Understanding Zipf’s Law

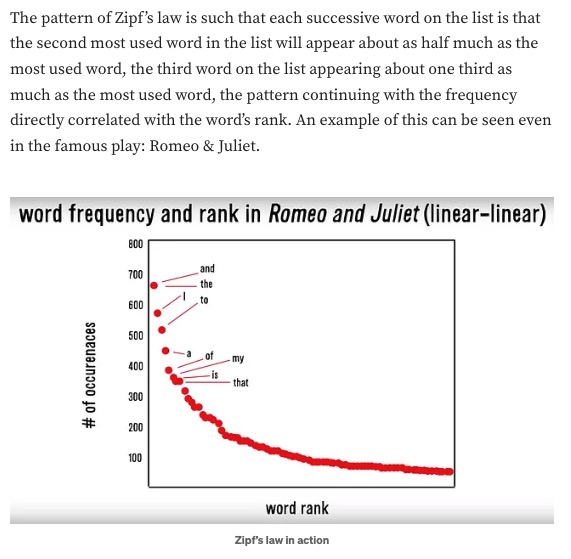

Before exploring how Zipf’s Law applies to Strategy’s Bitcoin holdings, it’s important to understand what this mathematical principle actually describes. Originally observed in linguistics by George Kingsley Zipf, this power law states that in many natural and human-made systems, the frequency of an item’s occurrence is inversely proportional to its rank in frequency.

In simpler terms, Zipf’s Law predicts that in a given set, the most frequent item will occur approximately twice as often as the second most frequent, three times as often as the third most frequent, and so on. This creates a distinctive distribution pattern where the top-ranked items dramatically overshadow those further down the list.

While initially applied to word frequency in languages, Zipf’s Law has proven remarkably consistent across diverse domains—from city populations and website traffic to income distributions and corporate market shares.

How Zipf’s Law applies to corporate Bitcoin holdings

When applied to corporate Bitcoin holdings, Zipf’s Law suggests a striking prediction: Strategy, as the current leader with 538.200 BTC, will likely maintain a commanding lead over all other corporate holders in a predictable pattern.

The mathematical prediction

According to Zipf’s Law, if Strategy remains the largest corporate Bitcoin holder, we can expect:

- The second-largest corporate holder will own approximately half as much Bitcoin as Strategy

- The third-largest holder will own approximately one-third as much as Strategy

- The fourth-largest holder will own approximately one-fourth as much as Strategy

This creates a distribution where the gap between Strategy and other corporations grows exponentially as more companies begin acquiring Bitcoin.

Current evidence supporting the pattern

While still early in the corporate Bitcoin adoption curve, we’re already seeing evidence of this Zipfian distribution forming. Tesla, which briefly emerged as the second-largest corporate Bitcoin holder, acquired significantly less than half of Strategy’s holdings before reducing its position further.

Other notable corporate holders like Block (formerly Square), Marathon Digital Holdings, and Galaxy Digital Holdings all follow a rough approximation of the Zipfian distribution relative to Strategy’s dominant position. As Strategy continues to increase its holdings through convertible bond issuances, ATM offerings, and strategic Bitcoin purchases, this gap appears to be widening rather than narrowing—exactly as Zipf’s Law would predict.

BitcoinTreasuries.net is the premier source for comprehensive data on Bitcoin holdings by public companies, private entities, and governments: Bitcoin Treasuries

Why corporate Bitcoin holdings may follow Zipf’s Law

Several underlying mechanisms explain why corporate Bitcoin holdings are likely to follow this power law distribution:

First-mover advantage and scale effects

Strategy’s early and aggressive entrance into corporate Bitcoin accumulation has created powerful advantages that compound over time. With 538.200 BTC (representing 2.56% of total Bitcoin supply), the company has achieved critical mass that allows it to:

- Develop expertise in Bitcoin treasury management ahead of competitors

- Build relationships with capital markets for efficient financing

- Create a Bitcoin-focused brand identity that attracts investor interest

- Establish operational procedures for large-scale Bitcoin acquisition

These advantages create a positive feedback loop that reinforces Strategy’s leadership position and makes it increasingly difficult for followers to catch up—a classic pattern in Zipfian distributions.

Capital structure and financial engineering

Strategy has pioneered innovative financing techniques for Bitcoin acquisition, including:

- Zero or low-coupon convertible bonds (currently with an average interest rate of just 0.421%)

- ATM equity offerings at premiums to Bitcoin NAV

- Preferred shares with Bitcoin-linked features

These financial engineering approaches allow Strategy to raise capital at favorable terms, maintaining a Bitcoin acquisition pace that other corporations struggle to match. With $ USD 9.26 bln in convertible debt and a conservative debt-to-Bitcoin NAV ratio of , Strategy has optimized its capital structure for continued Bitcoin accumulation.

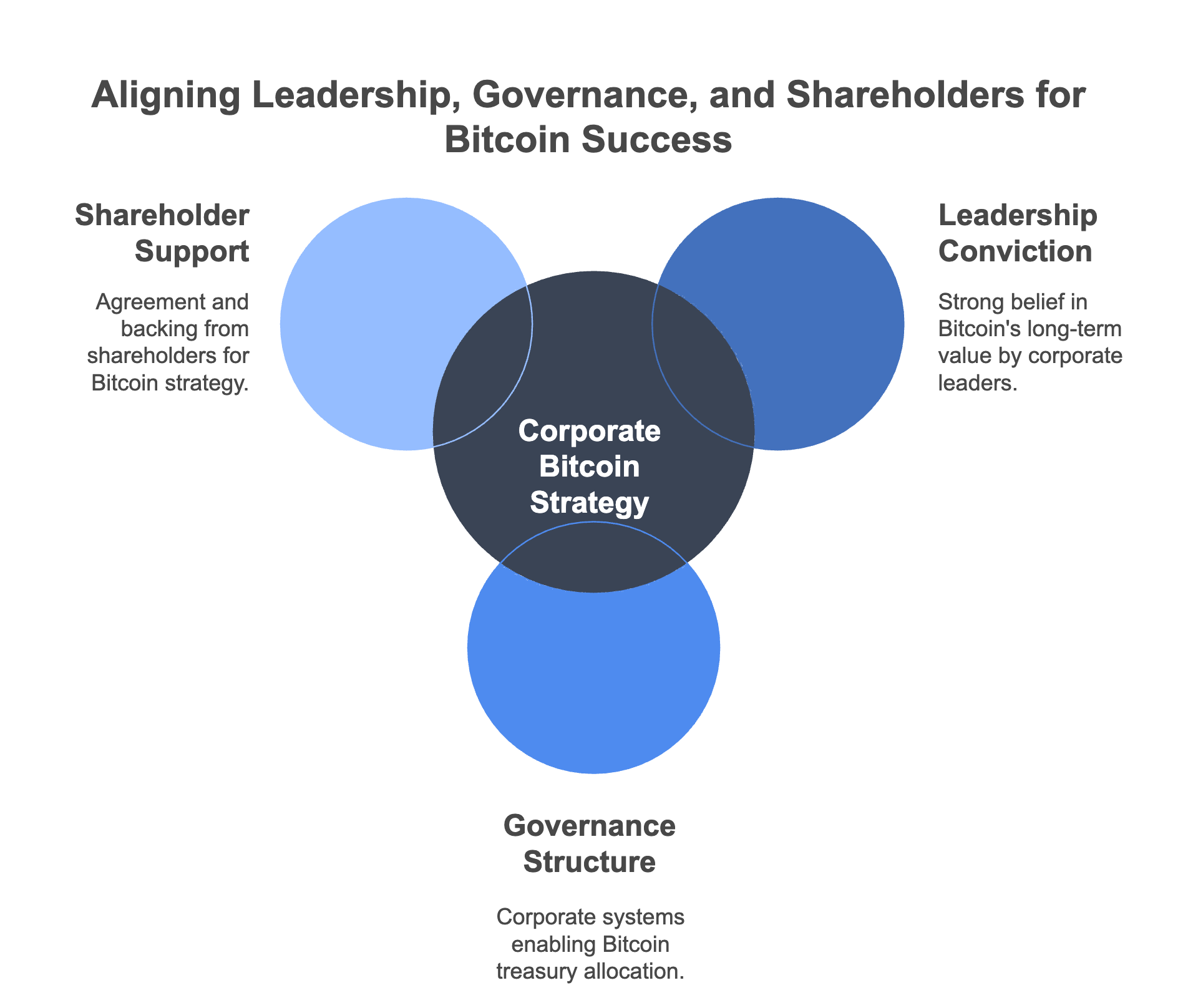

Leadership conviction and shareholder alignment

For a corporation to accumulate significant Bitcoin holdings, three critical factors must align:

- Leadership must have deep conviction about Bitcoin’s long-term value

- The corporate governance structure must allow for Bitcoin treasury allocation

- Shareholders must support the Bitcoin strategy

Strategy has optimized all three factors under Michael Saylor’s leadership, with governance structures and shareholder support aligned behind the Bitcoin vision. Few other corporations have achieved this alignment, creating another barrier that reinforces the Zipfian distribution of holdings.

Implications of Zipf’s Law for Strategy’s future dominance

If Zipf’s Law continues to govern the distribution of corporate Bitcoin holdings, several important implications emerge for Strategy and the broader market:

Maintaining exponential dominance

Assuming the corporate Bitcoin adoption trend continues, Strategy’s lead over other corporate holders would not just be maintained but would grow in absolute terms. If, for example, Strategy accumulates 1,000,000 BTC in the future, Zipf’s Law would predict:

- The second-largest holder would have approximately 500,000 BTC

- The third-largest holder would have approximately 333,333 BTC

- The fourth-largest holder would have approximately 250,000 BTC

This exponential gap would create a form of “digital monopoly” for Strategy in the corporate Bitcoin space, similar to how certain tech companies have established dominant positions in their respective domains.

Capital raising advantages

Strategy’s leading position, combined with its innovative financial engineering, creates self-reinforcing advantages for capital raising. As the company’s market cap grows (currently at USD 92.25 bln), it gains access to larger capital pools, enabling more efficient Bitcoin acquisition.

This creates a flywheel effect where:

- Strategy raises capital at favorable terms

- It acquires more Bitcoin, widening the gap with competitors

- The expanded Bitcoin holdings increase market capitalization

- Higher market cap enables more efficient future capital raising

- The cycle repeats, reinforcing the Zipfian distribution

Bitcoin yield and accumulation velocity

Strategy measures its Bitcoin accumulation efficiency using “Bitcoin yield”—the percentage increase in Bitcoin per share over time. Currently at +10.97% year-to-date, this metric demonstrates how Strategy is increasing its Bitcoin holdings faster than share dilution.

Zipf’s Law suggests that Strategy will not only maintain the largest corporate Bitcoin position but will also likely maintain the highest Bitcoin accumulation velocity among corporate holders. This means the company’s Bitcoin per share metrics (currently 0.00200135 BTC per basic share) would continue outpacing competitors.

Limitations and potential disruptors to the Zipfian pattern

While Zipf’s Law provides a compelling framework for understanding Strategy’s potential dominance, several factors could disrupt this pattern:

Government and sovereign wealth entry

If nation-states or sovereign wealth funds begin acquiring Bitcoin at scale, they could potentially break the Zipfian distribution among corporate holders. With access to capital and borrowing capacity beyond what even the largest corporations can access, governments could accumulate Bitcoin holdings that dwarf corporate positions.

Regulatory interventions

Regulatory changes could potentially alter the distribution by imposing limits on corporate Bitcoin holdings or creating barriers to accumulation for certain market participants. However, such interventions might merely shift the Zipfian distribution to a new set of players rather than eliminate it entirely.

Industry-specific adoption patterns

Companies in certain industries (such as financial services or technology) might adopt Bitcoin treasury strategies at different rates or scales, potentially creating industry-specific Zipfian distributions rather than a single corporate-wide pattern.

Market maturity effects

As the Bitcoin market matures and volatility decreases, the advantages of early accumulators might diminish, potentially allowing latecomers to catch up more quickly than a pure Zipfian model would predict.

Conclusion: The mathematical case for Strategy’s enduring leadership

Zipf’s Law provides a mathematical framework that supports the thesis that Strategy will maintain and likely expand its dominance among corporate Bitcoin holders. The patterns observed in many natural and human-created systems suggest that the distribution of corporate Bitcoin holdings will follow a power law where Strategy, as the leader, maintains exponentially larger holdings than its closest competitors.

With 538.200 BTC already on its balance sheet and a sophisticated capital markets strategy for continued accumulation, Strategy appears well-positioned to remain at the apex of corporate Bitcoin holders—not just as the largest holder, but by a margin that grows increasingly insurmountable as predicted by Zipf’s Law.

For investors, this mathematical perspective provides yet another lens through which to understand Strategy’s unique market position and the potential long-term implications of its Bitcoin accumulation strategy. As corporate Bitcoin adoption increases, the Zipfian distribution of holdings will be an important pattern to monitor, potentially reinforcing Strategy’s position as the definitive corporate Bitcoin treasury powerhouse.