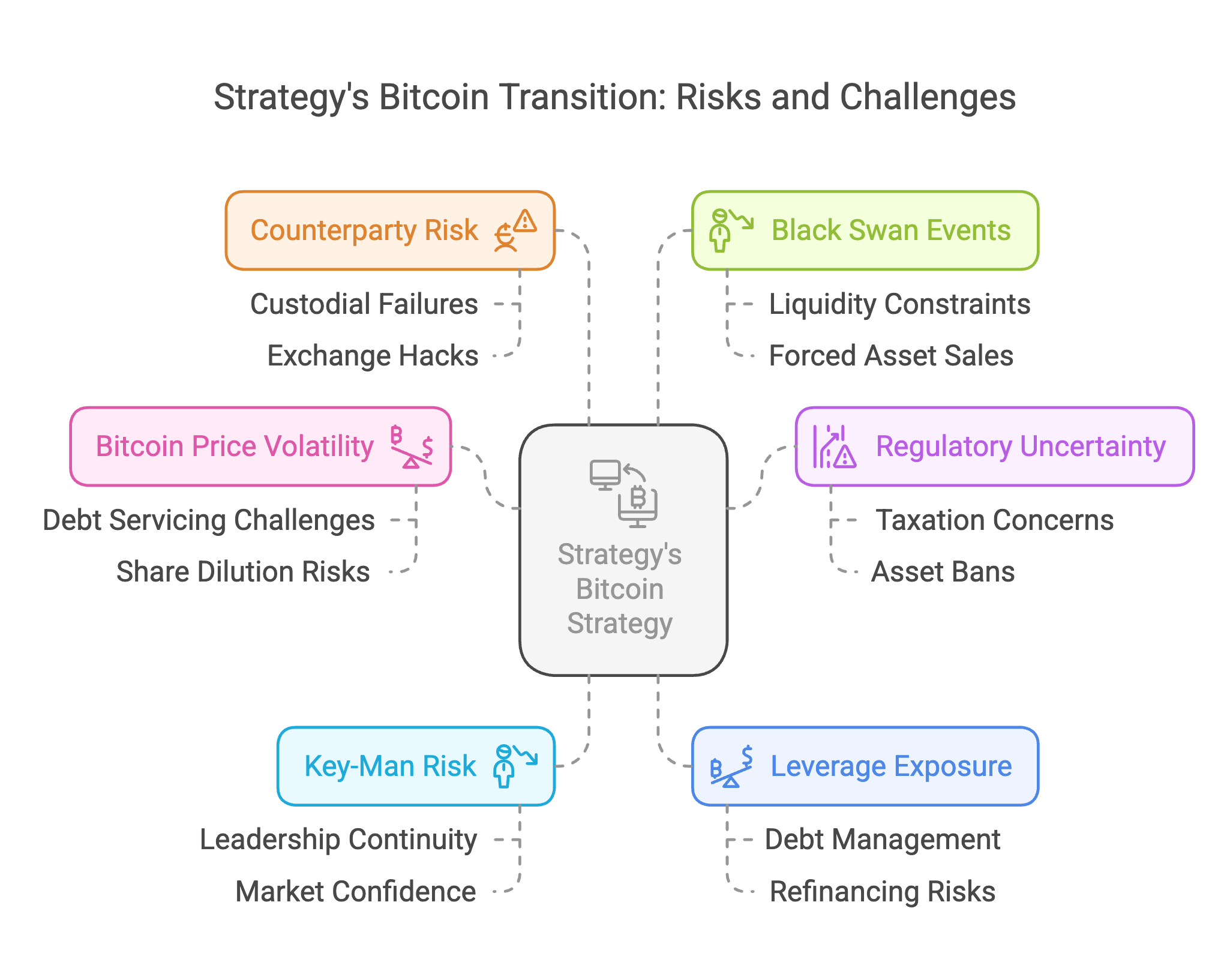

Risks and challenges for Strategy’s Bitcoin strategy

Strategy (formerly known as MicroStrategy) has redefined its corporate identity by transitioning from a business intelligence software company into a Bitcoin treasury company. While this transformation has created substantial shareholder value, it also exposes the company to several critical risks. Investors should consider these challenges carefully when evaluating Strategy as an investment.

Bitcoin price volatility

One of the most significant risks Strategy faces is the inherent volatility of Bitcoin. The company has built its financial model on the assumption that Bitcoin will continue to appreciate in value over time. However, a prolonged bear market could put immense pressure on its ability to service debt and fund further Bitcoin acquisitions without resorting to share dilution. Although Strategy has strategically structured its debt to avoid margin calls, maintaining financial stability amid sharp Bitcoin price declines remains a key challenge.

Regulatory uncertainty

Regulatory intervention is an ever-present risk for companies heavily involved in Bitcoin. Governments worldwide are still formulating policies for digital assets, and sudden regulatory shifts could impact Strategy’s business model. The historical precedent of Executive Order 6102, which once banned private gold ownership in the U.S., raises concerns that similar actions could be taken against Bitcoin. Should governments introduce restrictive measures, such as heavy taxation, outright bans, or forced divestment, Strategy’s ability to execute its Bitcoin strategy could be severely compromised.

Key-man risk

Michael Saylor has been the driving force behind Strategy’s shift to a Bitcoin-centric model. His leadership, vision, and relentless advocacy for Bitcoin have been instrumental in shaping investor confidence. However, should Saylor step down or become unable to lead the company, there is a risk that his successor may lack the same conviction and strategic foresight. While Strategy has built a team aligned with its long-term Bitcoin strategy, Saylor’s departure would likely introduce uncertainty in the market.

Leverage exposure

Strategy’s aggressive accumulation of Bitcoin has been fueled by debt issuance, including convertible bonds and at-the-market (ATM) equity offerings. While these financial maneuvers have been accretive to shareholders thus far, effective debt management remains crucial. The company has sought to maintain a leverage ratio around 25% to mitigate risks, but an unforeseen liquidity crisis or a sharp Bitcoin downturn could challenge its ability to refinance debt on favorable terms. The long-term sustainability of this leverage-driven strategy will be tested in varying market conditions.

Counterparty risk

While Strategy self-custodies its Bitcoin holdings, security risks remain. The potential for custodial failures, exchange hacks, or government-imposed seizures of assets could impact the company’s Bitcoin reserves. Any loss of Bitcoin due to security breaches or legal actions could undermine its financial stability and market confidence.

Black swan events

Unpredictable macroeconomic or geopolitical events—such as financial crises, wars, or systemic failures in the crypto industry—could disrupt Strategy’s operations. While Bitcoin is often seen as a hedge against traditional financial instability, extreme scenarios could lead to unexpected liquidity constraints or forced asset sales.

Conclusion

Despite these risks, Strategy’s Bitcoin strategy continues to attract investor interest as an alternative to direct Bitcoin ownership. The company’s ability to manage volatility, navigate regulatory landscapes, and maintain financial flexibility will be critical in determining its long-term success. As Bitcoin adoption increases and institutional interest grows, Strategy’s approach could either serve as a pioneering success story or a cautionary tale of excessive leverage and regulatory miscalculations. Investors should weigh these factors carefully when considering exposure to Strategy’s stock.