Why Strategy’s Convertible Bonds Are Irresistible to Investors

Strategy has revolutionized the convertible bond market with an innovative strategy that has drawn in traders, arbitrage funds, and institutional investors. The company’s ability to issue zero-coupon convertible bonds with extraordinarily high conversion premiums has made these instruments uniquely attractive. Let’s explore the reasons why Strategy’s convertible bonds stand out in the financial world.

1. Zero-Coupon Structure with High Premiums

Unlike most corporate convertible bonds, Strategy has successfully issued zero-coupon bonds with conversion premiums as high as 55% above the stock price at issuance. Achieving a 55% premium on a zero-coupon bond is nearly unheard of. Especially if you compare this unique occurrence to conditions in Japan, where interest rates have been near zero for decades, allowing companies like SoftBank to issue similar bonds.

By issuing bonds at such a high premium, Strategy minimizes immediate dilution for shareholders while securing long-term capital at nearly no cost. The impact of this strategy extends beyond simple capital raising—it effectively allows Strategy to issue stock at a much higher price, further fueling its aggressive Bitcoin accumulation strategy.

2. Extreme Volatility Creates Arbitrage Opportunities

Strategy’s share price is well known for its extreme volatility, largely due to its leveraged exposure to Bitcoin. The primary driver of convertible bond pricing is implied volatility—the more volatile the stock, the higher the value of the embedded option within the bond.

This dynamic presents convertible arbitrage traders with opportunities to buy the bonds at lower implied volatility and sell them at higher implied volatility, profiting from the inherent fluctuations in Strategy’s stock price. Traders have found Strategy’s convertibles particularly lucrative due to their deep liquidity and the rapid appreciation of Bitcoin, which directly impacts MSTR stock movements.

3. Profitable Gamma Trading & Market-Making

Convertible bond arbitrage funds actively hedge their positions using gamma trading, where they short MSTR stock when it rises and buy it when it falls. MSTR’s volatility ensures that traders can consistently capture price movements for profit. Traders of these convertible bonds must be vigilant, as the stock can move so quickly that even a short trip to the bathroom can result in millions of dollars in unexpected exposure.

This gamma trading not only provides profits to arbitrage traders but also stabilizes Strategy’s stock by dampening extreme price swings. As more convertible bond holders hedge their exposure, the liquidity of MSTR stock remains high, making it a preferred instrument for sophisticated market participants.

4. High Implied Volatility Enhances Time Value

Convertible bonds issued by Strategy have long-dated embedded call and put options. A put option in the context of a convertible bond gives the bondholder the right to “sell” the bond back to the issuer at a predetermined price before maturity. This means that after several years, bondholders have the right to redeem their bonds at face value. This provides investors with a degree of downside protection:

- If Strategy’s stock price performs well and the conversion option is attractive, investors can convert their bonds into equity.

- If the stock price underperforms, bondholders can exercise the put option and redeem their bonds for cash at par, mitigating potential losses.

This extended duration increases the time value of the embedded option, allowing traders to enter at initial pricing and exit later at a premium.

Strategy’s convertibles trade at very high implied volatility (nearly 70%), which is virtually unheard of for a e.g. five-year security. In traditional markets, longer-dated options typically see volatility compress over time, but Strategy’s stock is so volatile that the bonds maintain high implied volatility, keeping their value elevated in the secondary market.

5. Continuous Demand from Arbitrage Funds

Strategy’s bonds consistently trade at a premium in the secondary market due to ongoing demand from arbitrage funds. The bonds are issued with cheap volatility relative to market pricing, making them an attractive instrument for funds looking to profit from relative value trades.

Every time Strategy issues new bonds, investment bankers across Wall Street receive immediate demand from hedge funds looking to capture these inefficiencies. Traders will rush to get their allocations, knowing that the bonds will almost certainly appreciate in value once they begin trading in the open market.

6. Low Credit Risk Despite No Bitcoin Collateral

While Strategy’s convertible bonds are not directly secured by Bitcoin, they are backed by the company’s overall asset base, including its software business and large Bitcoin holdings. Investors believe that as long as Bitcoin does not suffer an 80%+ crash, Strategy remains solvent.

The bonds are structured with, as previously mentioned, a put option, meaning that even in a worst-case scenario, investors can redeem their bonds at par within several years, minimizing their credit risk exposure. This unique feature has made them even more appealing compared to traditional corporate debt.

7. Soft Call Feature Increases Predictability

A crucial feature of Strategy’s bonds is the soft call mechanism, which allows the company to force conversion if the stock price rises significantly above the conversion price. This mechanism ensures that once the bonds reach a certain price, they convert into equity, reducing Strategy’s debt load and further increasing its Bitcoin holdings.

This feature benefits both the company and investors:

- For Strategy, it means debt is eliminated in a way that benefits shareholders, rather than accumulating liabilities.

- For bondholders, they are able to convert into stock at an advantageous price, ensuring they realize significant profits.

- When convertible bonds become significantly “in the money,” their delta rises too high, making gamma trading ineffective. At this point, traders receive shares they are already short, leading to a natural demand for new convertible notes. Strategy can then issue new highly demanded convertible bonds, repeating the cycle, which the market eagerly absorbs.

The Broader Impact: A Win-Win for Strategy and Bondholders

Strategy has engineered a system where both the company and bondholders benefit:

- Strategy raises capital at an attractive rate—selling stock at a premium and using the proceeds to buy more Bitcoin.

- Convertible bond traders benefit from high volatility, arbitrage, and liquidity, ensuring their trades remain profitable.

- Arbitrage activity helps stabilize Strategy’s stock, as shorting pressure from bondholders balances speculative buying.

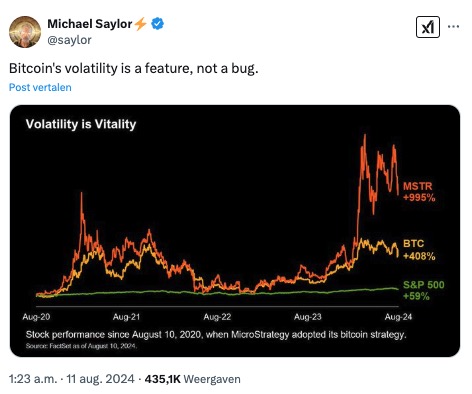

By leveraging the extreme volatility of Bitcoin and the capital markets’ insatiable demand for high-yield opportunities, Michael Saylor has transformed Strategy into a hybrid between a technology company and a financial institution. The company is no longer just an analytics firm or a Bitcoin holding entity—it has become a pioneer in financial engineering, utilizing convertible bonds as a weapon to continually amass more Bitcoin while rewarding sophisticated investors.

With the ongoing success of Strategy’s Bitcoin strategy and capital markets approach, these bonds remain among the most attractive instruments for sophisticated investors. As Strategy continues to execute its Bitcoin accumulation strategy, the appeal of its convertible bonds is likely to grow even further, cementing the company’s place as a dominant force in both the Bitcoin and fixed-income markets.