‘Cheap debt’ narrative: is Strategy’s convertible debt truly inexpensive?

When examining Strategy (formerly known as MicroStrategy), few aspects of its business model have generated as much enthusiasm among retail investors as its seemingly miraculous ability to issue debt at incredibly low interest rates. The company has successfully raised billions through convertible bonds with interest rates often below 1% - a feat that appears extraordinary when compared to the rates other corporations or even sovereign nations must pay.

This “cheap debt” narrative has become a cornerstone of the bull case for Strategy, with many investors pointing to these low-coupon convertible notes as evidence of the company’s financial ingenuity. However, as Emil Sandstedt argues in his provocative Medium article,

"All Your Models Are Destroyed — The Rise and Future Fall of MicroStrategy"

this narrative deserves significantly more scrutiny.

This article will examine Sandstedt’s critique of the “cheap debt” narrative, evaluate his arguments using Strategy’s financial data, and provide a balanced assessment of whether Strategy’s debt is truly as inexpensive as many investors believe.

The ‘cheap debt’ narrative

The conventional wisdom among many Strategy investors is straightforward: the company has discovered a way to borrow money at extraordinarily favorable terms, using the proceeds to purchase Bitcoin, which they expect to appreciate at a rate far exceeding their borrowing costs.

This perception is captured perfectly in quotes Sandstedt highlights from Reddit users:

“Don’t forget the dirt cheap loan (.063%) he secured for 6 or 700M.” — Reddit user #1.

“Imagine loaning someone 700M and 0% interest instead of buying btc.” — Reddit user #2.

This sentiment is widespread and has become a key justification for Strategy’s premium valuation. After all, if the company can consistently borrow at near-zero rates while Bitcoin appreciates at double-digit rates annually, the arbitrage opportunity appears enormous.

Sandstedt’s critique

Sandstedt forcefully challenges this narrative, arguing that investors fundamentally misunderstand the true cost of convertible debt. He writes:

“It is an easy mistake to make, in assuming that a low interest rate on a debt instrument means it is cheap. But because MicroStrategy’s many bond issues for the purpose of buying Bitcoin are convertible to equity at a predefined conversion price, a low interest rate on the bonds can’t be compared with interest rates on normal loans.”

His central argument is that convertible bonds are hybrid securities combining debt and equity features. The low coupon rate doesn’t represent a discount but is compensated for by the embedded call option that allows bondholders to convert to equity if the share price rises above the conversion price.

Sandstedt continues:

“It should go without saying that if lenders demand more than 4% from the US Government, they will not simultaneously demand less than 1% from MicroStrategy — a company with decreasing revenues and where the main business now consists of buying and holding Bitcoin.”

Evaluating the argument: Understanding convertible debt

To properly assess this critique, we need to understand what convertible debt actually is and how it works.

Convertible bonds are indeed hybrid securities containing both debt and equity components. They provide bondholders with:

- Regular interest payments (the coupon)

- The right to convert the bond into a predetermined number of shares at a specific conversion price

- Return of principal at maturity if not converted

The conversion option is effectively a call option on the company’s stock, allowing bondholders to participate in upside potential. This optionality is valuable, and it’s this value that enables companies to issue convertible debt at lower coupon rates than straight debt.

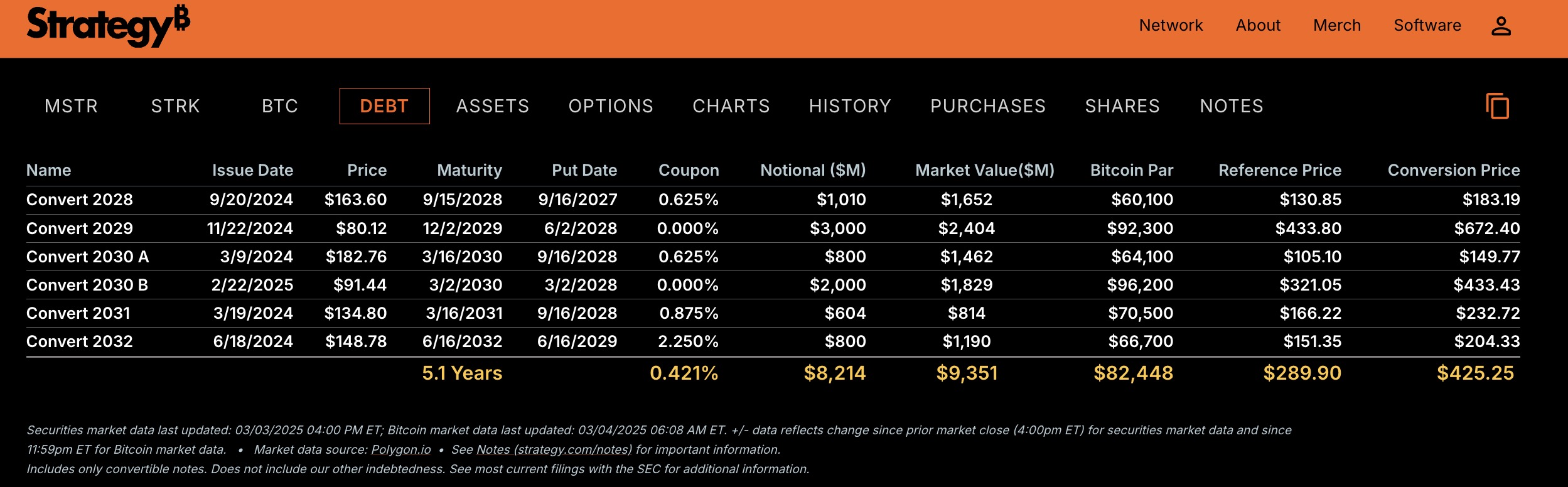

Currently, Strategy has USD 9.26 bln in convertible debt with an average interest rate of just 0.421%. This appears extraordinarily cheap compared to the 6.125% rate on its previous straight bonds issued in 2021 that the company has since redeemed.

Source: strategy.com/debt

Is Sandstedt right?

Sandstedt’s core argument - that the low coupon rates on Strategy’s convertible bonds don’t represent “cheap debt” but rather reflect payment in another form (equity upside) - is technically correct. The convertible bond market is pricing in the potential equity conversion, which explains the lower coupons.

However, there are several important counterpoints to consider:

1. Actual borrowing costs remain low

While the theoretical cost of the debt includes the equity optionality, Strategy’s actual cash outflows for debt service remain extremely low. The company currently pays only USD 34.6 mln annually on USD 9.26 bln of debt - an effective cash interest rate of 0.421%. This represents an extremely modest cash burden relative to the company’s Bitcoin holdings ( 538.200 BTC valued at approximately USD 50.156 bln).

2. Conversion at a premium is accretive

Sandstedt describes the conversion feature as a cost, but this ignores a crucial aspect of Strategy’s convertible debt structure. The company issues these bonds with conversion prices significantly above the market price at issuance - typically at 35-55% premiums. This means if conversion occurs, it happens at a price advantageous to existing shareholders.

For example, Strategy’s most recent $3 billion convertible bond issuance in November 2024 had a conversion price of $672.40, representing a 55% premium to the share price at issuance. If these bonds convert, Strategy will have effectively sold shares at a significant premium.

3. Success in difficult market conditions

Throughout 2024, while other companies struggled to raise capital at favorable rates, Strategy continued to successfully issue convertible bonds with remarkably low coupons. Their November 2024 $3 billion issuance carried a 0% coupon despite rising interest rates across the broader economy.

4. The straight bond comparison

Sandstedt points to Strategy’s 2021 straight bond issuance at 6.125% as evidence of the company’s “true” cost of capital. However, this comparison doesn’t fully acknowledge that:

- Strategy has since redeemed these bonds

- The company’s financial position has materially changed since 2021

- The convertible structure allows for pricing that reflects both debt characteristics and equity upside potential

The importance of capital structure

Where Sandstedt’s analysis becomes particularly valuable is in highlighting the importance of understanding Strategy’s overall capital structure and not just focusing on the headline coupon rates.

Strategy’s current debt strategy involves targeting a debt ratio of approximately 25% relative to Bitcoin holdings. This relatively conservative approach provides significant protection against market downturns, though Sandstedt warns this ratio could creep upward during periods of market euphoria.

The company currently has a debt-to-Bitcoin NAV ratio of , which includes both convertible debt and preferred equity. This represents a relatively modest leverage level that allows Strategy to weather significant market volatility without facing immediate financial distress.

The true cost of Strategy’s debt

To properly evaluate Strategy’s debt costs, we need to consider multiple perspectives:

-

Cash flow perspective: From this viewpoint, Strategy’s debt is indeed extremely cheap, requiring minimal cash outflows for debt service.

-

Total economic cost perspective: When including the value of the conversion option, the debt is priced appropriately for the risk involved, as Sandstedt argues.

-

Strategic/opportunistic perspective: If Bitcoin appreciates substantially, conversion occurs at premiums to NAV, making the debt accretive to Bitcoin per share.

-

Worst-case scenario perspective: If Bitcoin depreciates substantially and remains below the levels needed for conversion, Strategy faces principal repayment obligations at maturity.

Conclusion

Emil Sandstedt makes a valid technical point that Strategy’s convertible debt isn’t as “cheap” as many retail investors believe when considering the full economic cost including the conversion option. His argument serves as an important correction to oversimplified narratives about Strategy’s financing strategy.

However, his critique doesn’t fully acknowledge the strategic advantages of Strategy’s approach. The company has successfully engineered a capital structure that:

- Minimizes current cash outflows

- Provides exposure to Bitcoin with intelligent leverage

- Issues equity only at significant premiums if conversion occurs

- Maintains reasonable debt ratios to manage downside risk

For investors evaluating Strategy, understanding the nuances of its convertible debt strategy is essential. The “cheap debt” narrative oversimplifies a complex financial structure, but dismissing the advantages of Strategy’s approach would equally miss important aspects of the company’s strategy.

While Strategy currently pays minimal interest with USD 34.6 mln on USD 9.26 bln of debt, investors should recognize that this doesn’t represent “free money” but rather reflects a sophisticated capital structure designed to maximize Bitcoin acquisition while managing financial risk.

The true test of this strategy will come during a prolonged Bitcoin bear market, when Strategy’s ability to service and potentially refinance its debt will face more significant challenges. Until then, Michael Saylor’s approach continues to succeed in its primary objective - accumulating Bitcoin at a pace that would otherwise be impossible without this financial engineering.