Strategy’s accretive Bitcoin acquisition

Strategy (formerly MicroStrategy) has pioneered a unique financial approach to acquiring Bitcoin that challenges traditional financial wisdom. While most companies avoid diluting shareholders through issuing new shares, Strategy has increased its outstanding shares while simultaneously creating shareholder value. This article explores how Strategy’s financial engineering has transformed what would typically be considered dilutive actions into accretive ones, increasing Bitcoin per share and driving exceptional returns.

What does accretive mean for Strategy?

In traditional finance, “accretive” refers to a transaction that increases a financial metric, typically earnings per share. A transaction is considered accretive when the percentage increase in the numerator (earnings) exceeds the percentage increase in the denominator (shares outstanding).

For Strategy, accretivity operates differently. Rather than focusing on earnings per share, Strategy focuses on Bitcoin yield - the percentage change in Bitcoin per share over time. A transaction is accretive when it increases Bitcoin per share, resulting in a positive Bitcoin yield, even if it involves issuing new shares or taking on debt.

Michael Saylor, Strategy’s Executive Chairman, has redefined accretion in the context of Bitcoin acquisition:

“Our objective is to find ways to generate incremental Bitcoin for our shareholders and do that with either cash flow from the business or do it through intelligent accretive financings of equity or debt or other intelligent operations. Also, if you just buy the Bitcoin you can’t generate yield.”

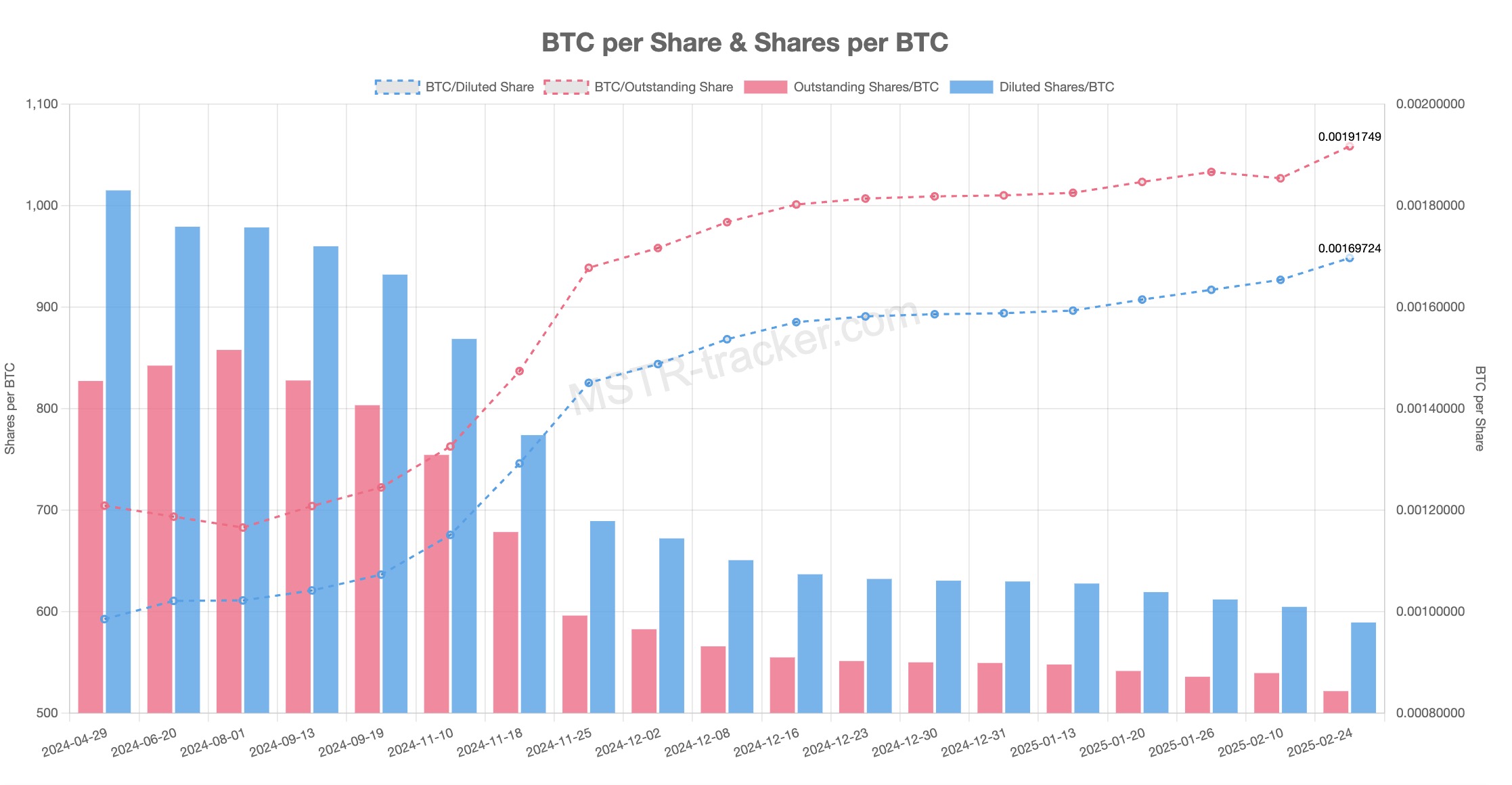

Currently, Strategy holds 499.096 Bitcoin, with a Bitcoin per diluted share value of 0.00169724 BTC. The Bitcoin yield year-to-date stands at +6.86%.

Source: mstr-tracker.com

The Bitcoin yield concept

The cornerstone of Strategy’s accretive acquisition model is the concept of “Bitcoin yield,” which measures how effectively the company increases its Bitcoin holdings relative to share dilution.

Bitcoin yield is defined as the percentage change period-to-period between Bitcoin holdings and assumed diluted shares outstanding. Simply put:

Bitcoin Yield = End Period Bitcoin Per Share / Start Period Bitcoin Per Share - 1

Strategy aims for a Bitcoin yield of 6-10% annually, though they have often exceeded this target. This yield represents the company’s ability to acquire Bitcoin at a faster rate than it dilutes shareholders - the essence of accretive acquisition.

Capital levers for Bitcoin acquisition

Strategy has four primary capital levers for financing Bitcoin purchases:

- Traditional debt (borrowing at fixed interest rates)

- Convertible debt (issuing debt that can be converted into shares)

- Equity issuance (selling new shares)

- At-the-market (ATM) offerings (selling shares directly into the market)

- Preferred stock (recently introduced with the STRK ticker)

Each of these mechanisms, when properly implemented, can increase Bitcoin per share despite increasing shares outstanding or debt.

ATM offerings: Selling new shares accretively

At-the-market (ATM) offerings allow Strategy to sell new shares directly into the market at current prices. This would typically dilute existing shareholders, but Strategy turns this dilution into accretion through a unique dynamic.

Here’s how ATM offerings work accretively:

- Strategy trades at a premium to its Bitcoin net asset value (NAV) - currently at 1.856xx

- Strategy sells new shares at this premium

- 100% of the proceeds are used to buy Bitcoin

- The result is more Bitcoin per share than before the offering

For example, if Strategy trades at 3x its Bitcoin NAV and issues new shares, it can buy more Bitcoin per share than it held before the offering. If each share corresponded to $100 worth of Bitcoin but traded at $300 (3x NAV), Strategy could sell one new share for $300, buy $300 worth of Bitcoin, and now have more Bitcoin backing each share than before.

As Saylor explains:

“When we sell a 100 million of a security back by 50 million of Bitcoin and we capture $50 million in a BTC gain, that is the value that we create for our shareholders. That BTC gain is reflected in the BTC yield that we show you.”

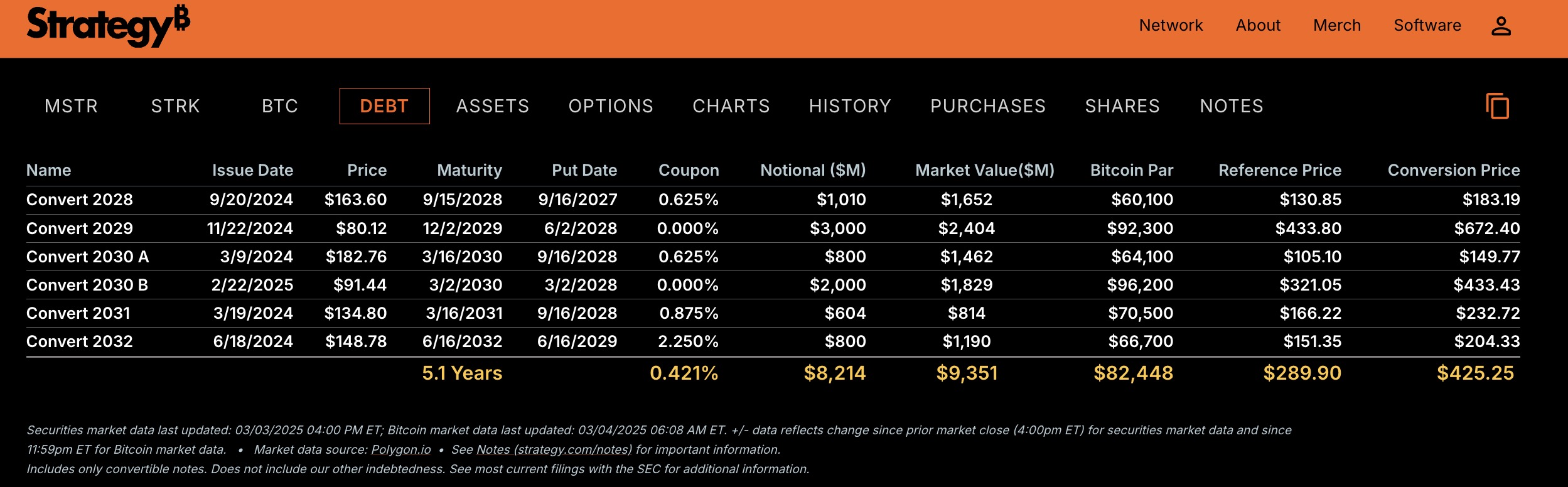

Convertible debt: Harnessing Bitcoin’s volatility

Strategy’s convertible notes represent another pillar of accretive acquisition. These bonds allow Strategy to:

- Raise cash without paying interest (many are 0% coupon bonds)

- Set conversion prices well above current share prices (typically 40-55% premium)

- Use proceeds to buy Bitcoin

- Benefit from debt potentially converting to equity if the share price rises above the conversion price

The conversion feature is particularly ingenious. If Strategy’s stock price rises above the conversion price, bondholders will convert their bonds to shares. This eliminates the debt from Strategy’s balance sheet without the company having to repay the principal.

As of 12 March 2025, Strategy has USD 9.26 bln in convertible debt with an average interest rate of just 0.373%%, resulting in annual interest expenses of only USD 34.6 mln.

Michael Saylor describes this as “selling volatility”:

“Bitcoin gives us 50 Vol 50 AR and the world’s full of people that would be delighted to take 20 Vol 20 AR… if we gave it to them over a long enough time frame it looks like a 60% BTC spread product where $100 million of capital results in $60 million of BTC gains for our shareholders and it still results in a very compelling instrument.”

This approach leverages Bitcoin and Strategy’s natural volatility. High volatility makes the conversion option more valuable, allowing Strategy to receive more cash when selling convertible bonds compared to traditional corporate bonds.

Source: strategy.com/debt

Preferred stock: The newest financing innovation

In January 2025, Strategy introduced another financing vehicle: preferred shares under the ticker symbol STRK. These shares offer:

- An 8% annual yield (compared to 6.01% for the broader preferred shares ETF market)

- A perpetual option to convert to Strategy common stock at 10% of the share price or $100, whichever is higher

- The ability for Strategy to perform additional ATM offerings using the STRK ticker

This preferred stock serves multiple purposes:

- It appeals to income-oriented investors who want Bitcoin exposure with steady income

- It provides Strategy with another avenue for accretive Bitcoin acquisition

- It offers potential conversion upside if Strategy’s share price appreciates significantly

As Bitcoin University’s analysis suggests, the STRK preferred shares could gain approximately 30% in value if interest rates decline to 1-1.5% within the next two years, in addition to providing the 8% annual yield.

The multiplier effect: Bitcoin trading at a premium

Central to Strategy’s model is the concept of trading at a premium to its Bitcoin net asset value (mNAV). This premium allows the accretive acquisition mechanism to function.

Strategy’s mNAV represents how much the market values Strategy relative to its Bitcoin holdings. An mNAV of 2.0 means Strategy shares trade at twice the value of their underlying Bitcoin.

The premium exists for several reasons:

- Strategy’s ability to generate Bitcoin yield through financial engineering

- The company’s positioning as a Bitcoin treasury company with potential financial service offerings

- The market’s expectation of future Bitcoin price appreciation

- Strategy’s ability to leverage capital markets to continue acquiring Bitcoin

As Michael Saylor explains:

“MicroStrategy is a transformer that converts Bitcoin volatility into tailored risk-reward profiles to suit the unique goals of different baskets of investors.”

The financial flywheel

Strategy has created a self-reinforcing flywheel that powers its Bitcoin acquisition:

- Strategy raises capital through one of its financing methods

- The capital is used to buy Bitcoin, increasing Strategy’s Bitcoin holdings

- Bitcoin price appreciation increases the value of Strategy’s holdings

- Strategy’s stock price increases, trading at a premium to its Bitcoin holdings

- The higher stock price increases Strategy’s capacity to raise more capital

- The cycle repeats

This flywheel allows Strategy to compound its Bitcoin holdings far faster than would be possible through direct Bitcoin acquisition alone.

The addition of index inclusion creates another powerful flywheel:

- As Strategy grows, it attracts more passive flows from indexes

- These flows increase Strategy’s share price

- The higher share price allows Strategy to raise more capital

- More capital enables more Bitcoin purchases

- More Bitcoin purchases increase the price of Bitcoin

- Strategy’s market cap grows, increasing its weighting in indexes

- The cycle accelerates

Why this model works

Strategy’s accretive acquisition model works because it addresses specific market needs:

- It provides Bitcoin exposure to investors who cannot directly own Bitcoin due to regulatory restrictions or mandate limitations

- It offers varying degrees of Bitcoin exposure with different risk-reward profiles

- It creates financial products with tailored volatility characteristics

- It leverages Bitcoin’s natural volatility to finance further Bitcoin acquisition

As Saylor notes:

“MicroStrategy is capturing capital that is either restricted (because of regulations) or reluctant (because of volatility) to flow directly into Bitcoin. MicroStrategy then converts this capital into Bitcoin, removing supply forever.”

Minimal leverage risk

Despite increasing its debt and share count, Strategy maintains a relatively conservative financial position. The company targets approximately 25% leverage, similar to a homeowner financing only a quarter of their home’s value.

With debt and preferred stock relative to Bitcoin NAV, Strategy maintains significant headroom against any potential liquidity crisis.

Additionally, the structure of convertible bonds means they don’t carry the same risks as margin debt:

- There are no maintenance margin requirements that could trigger forced selling

- The debt has fixed maturity dates years in the future

- Much of the debt will likely convert to equity if Bitcoin and Strategy’s price continue to rise

- The 0% coupon on most bonds minimizes cash flow pressure

Becoming a Bitcoin treasury company

Strategy is transitioning from an analytics software company into what it calls a “Bitcoin treasury company.” This evolution positions Strategy to potentially become a global Bitcoin bank, offering financial products and services backed by its substantial Bitcoin holdings.

Saylor describes the endgame:

“The endgame is to be the leading Bitcoin Bank, or merchant bank, or you could call it a Bitcoin finance company.”

With 499.096 Bitcoin ( 2.38%% of all Bitcoin), Strategy has established itself as the dominant corporate Bitcoin holder, creating a moat that competitors would struggle to breach.

Conclusion

Strategy has pioneered a revolutionary approach to Bitcoin acquisition that transforms traditional finance concepts. By leveraging capital markets and Bitcoin’s inherent characteristics, the company has succeeded in making dilution accretive - increasing Bitcoin per share while expanding its outstanding shares and debt.

This financial engineering represents one of the most innovative capital allocation strategies in modern finance. Strategy has created a system where it can consistently increase its Bitcoin holdings at a rate faster than its share count grows, generating Bitcoin yield for shareholders.

The company’s ability to issue new shares, convertible bonds, and preferred stock at premiums to its underlying Bitcoin holdings allows it to acquire Bitcoin in a way that benefits existing shareholders rather than diluting them. This accretive acquisition model, combined with Bitcoin’s price appreciation, has driven Strategy’s exceptional performance and positioned it as the leading corporate Bitcoin holder.

For investors considering Strategy, understanding this accretive acquisition mechanism is essential. The company’s value proposition extends beyond simple Bitcoin exposure - it offers a sophisticated financial engine designed to compound Bitcoin holdings and shareholder value over time.