‘Dilution is accretive’ narrative: A critical look at Strategy’s equity issuance

Strategy (formerly known as MicroStrategy) has pioneered a unique approach to corporate Bitcoin acquisition that challenges conventional financial wisdom. While traditional financial theory suggests that issuing new shares dilutes existing shareholders and diminishes their ownership stake, Strategy has managed to turn this concept on its head. The company has more than doubled its outstanding shares since 2020 while simultaneously delivering extraordinary returns to shareholders.

This seemingly paradoxical outcome has fostered a powerful narrative among Strategy investors: that the company’s share issuance and convertible bond structure somehow shields shareholders from meaningful dilution. As Emil Sandstedt argues in his detailed Medium article,

“All Your Models Are Destroyed — The Rise and Future Fall of MicroStrategy”, this dilution narrative deserves careful scrutiny.

This article examines Sandstedt’s critique of Strategy’s share dilution approach, evaluates the mechanics of its convertible bonds, and provides a balanced assessment of the reality behind the “dilution is accretive” narrative that has captivated investors.

The anti-dilution narrative

Many Strategy investors confidently assert that the company’s financial engineering protects shareholders from dilution in two key ways:

-

Convertible bonds are structured to minimize dilution - The claim is that Strategy’s convertible bonds are cleverly designed to prevent significant shareholder dilution.

-

ATM offerings increase Bitcoin per share - When shares trade at a premium to net asset value (NAV), Strategy can issue new shares and use the proceeds to buy more Bitcoin, potentially increasing the Bitcoin per share ratio despite the increased share count.

This thinking has become so prevalent that many investors celebrate each new convertible bond issuance and share offering as unequivocally positive developments, with little concern about potential dilution.

Sandstedt’s critique

Sandstedt directly challenges these assumptions, particularly regarding Strategy’s convertible bonds. He writes:

“Some investors seem to have misunderstood another aspect of the company’s convertible bonds. It concerns the notion that the company is protected from dilution due to how the convertible bond issues are structured.”

Sandstedt argues that investors have fundamentally misinterpreted how convertible bonds work. He points to the language from Strategy’s bond offerings, which includes phrasing like: “Subject to certain conditions, on or after [date], Strategy may redeem for cash all or a portion of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued and unpaid interest, if any […].”

While some investors interpret this as giving Strategy the ability to prevent dilution by redeeming bonds before they convert, Sandstedt explains that this is a misunderstanding:

“This sounds like a great deal to MicroStrategy — not so much for the lender. But this is common wording for convertible bonds. It does not mean that if the share price surpasses the higher conversion price stipulated for the convertible bond, MicroStrategy can somehow redeem the bonds just before they were to convert into equity (and as a consequence stop the dilution of existing shareholders).”

Evaluating the argument: Understanding convertible bond mechanics

To properly assess Sandstedt’s critique, we need to understand how convertible bonds actually function within Strategy’s capital structure.

How convertible bonds work

Convertible bonds give bondholders the right to convert their debt into equity at a predetermined price. For Strategy, these conversion prices are typically set 35-55% above the market price at issuance. This means:

- If Strategy’s stock price rises above the conversion price, bondholders can convert their bonds into shares

- If the stock price remains below the conversion price, the bonds remain as debt

The critical point that Sandstedt makes is that if Strategy’s share price exceeds the conversion price, bondholders will exercise their conversion right, not Strategy. This conversion is entirely at the bondholders’ discretion, and Strategy cannot prevent it.

We can see evidence of this in Strategy’s SEC filings. In June 2024, when Strategy redeemed its first convertible bond issuance (the 0.75% Convertible Senior Notes due 2025), the company stated:

“On June 13, 2024, the Company announced that it delivered a notice of full redemption (the “Notice”) to the trustee of the Company’s outstanding 0.750% Convertible Senior Notes due 2025 (the “2025 Notes”)… As a result of the delivery of the Notice, at any time prior to 5:00 p.m., New York City time, on July 11, 2024, the 2025 Notes are convertible, at the option of the holders of the 2025 Notes, at the applicable conversion rate of 2.5126 shares of the Company’s class A common stock per $1,000 principal amount (reflecting a conversion price of $397.99 per share).” (8-K, 2024-06-13)

This filing confirms that bondholders, not Strategy, controlled whether the bonds converted to equity. In this case, given that Strategy’s share price was well above the conversion price, bondholders predictably chose to convert rather than receive the principal repayment.

Anti-dilution provisions

Sandstedt further explains that convertible bonds contain anti-dilution provisions that protect bondholders, not Strategy shareholders:

“Anti-dilutionary clauses means that the conversion ratio increases in proportion to dilution, meaning the conversion price decreases in proportion (as principal amount stays the same). A 5% dilution from one bond converting into equity, in other words, lowers the conversion price of the other bonds accordingly.”

These provisions ensure that if Strategy issues more shares (thereby diluting existing shareholders), the conversion price for bondholders is adjusted to maintain their proportional claim. This prevents Strategy from issuing shares to deliberately keep the stock price below conversion thresholds.

Is Sandstedt right?

Sandstedt’s central argument about convertible bonds and dilution is technically correct. If Strategy’s share price rises above the conversion prices of its various bond issuances, conversion will occur, creating substantial dilution for existing shareholders.

However, there are important nuances to consider:

1. Conversion at a premium can be accretive

While conversion does create dilution, it may still be accretive to shareholders if it occurs at a significant premium to Bitcoin NAV. Strategy issues convertible bonds with conversion prices well above the market price at issuance, which means any resulting dilution happens at valuations favorable to existing shareholders.

For example, Strategy’s November 2024 $3 billion convertible bond issuance had a conversion price of $672.40, representing a 55% premium to the share price at issuance. If these bonds convert, Strategy will have effectively sold shares at a significant premium.

2. Bitcoin per share is a more nuanced metric

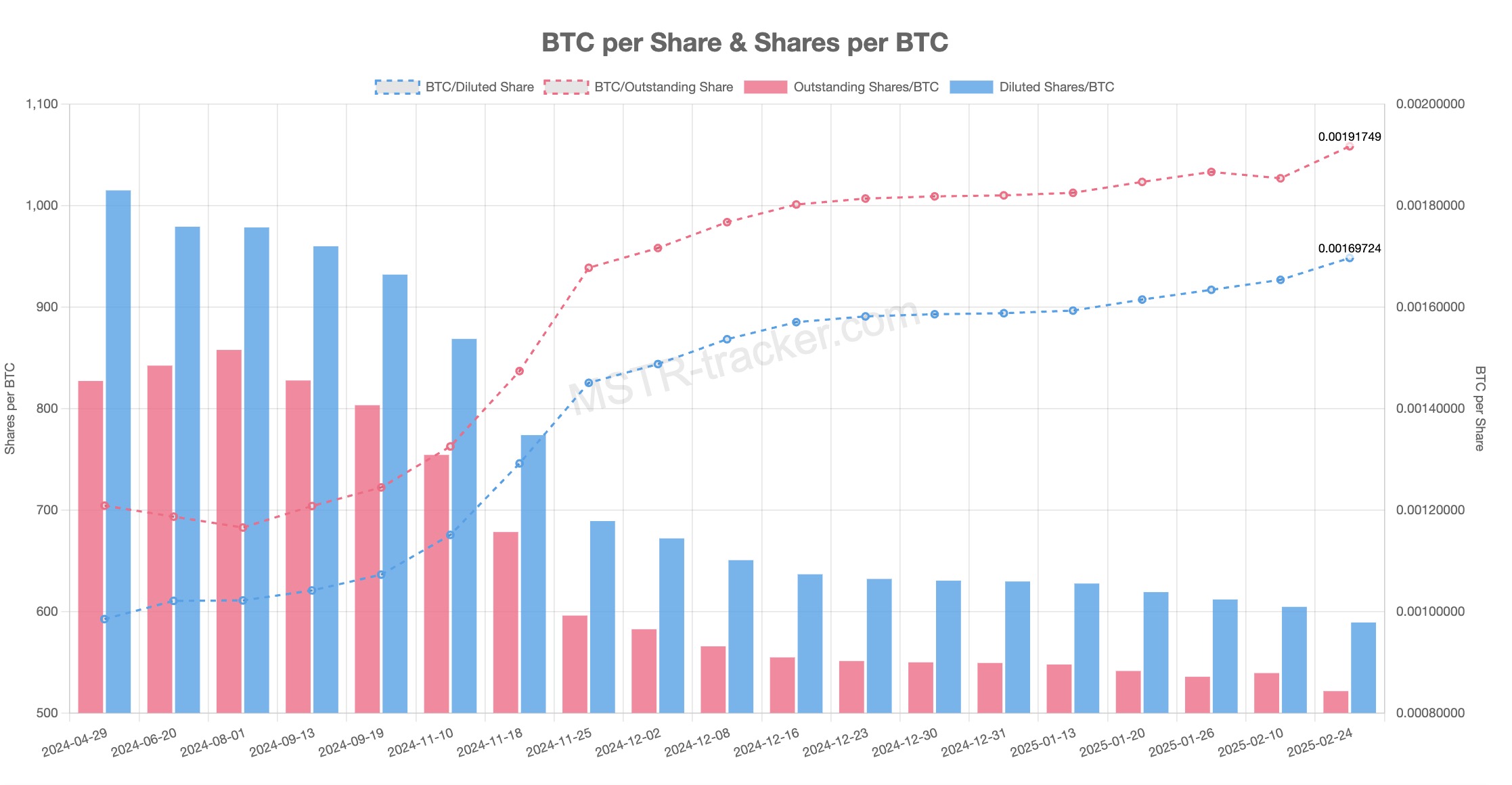

The true measure of whether Strategy’s equity issuance is accretive or dilutive is what happens to Bitcoin per share. As of 23 April 2025, Strategy holds 538.200 BTC, with Bitcoin per diluted share of 0.00178004 BTC.

When Strategy issues shares or convertible bonds at a premium to its Bitcoin NAV, it can acquire more Bitcoin per dollar raised, potentially increasing the Bitcoin per share ratio despite the increased share count. This is the key to Strategy’s approach - using the premium valuation to acquire Bitcoin more efficiently than direct purchases would allow.

The company has achieved a Bitcoin yield year-to-date of +10.97%, reflecting growth in Bitcoin per share despite share dilution.

3. The software business is negligible in the analysis

Sandstedt is right that Strategy’s software business has become virtually irrelevant to its valuation. With the company now described as a “Bitcoin Treasury Company,” its value primarily reflects its Bitcoin holdings and capital structure strategy, not its legacy software operations.

ATM offerings and dilution

Strategy’s at-the-market (ATM) offerings represent another aspect of its capital raising strategy that Sandstedt addresses. He notes:

“With the continued issuance of shares through ATM offerings to purchase more Bitcoin, onlookers thought that Saylor conducted some sort of magic trick, where he with no additional risk could increase the company’s Bitcoin per share ratio. It needs to be stressed that the issuance in 2023 and early 2024 was conducted with little to no premium to net asset value.”

Sandstedt correctly observes that ATM offerings are only accretive when shares trade at a premium to Bitcoin NAV. Without this premium, the dilution from new shares neutralizes any benefit from additional Bitcoin purchases.

However, Strategy’s current situation is different. With shares trading at a premium to Bitcoin NAV (currently at 2.069xx), the company can now conduct ATM offerings that increase Bitcoin per share, as demonstrated by its growing Bitcoin yield.

Source: mstr-tracker.com

The reality of dilution risk

While Strategy’s approach can be accretive in favorable market conditions, investors should recognize several important risk factors:

1. Conversion risk in bear markets

If Bitcoin’s price declines substantially and Strategy’s share price IS below the conversion thresholds for its convertible bonds at maturity, the company will face principal repayment obligations rather than conversion. This could force Strategy to issue new shares at much lower prices to repay the debt, resulting in severe dilution during unfavorable market conditions. But also they could potentially refinance or “roll” the existing debt by issuing new convertible bonds with later maturity dates. Given the high volatility of Strategy’s shares and Bitcoin’s price action, convertible arbitrage funds and other investors might be eager to maintain exposure through new issuances, even in challenging market conditions. Strategy could also just issue new convertible bonds.

2. Anti-dilution provisions create a domino effect

As Sandstedt notes, anti-dilution provisions in convertible bonds mean that conversion of one bond issue can trigger adjustments to the conversion prices of others. This creates a potential domino effect where one conversion leads to more, amplifying dilution during market downturns. However, this risk appears manageable in Strategy’s case due to the wide gaps between conversion prices (ranging from $149.77 to $672.40), staggered maturities spanning from 2028 to 2032, and the typically modest scale of anti-dilution adjustments. These structural features create natural barriers that make a cascading conversion scenario less likely to materialize in practice.

3. The premium is not guaranteed

Strategy’s ability to issue shares and convertible debt at a premium to Bitcoin NAV depends entirely on market sentiment. If investor enthusiasm wanes, this premium could disappear, eliminating the company’s ability to conduct accretive offerings. While Strategy can simply pause capital raising activities during such periods—as they did during 2022-2023 when shares traded near or below NAV—extended periods without a premium could limit their Bitcoin acquisition pace and potentially affect debt refinancing options. However, Strategy’s long-term approach gives them considerable flexibility to wait for favorable market conditions to resume their accretive issuance strategy.

Conclusion

Emil Sandstedt’s critique of Strategy’s dilution narrative highlights important misconceptions among some investors. The company’s convertible bonds do not protect against dilution - they virtually guarantee it if share prices rise sufficiently. However, this dilution can still be beneficial to shareholders if it occurs at significant premiums to Bitcoin NAV.

The key insight from this analysis is that Strategy’s financial engineering relies on maintaining a premium valuation relative to its Bitcoin holdings. When this premium exists, the company can issue shares and convertible debt in ways that potentially increase Bitcoin per share. When it disappears, the strategy becomes much more challenging to execute successfully.

For investors evaluating Strategy, understanding these nuances is essential. The “dilution is accretive” narrative contains elements of truth but oversimplifies a complex financial dynamic. Strategy’s approach works brilliantly when market sentiment is favorable but carries significant risks during downturns.

The ultimate test of Strategy’s financial model will come during a prolonged Bitcoin bear market, when maintaining premium valuations becomes difficult and conversion dynamics could turn unfavorable. Until then, Michael Saylor’s approach continues to successfully increase Bitcoin per share, albeit with a gradual growth in potential dilution risk embedded in the company’s expanding convertible debt obligations of USD 9.26 bln.