Understanding the claim on Strategy’s Bitcoin holdings

As Strategy (formerly known as MicroStrategy) has accumulated 538.200 Bitcoin valued at USD 50.156 bln, a critical question emerges for both equity and debt investors: who exactly has a claim on these Bitcoin holdings, particularly in adverse scenarios? This question becomes especially important when examining Strategy’s convertible bonds and other fixed income instruments that have fueled the company’s rapid Bitcoin accumulation.

Fixed income instruments with no direct Bitcoin claims

A fundamental misunderstanding about Strategy’s debt structure is that bondholders have a direct claim on the company’s Bitcoin holdings. This is not the case.

None of Strategy’s convertible bonds have any direct claim on the Bitcoin itself. That is not a collateralization option. The company is pricing these bonds based on the volatility of the underlying stock rather than providing direct claims on the Bitcoin holdings themselves.

This insight reveals that Strategy’s convertible bonds are not secured by the company’s Bitcoin holdings in any direct legal sense. Instead, convertible bondholders are extending credit based on Strategy as a corporate entity, with the convertible feature allowing them to participate in the company’s equity upside if the stock performs well.

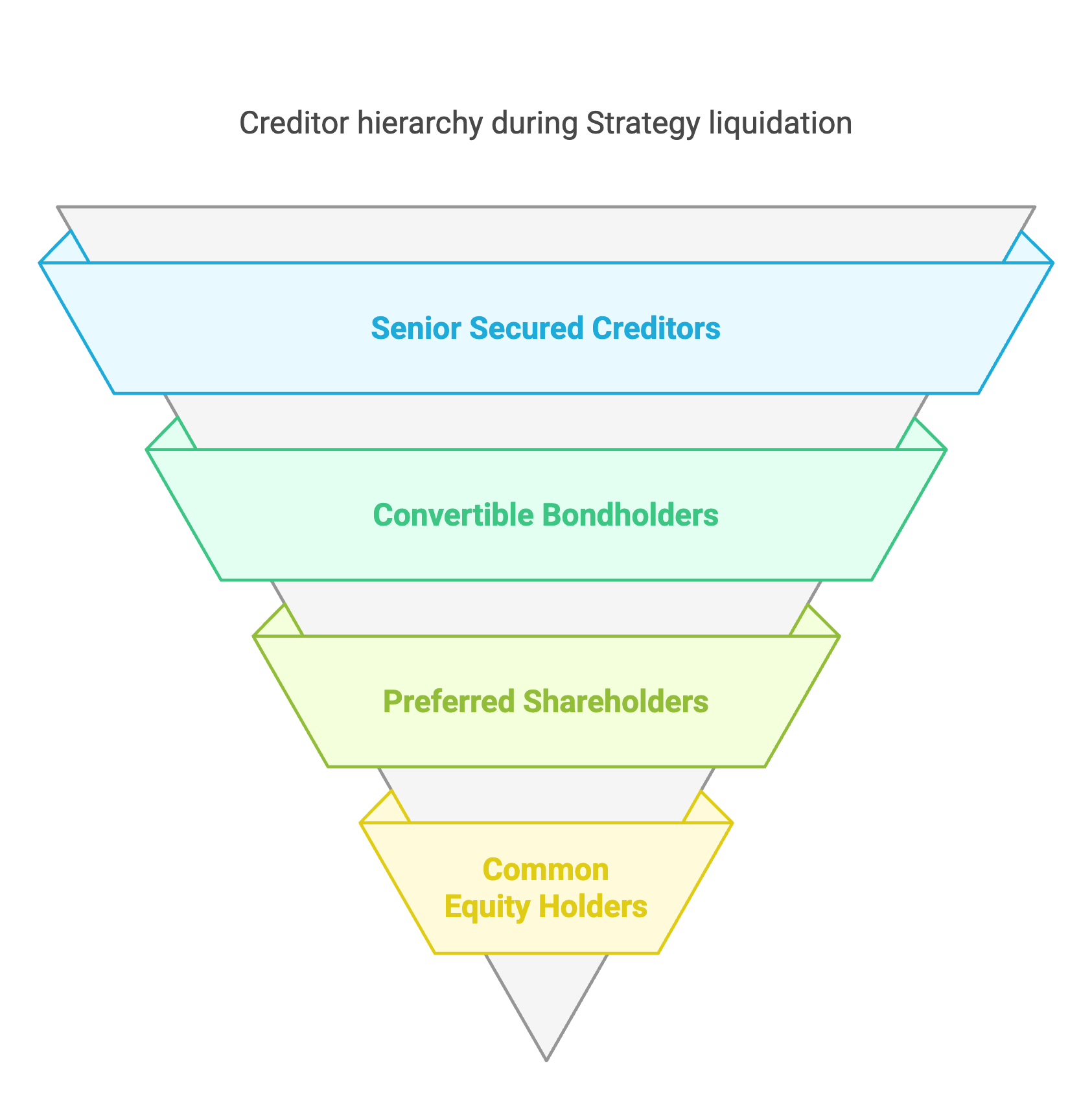

The creditor hierarchy in a liquidation scenario

In a hypothetical liquidation scenario, understanding the claim hierarchy becomes essential:

-

Senior secured creditors: Although Strategy has recently retired its $500 million senior secured notes that matured in June 2028, any future secured debt would have first priority claims.

-

Convertible bondholders: As unsecured senior obligations, Strategy’s approximately USD 9.26 bln in convertible notes would have claims on the company’s assets, including its Bitcoin.

-

Preferred shareholders: Holders of Strategy’s preferred stock (STRK) would be next in line.

-

Common equity holders: Regular shareholders would be last in line for any recovery.

The absence of direct collateralization matters significantly because it means that while creditors would have claims against Strategy in a bankruptcy or liquidation, they would not have specific rights to particular Bitcoin. The Bitcoin would be treated as a corporate asset to be liquidated to satisfy all creditor claims according to their priority.

The Bitcoin as backstop without direct claims

While Strategy’s bonds don’t have direct claims on the Bitcoin, the growing Bitcoin holdings do provide an important credibility factor to the company’s credit profile. As the Bitcoin holdings become larger and more substantial, they provide some level of credit clarity to the convertible bond traders.

The traders understand that while they might not have a direct claim on the Bitcoin, they do have a claim on Strategy as a corporate entity. In a worst-case scenario, the Bitcoin holdings could be liquidated to satisfy creditor claims.

This distinction is crucial for understanding the risk profile of Strategy’s debt. The Bitcoin holdings serve as an indirect form of collateral or backstop for the entire corporate entity rather than as direct security for specific debt instruments.

Liquidation scenarios and risks

The most concerning liquidation scenario would involve a significant and sustained drop in Bitcoin’s price, potentially coupled with an inability to refinance maturing debt. While Strategy has been careful with its debt structure, several risk factors remain.

The severe drawdown scenario

Serious problems would only emerge in an extreme scenario where Strategy can’t pay its obligations anymore—either the coupons or the debt principal. This would typically happen if Bitcoin experienced a violent reversal and the crypto market was in a dire situation.

Financial analysis suggests that Strategy would face significant challenges if Bitcoin experienced an 80% or greater drop from current levels, especially if this decline persisted for an extended period. At current Bitcoin prices of approximately USD 93,192.00, an 80% drop would put Bitcoin around $19,367, well below Strategy’s average acquisition cost of USD 67,766 per Bitcoin.

Debt maturity wall risk

Strategy’s convertible debt maturities are staggered between 2027 and 2032, which helps mitigate the risk of facing a “debt wall” where too many obligations come due simultaneously. The company’s current annual interest expense is only USD 34.6 mln on its USD 9.26 bln of convertible debt, representing an incredibly low average interest rate of 0.421%.

However, if Bitcoin’s price remains depressed for an extended period coinciding with these debt maturities, Strategy could face significant debt repayment obligations without the benefit of debt-to-equity conversion. This scenario would likely force Strategy to either:

- Issue new equity at potentially unfavorable prices, leading to substantial dilution

- Attempt to refinance debt in challenging market conditions

- Liquidate some Bitcoin holdings at depressed prices

Minimal margin call risk

An important distinction between Strategy’s debt and traditional leveraged Bitcoin positions is the absence of maintenance margin requirements that could trigger forced selling during price declines.

Strategy’s debt is not structured like a traditional margin loan, where assets risk liquidation if the collateral value drops below a certain threshold. Instead, Strategy uses fixed-rate, low or zero-interest, long-term, unsecured convertible debt, giving it ample time and flexibility to manage its obligations and navigate inevitable market fluctuations.

This structure eliminates the risk of forced liquidations during temporary market downturns, providing Strategy with time to weather volatility. The company’s current debt-to-Bitcoin NAV ratio stands at , which is relatively conservative compared to many leveraged investment approaches.

Trading below NAV during market stress

During extreme market stress, Strategy’s stock has historically traded below its Net Asset Value (NAV), meaning that the market valued the company at less than the value of its Bitcoin holdings. This occurred during the 2022-2023 crypto winter and could happen again in future downturns.

This trading below NAV creates a paradoxical situation where equity investors effectively get a “discount” on Bitcoin by purchasing Strategy shares. However, it also reflects market concerns about:

- Future capital access and the company’s ability to raise new capital

- Long-term debt viability in a scenario where Bitcoin remains depressed

- Strategy execution risks during stressed market conditions

The discount to NAV isn’t a protective feature but rather a manifestation of increased risk perception by the market during periods of stress.

Potential for share dilution in extreme scenarios

In an extreme scenario where Bitcoin drops dramatically for a prolonged period and Strategy is forced to repay convertible bonds because they haven’t hit their conversion price, the company would likely need to issue significant new equity to raise cash for debt repayment.

In an extreme scenario where Bitcoin drops dramatically for a prolonged period and Strategy is forced to repay a convertible bond because it hasn’t hit its conversion price, the debt would be equitized. While dilutive to existing shareholders, this outcome avoids default and liquidation of Bitcoin holdings.

This equitization of debt—essentially converting debt to equity through new share issuance—would be highly dilutive to existing shareholders but would avoid the need to sell Bitcoin at depressed prices and would prevent default.

Convertible bondholders’ perspective on claims

From the perspective of convertible bondholders, Strategy’s Bitcoin holdings provide comfort regarding the company’s ability to meet its obligations, even though there’s no direct claim on those assets.

The pricing of Strategy’s convertible bonds reflects this understanding. With 0% coupon rates on recent issuances, investors are clearly accepting these terms based on:

- The high implied volatility of Strategy’s stock

- The embedded call option value due to potential Bitcoin price appreciation

- The company’s growing Bitcoin treasury providing credit comfort

The software business as interest coverage

Strategy’s legacy software business does provide some cashflow to service debt obligations. Financial analysis indicates that the revenues from the software business were just about covering all of the interest rate expenses at recent assessment.

With Strategy’s recent focus on zero-coupon bonds, this interest coverage becomes even less of a concern going forward. The company’s USD 34.6 mln in annual interest expenses is relatively small compared to the company’s total asset base and software business revenues.

The “soft call” feature as a debt relief mechanism

An important feature of Strategy’s convertible bonds that is often overlooked is the “soft call” provision. This gives Strategy the right to force conversion after a certain period of time if the stock price has reached a specific threshold above the conversion price.

There is a soft call feature in most of these bonds which means after a certain period of time, if the price of the stock is a certain amount above the strike price, Strategy can call all the bondholders and force them to either convert or have their bonds redeemed at par.

This feature provides Strategy with a mechanism to eliminate debt from its balance sheet once the stock has appreciated significantly, converting debt obligations into equity. Since the bonds would already be deep in-the-money at that point, bondholders would naturally choose to convert rather than have their bonds redeemed at par.

Conclusion: The reality of Bitcoin claims

The reality of claims on Strategy’s Bitcoin holdings is nuanced. No specific debt instruments have direct claims on Bitcoin as collateral. Instead, Strategy’s Bitcoin treasury serves as an indirect backstop for all company obligations, with claims prioritized according to standard creditor hierarchies in a liquidation scenario.

For equity investors, this means that while there is no direct risk of losing Bitcoin to bondholders in typical market conditions, a severe and prolonged Bitcoin decline could eventually force the company to either dilute shareholders substantially or liquidate some Bitcoin at unfavorable prices to meet debt obligations.

Strategy’s careful debt structure—featuring staggered maturities, low interest rates, and the absence of margin call mechanisms—provides significant protection against forced Bitcoin sales during temporary market downturns. However, the company’s leveraged approach to Bitcoin acquisition inherently amplifies both upside and downside exposure, making it crucial for investors to understand these dynamics when considering an investment in Strategy.

The most likely path to problems would involve a catastrophic decline in Bitcoin’s value (80% or more) that persists for years, combined with an inability to refinance maturing debt.