Monopolizing Digital Capital: Strategy’s Moat

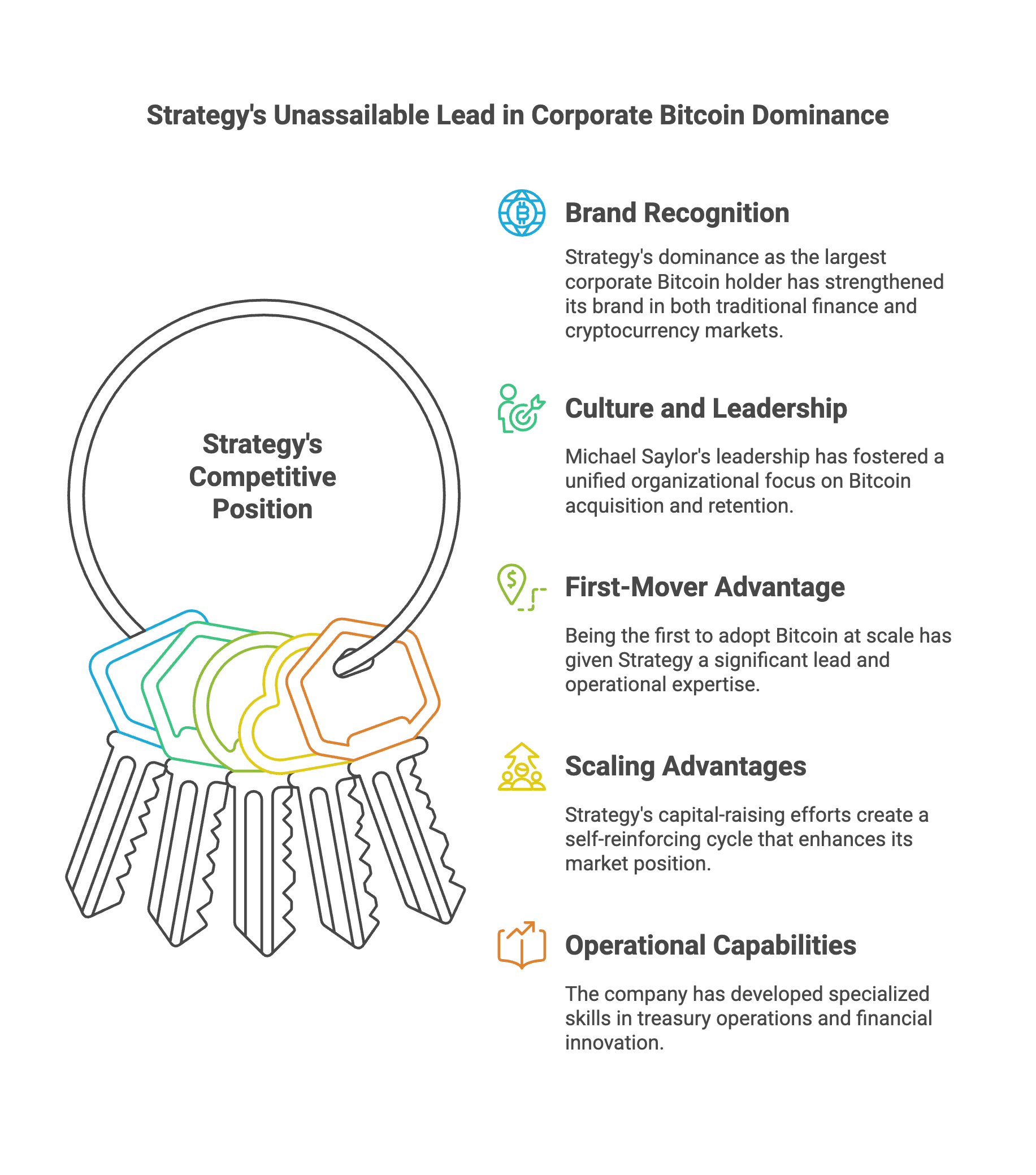

Strategy (formerly known as MicroStrategy) has established what appears to be an unassailable position in the digital capital markets through several key competitive advantages. The company’s unique combination of first-mover benefits, market positioning, and scaling advantages has created significant barriers to entry for potential competitors.

Core competitive advantages

Brand recognition

Strategy has established itself as the Bitcoin treasury company of the world, holding significantly more Bitcoin on its balance sheet than any other company. This dominant position has created strong brand recognition in both traditional finance and cryptocurrency markets. The company’s reputation for being the largest corporate holder of Bitcoin has become a self-reinforcing advantage, attracting both institutional investors and retail shareholders who want exposure to Bitcoin through a regulated entity.

Culture and leadership

Michael Saylor has created a laser-focused culture centered on a clear mission to buy Bitcoin, hold Bitcoin, and increase Bitcoin holdings to benefit shareholders. This singular focus has helped align the entire organization toward a common goal. Under Saylor’s leadership, the company has maintained unwavering conviction in its Bitcoin strategy, even during market downturns. This consistency has built trust with investors and strengthened the company’s position as the leading corporate Bitcoin holder.

First-mover advantage

As the first company to adopt Bitcoin as its primary treasury reserve asset at scale, Strategy gained several critical advantages:

- Established market leadership before others entered

- Built expertise in regulatory compliance and custody

- Developed relationships with capital markets

- Created operational processes for large-scale Bitcoin acquisition

These early moves have compounded over time, creating an increasingly wide moat between Strategy and potential competitors.

Monopolistic position

The barriers to challenging Strategy’s position are substantial and multifaceted. Very few companies have both the capital and financial leverage required to purchase comparable amounts of Bitcoin. Even among those that do, finding leadership with both the understanding and commitment to pursue an aggressive Bitcoin strategy is rare. Most companies also lack the ownership structure that would allow unilateral pursuit of a Bitcoin strategy without broader shareholder approval.

Perhaps most importantly, if another company attempted to match Strategy’s holdings, their demand would drive up Bitcoin’s price, increasing Strategy’s market cap and enhancing its ability to raise more capital. This creates a powerful defensive moat that becomes stronger as the company grows.

Scaling advantages

Strategy has built powerful scaling advantages that reinforce its market position through the capital markets flywheel. The company raises capital to buy more Bitcoin, which drives price appreciation and increases market cap, enabling further capital raising. This cycle creates a self-reinforcing growth engine that becomes more powerful over time.

The company’s growing presence in market indices creates another powerful feedback loop. As Strategy gets added to more indices, it attracts increased passive investment flows, driving share price higher and enabling more Bitcoin acquisition. This growth increases market cap and index weighting, attracting even more passive flows.

Operational capabilities

Strategy has developed specialized capabilities that provide durable competitive advantages through its treasury operations and financial innovation. The company’s key operational strengths include:

- Deep expertise in executing large Bitcoin purchases

- Strong relationships with counterparties and custody providers

- Sophisticated risk management and compliance frameworks

- Innovative financial product development

- Advanced treasury management capabilities

Market positioning barriers

The challenges facing potential competitors are significant. Smaller companies cannot scale a Bitcoin strategy effectively due to capital constraints, while larger companies have core businesses that prevent them from offering pure-play Bitcoin exposure. Bitcoin’s volatility deters most corporations due to the financial unpredictability and cash flow management challenges it creates.

Most companies also face operational constraints in Bitcoin operations, regulatory compliance, and corporate governance. These barriers create a protective moat around Strategy’s market position that grows stronger as the company expands its lead.

Conclusion

Strategy has established formidable competitive advantages through its first-mover position, scaling benefits, and operational capabilities. The company’s moat appears to be widening as network effects and market structure advantages compound over time. While competition may emerge, Strategy’s early lead and continuing innovation in digital capital markets make its position increasingly difficult to challenge.

The combination of brand recognition, culture, first-mover advantages, and scaling benefits has created what appears to be a sustainable competitive position. As digital capital markets continue to evolve, Strategy’s moat may provide lasting protection for its market leadership, allowing it to maintain its position as the dominant player in corporate Bitcoin adoption and digital capital markets.