Strategy’s STRK: comprehensive analysis of the perpetual preferred Stock

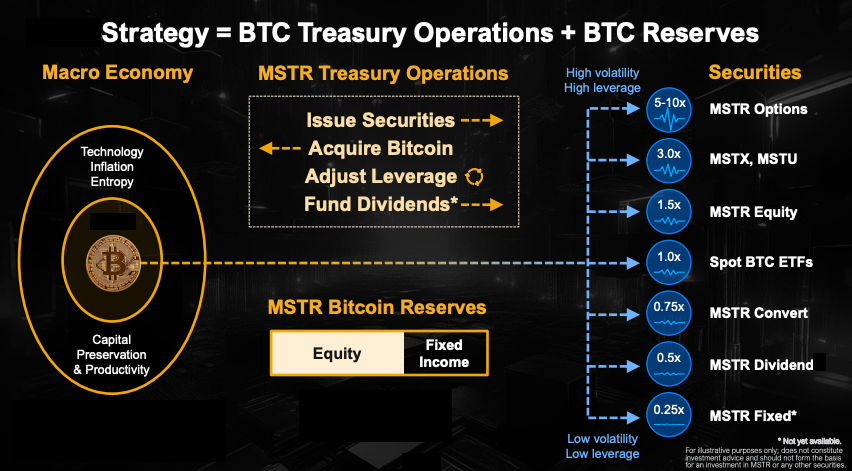

Strategy (formerly known as MicroStrategy) has issued a groundbreaking preferred stock that represents a significant evolution in Bitcoin-backed financial instruments. As the world’s largest corporate holder of Bitcoin with 499.096 BTC valued at USD 41.286 bln, Strategy continues to innovate in creating Bitcoin-backed financial products.

Offering details and structure

Initial offering specifications

- Ticker: STRK

- Initial offering size: 7,300,000 shares

- Offering price: $80.00 per share

- Liquidation preference: $100 per share (A liquidation preference of $100 per share means that if Strategy were to be liquidated (e.g., through bankruptcy, sale, or dissolution), STRK preferred shareholders would be entitled to receive $100 per share before any money is distributed to common stockholders.)

- Net proceeds: approximately $563.4 million

- Offering window: January 27 - January 30, 2025

Dual value proposition

8% fixed annual yield

The STRK preferred shares offer an 8.00% fixed annual dividend based on the $100 liquidation preference. This means each share will generate $8.00 in annual dividends, paid in quarterly installments of $2.00 per share. The dividend structure has several key features:

Cumulative Dividend Structure

If Strategy cannot or does not declare a dividend payment, the unpaid dividends accumulate These accumulated (unpaid) dividends must be paid before any dividends can be paid to common stockholders Accumulated dividends must also be paid before redemption or liquidation

Quarterly Payment Schedule

Dividends are payable, when declared by Strategy’s board of directors Payment dates are set for: March 31, June 30, September 30, December 31

Flexible Payment Options

Strategy maintains discretion in how dividends are paid:

- Cash payments: Traditional cash dividend payments

- Class A common stock: Dividends paid in newly issued Strategy shares

- Combination: A mix of both cash and shares

The payment flexibility allows Strategy to manage its cash flow while ensuring preferred shareholders receive their dividend value, whether in cash or equity. This is particularly important given Strategy’s focus on maintaining and growing its Bitcoin holdings.

Perpetual strike option

The STRK preferred shares include a unique perpetual strike option that gives holders the right to redeem their shares for either:

- $100 per share (the liquidation preference), or

- 10% of one Strategy share

Here’s how this mechanism works:

Base Case: Share Price Below $1,000

When Strategy’s share price is below $1,000, the $100 redemption option is more valuable Example: If Strategy trades at $800, 10% would only be worth $80, making the $100 redemption more attractive

Conversion Economics: Above $1,000

The 10% option becomes more valuable when Strategy shares exceed $1,000 At $1,000 per Strategy share:

$100 cash redemption = $100 value

10% of Strategy share = $100 value (break-even point)

At $1,800 per Strategy share:

$100 cash redemption = $100 value

10% of Strategy share = $180 value

Strategic Timing Considerations

Due to the current high-yield environment:

Even if Strategy shares reach $1,000, holders might not redeem.

Example: If STRK trades at $180 due to its 8% yield, redeeming for $100 would mean giving up this premium The 10% option only becomes attractive when Strategy shares trade above $1,800, making the conversion value exceed both the $100 redemption and the market price of STRK

Projected Timeline

Based on Strategy’s growth projections and Bitcoin price expectations:

The perpetual strike option could become valuable between December 2027 and December 2028 This assumes Strategy’s continued execution of its Bitcoin accumulation strategy and positive Bitcoin price performance

This structure provides STRK holders with significant upside potential while maintaining a floor value of $100 per share, effectively combining yield with exposure to Strategy’s potential growth.

Comparison with traditional preferred shares

STRK represents a new type of preferred share that offers distinct advantages over traditional preferred stock investments. Let’s compare it with the iShares Preferred and Income Securities ETF (PFF), which holds preferred shares from 441 different companies:

Yield Structure

- STRK: 8.00% annual fixed yield

- PFF: 6.01% yield (5.55% after expenses)

- STRK yield premium: 2.45%

Asset Backing PFF is backed by traditional assets including commercial real estate, office properties, and telecommunications infrastructure - sectors potentially facing significant market risks and technological disruption.

In contrast, STRK is backed by Strategy’s substantial Bitcoin holdings of 499.096 BTC, which for Bitcoin believers represents superior collateral.

Risk Profile While PFF diversifies risk across hundreds of companies to protect against individual business failures, STRK offers a more focused exposure to Bitcoin’s performance through Strategy’s holdings. For investors who believe in Bitcoin’s future, this concentrated exposure combined with a higher yield presents a compelling value proposition. This innovative structure makes STRK particularly attractive for investors seeking both yield and Bitcoin exposure through a traditional financial instrument.

Target audience and market demand

STRK has been designed to appeal to a diverse group of investors, each attracted by different aspects of the offering.

Primary Investor Segments

The preferred shares are particularly attractive to:

- Income-focused investors seeking above-market yields

- Bitcoin enthusiasts looking for lower volatility exposure

- Retirees who need dependable quarterly income

- Institutional investors wanting regulated Bitcoin exposure

- Conservative investors who prefer not to write options

- Fixed-income investors interested in digital asset exposure

Key Investment Appeal

STRK combines several compelling features:

- Superior Yield: 8% annual return exceeds traditional preferred shares

- Bitcoin Exposure: Backed by Strategy’s 499.096 BTC holdings

- Growth Potential: Possible price appreciation as interest rates decline

- Income Reliability: Quarterly dividend payments

- Professional Management: Access to Bitcoin through a regulated, publicly traded company

This combination of features positions STRK as a unique financial instrument bridging traditional fixed-income investments with Bitcoin exposure, making it particularly attractive for investors who want Bitcoin exposure without direct cryptocurrency ownership.

Capital structure implications

- Raises capital without common stock dilution

- Enables continued Bitcoin accumulation

- Minimal impact on existing shareholders

- Creates new fixed-income dividend instrument

Risk considerations and features

The innovative nature of STRK brings specific risks and challenges to consider. The most immediate concern centers around market adoption, as the success of this new financial instrument depends on developing consistent trading patterns and establishing reliable liquidity pools.

Interest rate dynamics play a crucial role in STRK’s performance. While high rates make the 8% yield attractive now, an extended period of elevated rates could impact both STRK’s market price and its relative attractiveness compared to other fixed-income instruments.

The company has incorporated several protective features into STRK’s structure. Strategy retains the right to redeem all shares under specific conditions: if the total liquidation preference falls below 25% of the original offering or in case of certain tax events. In such cases, redemption would be priced at the liquidation preference plus any unpaid dividends.

Conclusion

STRK represents a significant milestone in Strategy’s evolution and the broader Bitcoin financial ecosystem. Its success could validate Strategy’s vision of becoming the premier Bitcoin treasury company while demonstrating the viability of Bitcoin-backed fixed-income products in traditional financial markets. This could pave the way for future innovations in Bitcoin-backed financial products, particularly in the fixed-income space.

This offering represents a significant milestone in Strategy’s evolution and the broader Bitcoin financial ecosystem, potentially setting the stage for future innovations in Bitcoin-backed financial products.