shares directly with the issuer, exchanging them for the underlying Bitcoin. This mechanism prevents ETFs from developing significant premiums or discounts to their NAV.

Strategy, however, offers no such redemption capability. Shareholders cannot exchange their shares for the company’s Bitcoin holdings, which allows the stock to trade at substantial premiums to NAV (currently 1.840x for basic shares and 2.069x for diluted shares).

Active acquisition vs. passive holding

Unlike ETFs, which passively hold Bitcoin, Strategy actively acquires more Bitcoin over time through sophisticated capital raising and financial engineering. The company has demonstrated an ability to increase Bitcoin per share (currently 0.00200135 BTC BTC per basic share) by issuing equity and debt at premiums to NAV, then using the proceeds to buy additional Bitcoin.

This approach has allowed Strategy to generate a Bitcoin yield (the percentage increase in Bitcoin per share) of +10.97% year-to-date, creating value that static Bitcoin holdings or ETFs cannot match.

Forward-looking valuation

Traditional equity markets are fundamentally forward-looking. Stocks like Apple, Nvidia, and other major tech companies don’t trade based solely on their current assets and earnings, but on expectations of future growth and market position 10-15 years ahead.

When applying this same forward-looking framework to Strategy, the company’s premium valuation begins to make more sense:

- If Bitcoin reaches $1 million per coin in the next decade (a price target many Bitcoin proponents consider reasonable), Strategy’s current holdings of 538.200 BTC would be worth approximately $1 million x 538.200.

- With continued Bitcoin acquisition through capital market activities, Strategy could potentially hold 750,000 to 1 million Bitcoin within that timeframe, worth $750 billion to $1 trillion at the same price projection.

- Future financial services built on Bitcoin holdings could generate additional revenue streams beyond simple asset appreciation.

From this perspective, Strategy’s current market capitalization of USD 92.25 bln reflects not just its current Bitcoin holdings valued at USD 50.156 bln, but the expected future value of an aggressive and sophisticated Bitcoin acquisition strategy. Isn’t Strategy then today massively undervalued?

The role of financial engineering

Strategy’s approach to Bitcoin acquisition goes far beyond simply buying and holding the digital asset. The company has pioneered innovative financial engineering techniques that traditional analysts often struggle to properly evaluate:

Convertible bond issuance

Strategy has raised billions through convertible bonds, currently holding USD 9.26 bln in convertible debt with an extraordinarily low average interest rate of 0.421%. This creates an annual interest expense of just USD 34.6 mln.

These bonds allow Strategy to:

- Raise capital at minimal interest cost

- Convert debt to equity if share price rises above conversion thresholds

- Avoid the risk of forced liquidation during market downturns

Traditional finance often misunderstands this approach, viewing the debt as a traditional liability rather than recognizing the sophisticated capital structure optimization at work.

Accretive dilution

Perhaps the most counterintuitive aspect of Strategy’s model is how it turns traditional dilution into accretive value for shareholders. When the company issues new shares at a premium to its Bitcoin NAV, it can acquire more Bitcoin per dollar raised than the dilution it creates.

This “accretive dilution” increases Bitcoin per share over time, even as total shares outstanding grow. Traditional financial analysis, which typically views share issuance as negative, fails to account for this unique dynamic.

Comparisons to traditional companies

The difficulty in valuing Strategy becomes evident when comparing it to other major companies. Traditional comparison metrics like P/E ratios (Strategy is currently trading at 14.54x) don’t capture the unique aspects of its business model.

Consider how we value companies like Tesla, Apple, or even commodities companies:

Tesla: Trades at high multiples based on future growth potential and market disruption—not current earnings. Similarly, Strategy represents a potentially disruptive force in corporate treasury management.

Apple: Values incorporate massive cash reserves and future product ecosystems. Strategy’s Bitcoin holdings and potential financial services represent similar stores of value and future business potential.

Commodity producers: Often valued based on their reserves and extraction costs. Strategy could be viewed as a “Bitcoin producer” through financial engineering rather than mining.

When comparing Strategy to companies of similar market capitalization, it’s currently trading in the range of companies like CVS and Chipotle. This comparison highlights the valuation disconnect—Bitcoin as a strategic asset class is clearly more significant than retail pharmacy chains or restaurant operations.

The importance of Bitcoin context

Many traditional analysts evaluating Strategy lack sufficient understanding of Bitcoin itself, creating another layer of misvaluation.

Without understanding Bitcoin’s long-term value proposition, scarcity mechanics, and adoption curve, it’s impossible to properly value a company building its future on Bitcoin acquisition.

This knowledge gap explains why Strategy is often undervalued by traditional finance but better appreciated by those with deeper Bitcoin expertise. Without understanding Bitcoin’s long-term value proposition, scarcity mechanics, and adoption curve, traditional analysts frequently miss the full potential of Strategy’s business model.

Bitcoin experts, who grasp both the Bitcoin fundamentals and Strategy’s financial engineering approach, are more likely to recognize the company’s premium valuation as justified or even conservative relative to its future potential. As Bitcoin adoption increases and more institutional investors develop Bitcoin literacy, this valuation gap should narrow, potentially driving Strategy’s market valuation higher.

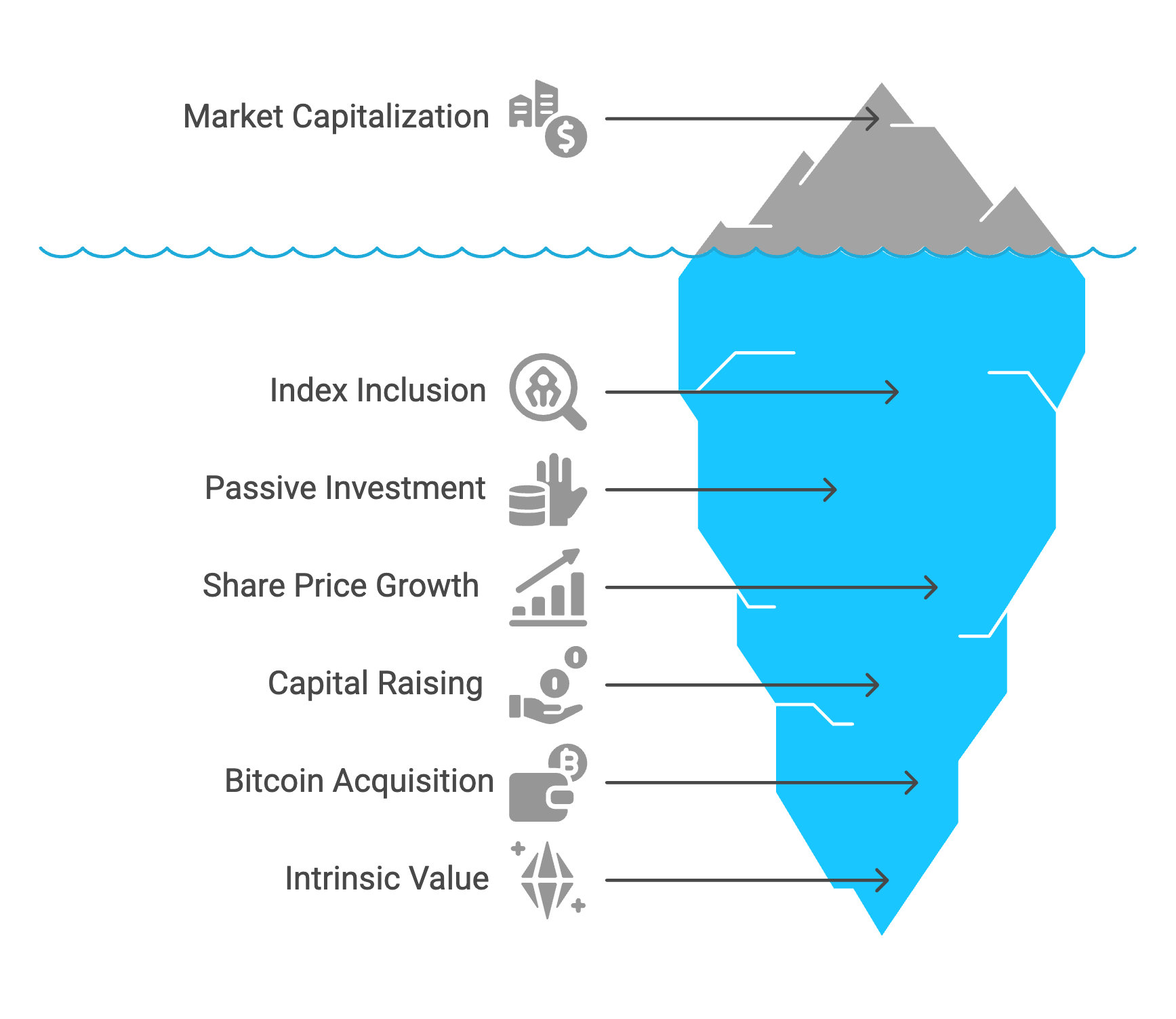

The impact of passive flows

Another underappreciated aspect of Strategy’s value proposition involves index inclusion and passive investment flows. As Strategy’s market capitalization grows, it moves up the rankings of publicly traded companies (currently ranked in the US market).

The company’s inclusion in the NASDAQ 100 has already increased passive investment flows. Potential inclusion in the S&P 500 would dramatically accelerate this trend, creating a self-reinforcing cycle:

- Higher market capitalization leads to greater index inclusion

- Index inclusion increases passive investment flows

- Increased investment supports higher share prices

- Higher share prices enable more efficient capital raising

- More capital allows for increased Bitcoin acquisition

- More Bitcoin acquisition raises the company’s intrinsic value

- Higher intrinsic value supports higher market capitalization

This flywheel effect is largely ignored in traditional valuation models that focus on static metrics rather than dynamic systems.

Strategic positioning for future valuation

Strategy’s positioning for the future financial landscape provides another lens through which to understand its current premium valuation:

-

Bitcoin adoption acceleration: If Bitcoin adoption continues to increase, early corporate adopters like Strategy will benefit disproportionately.

-

Financial services potential: Strategy could eventually leverage its Bitcoin holdings to offer Bitcoin-backed financial products, generating additional revenue streams.

-

Market positioning: As the largest corporate Bitcoin holder by a significant margin (currently holding 2.56% of all Bitcoin), Strategy has established a nearly unassailable first-mover advantage.

Traditional models struggling to value Strategy today are even less equipped to account for these future developments, creating an opportunity for investors who can think beyond conventional frameworks.

The new valuation paradigm

To properly value Strategy, investors need to develop a new framework that incorporates both traditional financial analysis and Bitcoin-specific considerations:

-

Bitcoin NAV as baseline: The company’s Bitcoin holdings ( 538.200 BTC valued at USD 50.156 bln) provide a foundation for valuation.

-

Future Bitcoin accumulation: Projected increases in Bitcoin holdings through capital market activities must be modeled.

-

Bitcoin price projections: Long-term Bitcoin price expectations significantly impact valuation, creating a wide range of potential outcomes.

-

Capital structure efficiency: The company’s ability to optimize its debt and equity issuance to maximize Bitcoin acquisition should be factored in.

-

Financial services potential: Future business lines leveraging Bitcoin holdings may create additional value beyond the assets themselves.

This integrated approach bridges the gap between traditional financial analysis and Bitcoin-specific considerations, providing a more accurate valuation framework for Strategy and similar companies that may emerge.

Conclusion

The struggle to properly value Strategy highlights a broader challenge facing financial markets as digital assets become increasingly integrated with traditional financial structures. Strategy represents one of the first major corporate attempts to bridge these worlds, creating understandable confusion among traditional analysts.

As more investors develop expertise in both traditional finance and Bitcoin, valuation frameworks will evolve to better capture Strategy’s unique value proposition. Until then, the valuation disconnect creates both risks and opportunities for investors willing to look beyond conventional metrics.

With 538.200 Bitcoin on its balance sheet, a market capitalization of USD 92.25 bln, and innovative financial engineering approaches, Strategy represents not just a Bitcoin investment vehicle but a pioneering model for corporate treasury management in the digital age. Those who recognize this evolution ahead of the broader market may find significant value in what traditional finance still struggles to understand.