Examining the ‘Infinite Money glitch’ narrative: Is Strategy’s financial model sustainable?

Strategy has captivated the financial world with its aggressive Bitcoin acquisition strategy. Perhaps no aspect of this approach has generated more excitement—and controversy—than what some enthusiasts have dubbed the “infinite money glitch.” This concept suggests that Strategy has discovered a perpetual motion machine for wealth creation by repeatedly leveraging its Bitcoin holdings to acquire more Bitcoin.

But is this financial engineering truly sustainable, or does it conceal fundamental flaws that could eventually unravel? A recent in-depth critique by Emil Sandstedt titled “All Your Models Are Destroyed — The Rise and Future Fall of MicroStrategy” has challenged the sustainability of this approach. This article will examine Sandstedt’s arguments against the narrative while evaluating whether they hold up against the available evidence.

Understanding the ‘infinite money glitch’ concept

The “infinite money glitch” narrative, as described by enthusiastic Strategy investors, follows a seemingly elegant circular logic:

- Strategy raises capital through equity issuances or convertible debt

- The company uses this capital to purchase Bitcoin

- Bitcoin’s price increases, driving up Strategy’s share price

- The higher share price enables Strategy to raise even more capital at favorable terms

- The cycle repeats, creating what appears to be a perpetual wealth generation engine

As one Reddit user quoted in Sandstedt’s article put it:

“Buy Bitcoin, Bitcoin goes up, Stock is tied to Bitcoin, Stock goes up, Sell stock, use cash to buy more Bitcoin, repeat. Infinite money glitch.”

This concept has contributed to the extraordinary rally in Strategy’s stock price and has become a cornerstone of the bull case for the company.

Sandstedt’s critique of the ‘infinite money glitch’

Sandstedt’s analysis is particularly critical of this narrative, arguing that it fundamentally misunderstands the mechanics of financial markets and Strategy’s relationship to Bitcoin price movements.

He writes:

“MicroStrategy does not have control over the Bitcoin price; the size of the issues is dwarfed by Bitcoin’s total market capitalization. Whatever buy pressure the company can apply on the Bitcoin price through these treasury operations, is multiple times offset by the sell pressure applied by the new issuance on the MicroStrategy share price.”

Sandstedt further argues that the “glitch” could transform into “permanent monetary losses should the company have to liquidate parts of its Bitcoin holdings or raise funds in a depressed market environment as the convertible bonds finally mature below conversion price.”

His conclusion is blunt: “In other words, there is no glitch, but mainly debt-fueled risk taking which may give a certain boost to the upside, or a fatal blow to the downside.”

Analyzing Sandstedt’s critique

While Sandstedt raises valid concerns about the potential risks in Strategy’s model, his analysis may overlook several important aspects of the company’s approach:

1. Strategy’s actual impact on Bitcoin’s price

Sandstedt correctly points out that Strategy cannot single-handedly control Bitcoin’s price. However, Strategy’s purchases may have more influence than he acknowledges. As the company currently holds 2.56% of the total Bitcoin supply, its continued accumulation could contribute to upward price pressure through supply reduction—particularly as the company has stated it has no intention of ever selling its holdings.

Furthermore, Strategy’s bold moves have significant signaling effects in the market. When a publicly traded company with a strong reputation makes large Bitcoin purchases, it influences market sentiment and potentially attracts other institutional investors, creating a broader impact than the direct market buy pressure alone.

2. The self-reinforcing flywheel effect

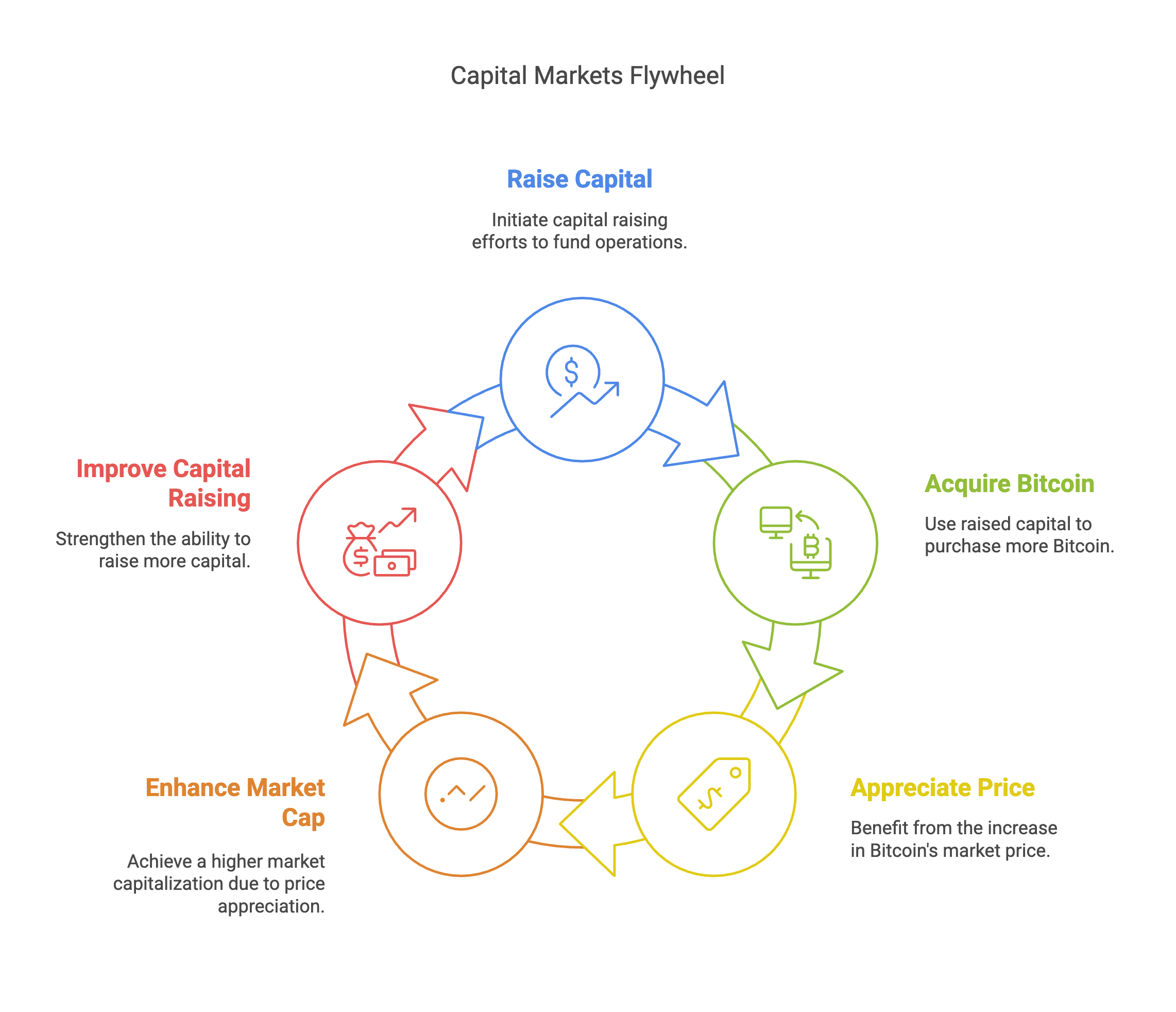

Strategy has created multiple interconnected flywheels that may be more powerful than Sandstedt’s analysis suggests. This model creates two powerful self-reinforcing cycles:

Capital markets flywheel:

- Strategy raises capital → Buys more Bitcoin → Price appreciation increases market cap → Greater capital raising ability → More Bitcoin acquisition

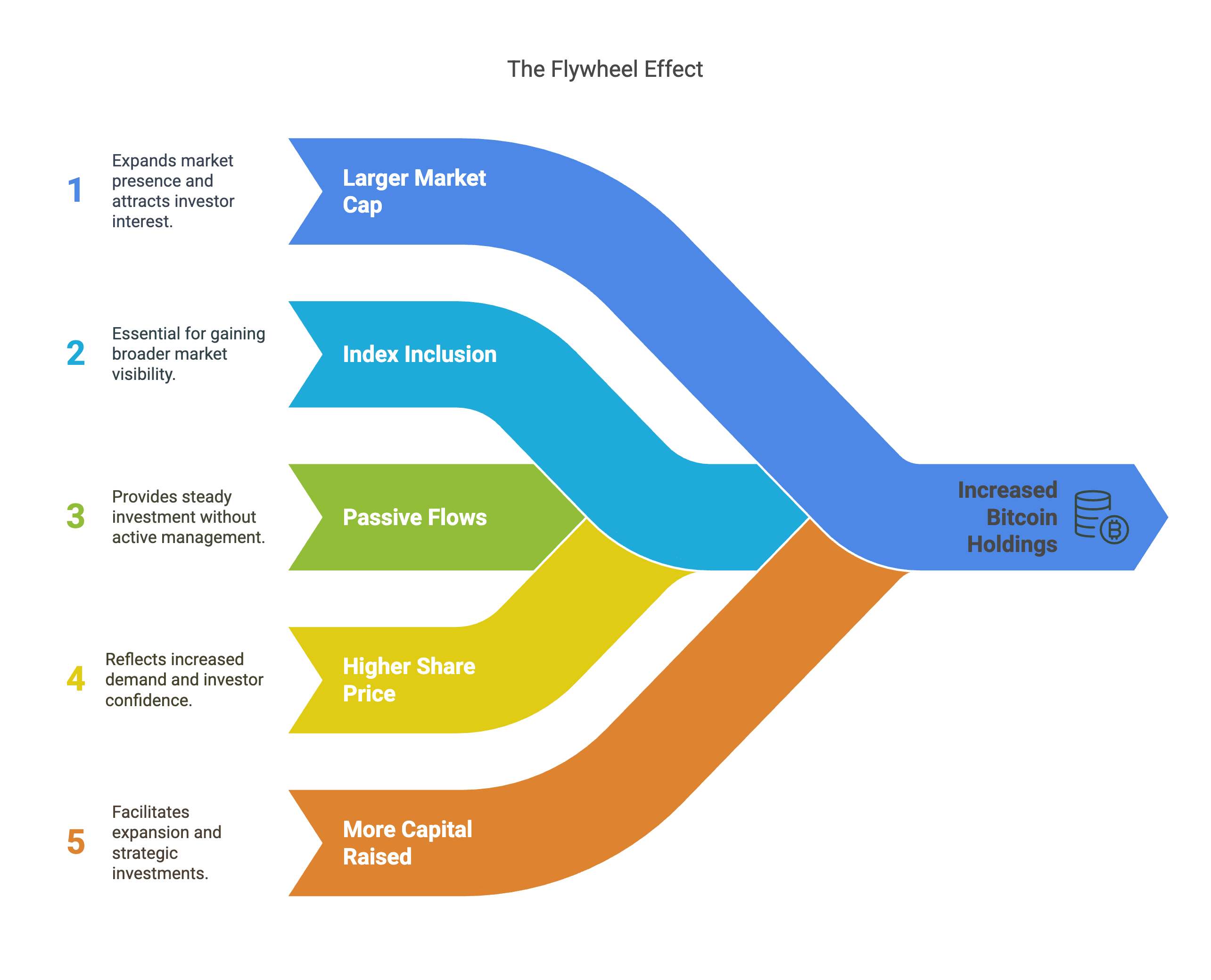

Index inclusion flywheel:

- Larger market cap → Greater index inclusion → More passive flows → Higher share price → More capital raised → More Bitcoin

These flywheels create network effects that can potentially accelerate over time rather than diminish.

3. Strategy’s approach to debt management

Sandstedt suggests that Strategy’s approach could lead to “permanent monetary losses” if convertible bonds mature below conversion price. However, Strategy maintains a conservative leverage ratio of approximately 25%, similar to a homeowner financing only a quarter of their home’s value.

As of 23 April 2025, Strategy has USD 9.26 bln in convertible debt with an average interest rate of just 0.421%, resulting in annual interest expenses of only USD 34.6 mln. This relatively low debt burden gives the company significant breathing room even in adverse market conditions.

Additionally, Strategy has demonstrated sophisticated debt management by refinancing higher-interest debt with more favorable terms, as seen when they retired their 6.125% senior secured notes in favor of lower-rate convertible offerings.

Where Sandstedt may be right

Despite the counterpoints above, several of Sandstedt’s concerns deserve serious consideration:

1. Dependency on market sentiment

Strategy’s model does indeed rely heavily on market sentiment remaining positive toward both Bitcoin and Strategy itself. If investor confidence falters, the premium at which Strategy trades relative to its Bitcoin holdings could collapse, undermining the financial engineering that powers its acquisition strategy.

Currently, Strategy trades at a premium of 2.069x to its Bitcoin net asset value. Should this premium disappear, Strategy would lose its ability to issue shares accretively, potentially halting its Bitcoin acquisition program.

2. Bitcoin price volatility risks

Sandstedt’s point about Strategy facing difficulties in a prolonged Bitcoin bear market is valid. During the 2022-2023 crypto winter, Strategy’s ability to raise capital was severely constrained, limiting its Bitcoin purchases precisely when prices were most attractive. That is probably why Michael Saylor always says:

While the company has structured its debt to avoid margin calls, the coincidence of multiple convertible notes maturing during a prolonged Bitcoin bear market could create significant financial stress.

3. The sustainability question

Perhaps most importantly, Sandstedt questions whether Strategy’s approach is truly sustainable in the long term or merely a temporary phenomenon that will eventually unravel:

“So any ‘infinite money glitch’, could just as well transform into permanent monetary losses should the company have to liquidate parts of its Bitcoin holdings or raise funds in a depressed market environment as the convertible bonds finally mature below conversion price.”

This concern sounds plausible on the surface but doesn’t hold up under numerical scrutiny. For Strategy to face genuine financial distress:

1 - Bitcoin’s price would need to fall substantially below Strategy’s average purchase price of USD 67,766 and stay there until bond maturities.

2 - The market would need to completely lose faith in Bitcoin’s future, preventing Strategy from refinancing its debt.

3 - All convertible bonds would need to fail to convert, requiring full principal repayment.

Given that Strategy’s earliest significant convertible bond maturities are years away (2027-2032) and are staggered, even a multi-year bear market would likely see only a portion of these bonds requiring repayment at any one time.

With a debt-to-Bitcoin NAV ratio of just , Bitcoin would need to drop by approximately 80-85% from current levels and remain there for years to create genuine financial distress. Even then, Strategy would still have options to refinance or restructure its debt without being forced to liquidate Bitcoin holdings.

The middle ground: A powerful but imperfect model

A balanced assessment suggests that Strategy’s financial model is neither an “infinite money glitch” nor a doomed Ponzi scheme. Rather, it’s a sophisticated capital markets strategy with both significant strengths and meaningful risks:

Strengths:

- Leverages capital markets efficiently to acquire Bitcoin

- Creates multiple self-reinforcing feedback loops

- Maintains reasonable debt levels with favorable terms

- Increases Bitcoin per share for long-term holders (currently 0.00178004 BTC BTC per diluted share)

- Generates substantial Bitcoin yield (currently +10.97% year-to-date)

Risks:

- Dependent on maintaining market premium to NAV

- Vulnerable during prolonged Bitcoin bear markets

- Convertible debt could become problematic if conversion prices aren’t met

- Success partially dependent on continued positive Bitcoin price performance long term

- Increasing competition from Bitcoin ETFs and other investment vehicles

Conclusion: Not a glitch, but a strategic bet

The “infinite money glitch” narrative oversimplifies Strategy’s financial engineering, ignoring both its limitations and the very real risks involved. Sandstedt’s critique offers a necessary counterbalance to uncritical enthusiasm, highlighting potential points of failure in the company’s approach.

However, his analysis may underestimate the power of the self-reinforcing cycles Strategy has created and the company’s prudent approach to debt management. The truth likely lies somewhere in between: Strategy has developed an innovative capital markets strategy that works extraordinarily well under certain conditions but is not immune to market forces.

For investors, the key insight is that Strategy’s model is not a financial perpetual motion machine but rather a leveraged bet on Bitcoin’s long-term appreciation and continued market confidence in the company’s approach. This bet may continue to pay off handsomely if Bitcoin adoption grows and market sentiment remains positive, but it also carries some downside risks that shouldn’t be dismissed.

As Michael Saylor himself has acknowledged, “volatility is vitality” for Strategy. The company’s success depends not on eliminating this volatility but on managing it effectively through market cycles. Whether this approach proves sustainable over decades remains an open question that only time will answer.