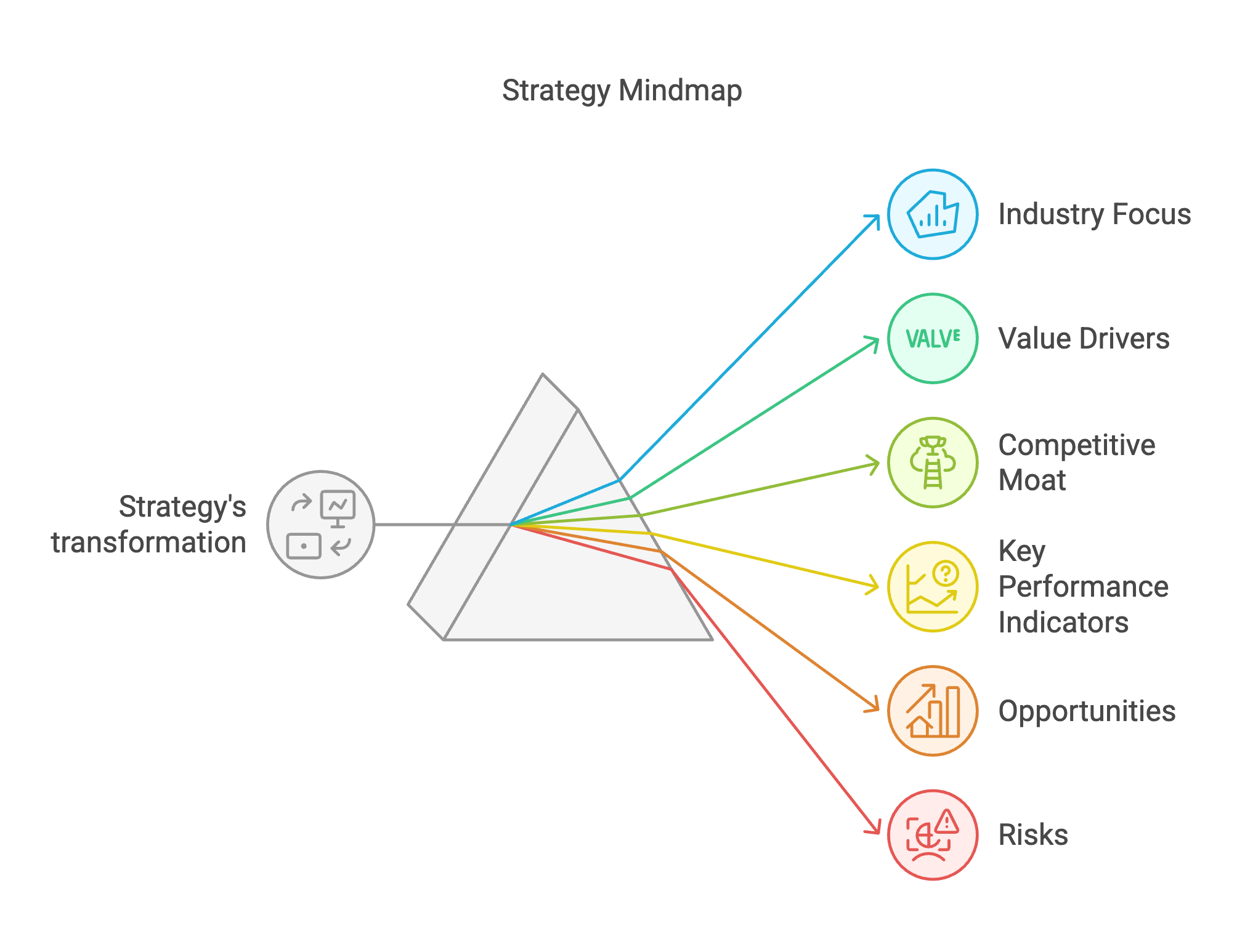

A complete mindmap for Strategy

Strategy (formerly known as MicroStrategy) represents a unique transformation story in corporate history. Founded in 1989 as a business intelligence software provider, the company has evolved into the world’s largest corporate holder of Bitcoin, with a visionary approach to digital capital and financial markets. This transformation showcases how traditional businesses can adapt and thrive in the emerging digital economy.

Industry focus

Strategy operates with a dual focus that sets it apart in the corporate landscape. While maintaining its foundation as a business intelligence software provider, the company has pioneered a new path in financial services as a Bitcoin treasury company. This unique combination allows Strategy to leverage its traditional business expertise while leading the corporate adoption of Bitcoin as a treasury reserve asset. The synergy between these two sectors has created a powerful platform for growth and innovation.

Value drivers

Maximizing Bitcoin holdings via capital markets

Strategy has revolutionized corporate Bitcoin acquisition through sophisticated capital market operations. With current holdings of 538.200 Bitcoin, representing 2.56% of the total Bitcoin supply, the company has demonstrated remarkable effectiveness in capital deployment. Strategy utilizes a comprehensive approach to funding its Bitcoin acquisition, combining traditional debt instruments with innovative financial products like convertible bonds and strategic equity issuance. The company’s at-the-market (ATM) offerings have proven particularly effective, allowing for flexible and efficient capital raising while maintaining shareholder value.

Maximizing cash flows via Bitcoin holdings

Strategy has developed a sophisticated approach to generating value from its substantial Bitcoin holdings. The company offers a comprehensive suite of financial services, including institutional custody solutions and advanced treasury management services. By leveraging its position as the largest corporate Bitcoin holder, Strategy can provide unique banking solutions to institutional clients while developing innovative insurance products. The lending and borrowing services further enhance the company’s ability to generate sustainable cash flows from its Bitcoin reserves.

Competitive moat

Strategy’s competitive advantage stems from several interconnected elements that create a formidable barrier to entry for potential competitors. The company’s brand has become synonymous with corporate Bitcoin adoption, earning global recognition as the pioneer in institutional Bitcoin strategy. This reputation is reinforced by its monopolistic position in corporate Bitcoin holdings, which would be extremely difficult for competitors to challenge given the current market dynamics.

The company’s leadership under Michael Saylor has proven instrumental in establishing and maintaining this competitive edge. His visionary approach to digital capital has not only guided Strategy’s transformation but has also helped shape the broader conversation around corporate Bitcoin adoption. Perhaps most notably, Strategy has turned what many consider a weakness of Bitcoin - its volatility - into a strategic advantage, using market fluctuations to enhance its financial instruments and create additional value for shareholders.

Key performance indicators

Strategy measures its success through three critical metrics that reflect its effectiveness in executing its Bitcoin strategy. The Bitcoin yield, currently at +10.97% year-to-date, demonstrates the company’s ability to grow its Bitcoin holdings efficiently through market operations. The Bitcoin per share metric, currently at 0.00200135 BTC BTC per basic share and 0.00178004 BTC BTC per diluted share, provides a clear measure of shareholder value creation.

The company’s total Bitcoin holdings of 538.200 Bitcoin, acquired at an average cost of USD 67,766, represent the largest corporate Bitcoin position globally. This achievement not only validates Strategy’s acquisition approach but also strengthens its position as the leading corporate player in the Bitcoin space.

Opportunities

Strategy’s market position opens up several significant opportunities for future growth. The company’s public corporate monopoly on Bitcoin creates a unique value proposition that becomes stronger as institutional adoption increases. Through intelligent capital market operations, Strategy continues to generate Bitcoin yield for shareholders while building its position as the premier corporate Bitcoin holder.

The potential to become a global Bitcoin bank represents a particularly exciting opportunity. Strategy’s substantial Bitcoin holdings provide the foundation for offering sophisticated financial services backed by Bitcoin. Additionally, the company’s growth trajectory makes it a strong candidate for inclusion in major market indices like the S&P 500, which could drive significant value creation through increased institutional investment flows.

Risks

While Strategy’s position is strong, prudent risk management requires acknowledging potential challenges. The most significant risk would be a Bitcoin extinction event - a complete failure of the Bitcoin network would fundamentally impact Strategy’s business model and value proposition. Additionally, a prolonged decline in Bitcoin price could affect the company’s ability to execute its strategy effectively, though the company’s long-term approach and strong balance sheet help mitigate this risk.

Conclusion

Strategy has successfully executed a remarkable transformation from a traditional software company into the world’s leading corporate Bitcoin holder. With 538.200 Bitcoin representing 2.56% of total supply, and a market capitalization of USD 92.25 bln, the company has established itself as a pioneering force in the digital asset space. Through its innovative approach to capital markets and Bitcoin accumulation, Strategy continues to build on its first-mover advantage while maintaining a strong moat against potential competitors. The company’s unique position in both the software and Bitcoin sectors, combined with its clear vision and execution capability, positions it well for continued leadership in the evolving digital economy.