Strategy’s unique bitcoin-centric corporate strategy

The core thesis behind strategy’s valuation

Strategy holds more Bitcoin than any other publicly traded company, with a total of 538.200 BTC as of 23 April 2025. This massive Bitcoin treasury makes it fundamentally different from traditional corporations, positioning it as a publicly traded Bitcoin acquisition vehicle rather than a conventional business with revenue-driven operations.

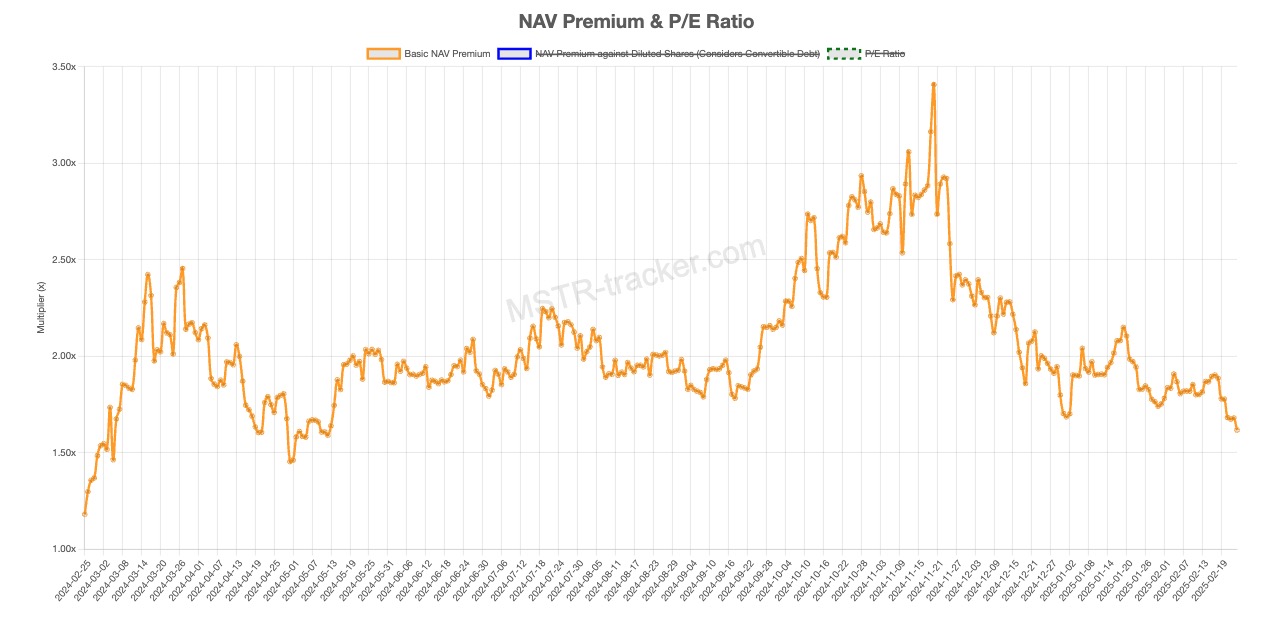

Despite its primary asset being Bitcoin, Strategy’s stock consistently trades at a significant premium relative to the market value of its Bitcoin holdings. Currently, its market capitalization stands at USD 92.25 bln, while the net asset value (NAV) of its Bitcoin holdings is USD 50.156 bln, reflecting a 1.840x premium to NAV. This means investors are willing to pay more for Strategy shares than the direct market value of the Bitcoin the company owns.

This phenomenon raises an essential question: why would investors prefer buying Strategy stock at a premium rather than purchasing Bitcoin directly or investing in a Bitcoin ETF?

The answer lies in two fundamental market expectations:

- Bitcoin’s Price Appreciation: Investors expect Bitcoin’s price to increase significantly over time, making Strategy’s stock more valuable as its Bitcoin holdings appreciate.

- Ongoing Bitcoin Accumulation: Strategy has demonstrated a consistent ability to acquire more BTC over time, increasing the Bitcoin per share ratio and enhancing long-term shareholder value.

Strategy as a leveraged bitcoin proxy

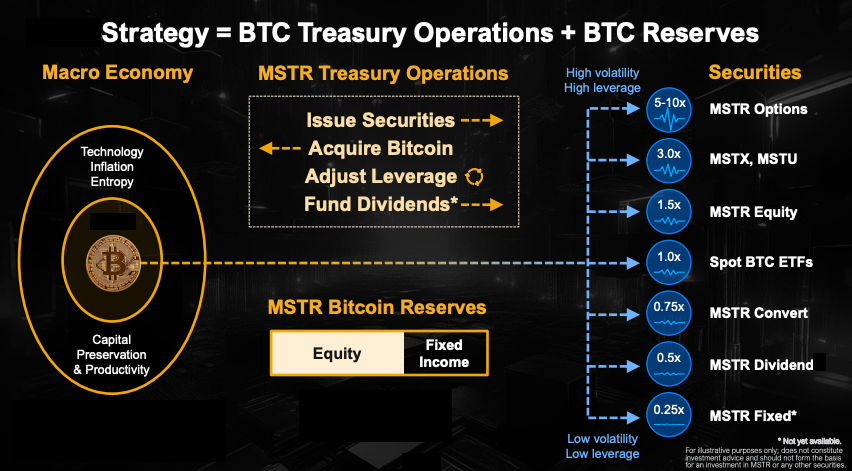

One of the primary reasons Strategy trades at a premium is that it provides leveraged exposure to Bitcoin’s price movements. Unlike direct Bitcoin ownership or investing in a Bitcoin ETF—which offer a 1:1 correlation with Bitcoin’s price—Strategy utilizes financial mechanisms to amplify its Bitcoin exposure beyond what it could achieve through traditional revenue generation alone.

This financial leverage comes from two primary mechanisms:

-

Equity issuance at a premium

- Strategy sells new shares at a premium to its Bitcoin NAV, raising additional capital to buy more Bitcoin.

- This means for every dollar raised, Strategy can acquire more Bitcoin per share than it otherwise could.

- As long as the stock trades at a premium to NAV, issuing shares remains accretive to existing shareholders, increasing the company’s BTC per share ratio.

-

Convertible bond issuance at near-zero interest rates

- Strategy has effectively leveraged its balance sheet by issuing USD 9.26 bln in convertible bonds with an ultra-low interest rate of 0.421%.

- These bonds allow the company to raise capital without immediate repayment obligations, using the proceeds to buy more Bitcoin.

- If Strategy’s stock price surpasses the bond’s conversion price, the debt is converted into shares, eliminating repayment obligations and increasing the number of Bitcoin-backed shares.

By utilizing these strategies, Strategy’s stock price tends to outperform Bitcoin in bull markets, making it a preferred vehicle for investors seeking amplified returns on Bitcoin’s appreciation.

The market’s expectation of continued bitcoin accumulation

Another key factor in Strategy’s valuation premium is the expectation that it will continue acquiring Bitcoin over time. Unlike Bitcoin ETFs or direct holders who rely solely on their initial capital, Strategy has a dynamic approach that allows for continuous Bitcoin accumulation.

- The company has a Bitcoin ownership percentage of 2.56% of total BTC market capitalization, reinforcing its position as the largest corporate BTC holder.

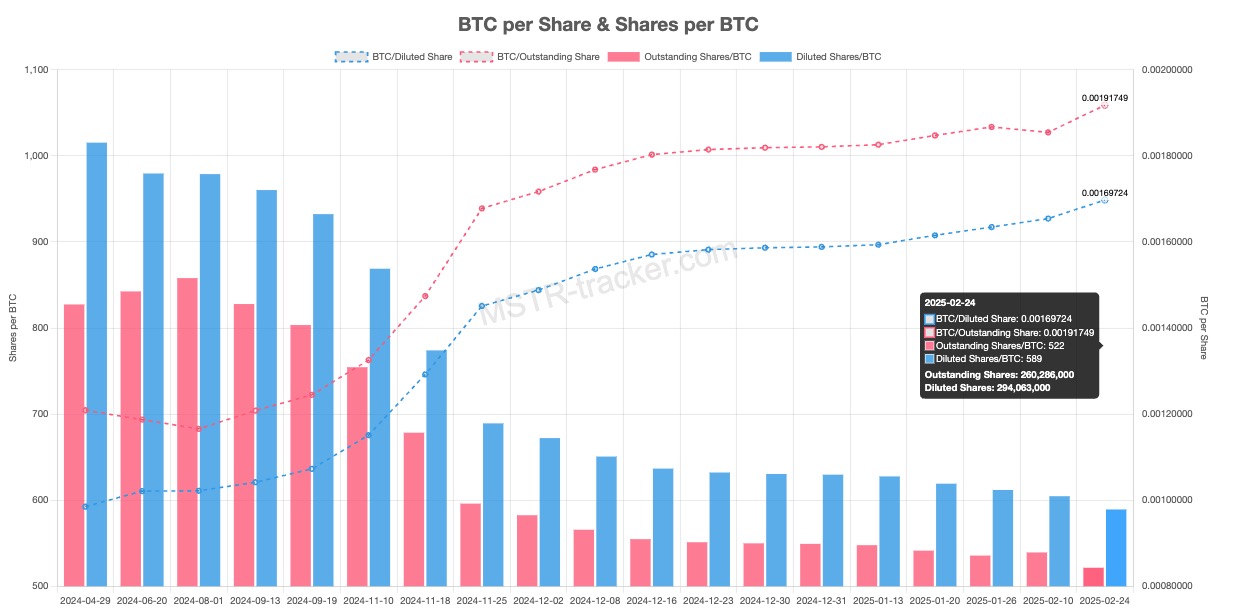

- It has consistently increased its Bitcoin per share ratio, with each basic share currently representing 0.00200135 BTC BTC and each diluted share holding 0.00178004 BTC BTC.

- Strategy has a Bitcoin yield year-to-date (YTD) of +10.97%, reflecting its ability to generate incremental Bitcoin returns through its treasury strategy.

Investors recognize that Strategy is not a static Bitcoin holder, but an active player that leverages corporate finance tools to continuously increase its BTC holdings. This makes its stock more attractive than passive investment vehicles like Bitcoin ETFs, which do not grow their Bitcoin reserves over time.

Image from mstr-tracker.comStrategy’s influence on bitcoin’s market dynamics

Unlike Bitcoin ETFs or institutional funds, Strategy does more than simply hold Bitcoin—it actively drives demand and influences market sentiment. Every large-scale Bitcoin acquisition by Strategy creates:

- Upward price pressure on Bitcoin, benefiting all BTC holders.

- A self-reinforcing market effect, where the anticipation of future purchases pushes Bitcoin’s price higher, further benefiting Strategy.

- Increased institutional interest, as traditional investors see Strategy as a regulated, publicly traded Bitcoin gateway.

Additionally, Strategy’s historical volatility plays a role in investor expectations. Its historic volatility is significantly higher than many large-cap stocks, reflecting its strong correlation with Bitcoin price movements.

Volatility is vitality for Strategy. Volatility is a feature not a bug.

Why do investors buy Strategy stock?

Strategy’s stock does not simply represent Bitcoin ownership—it is a financially engineered vehicle for leveraged Bitcoin exposure, accessible through public markets. The premium it commands is justified by:

-

Access to Institutional Capital

- Many institutional investors face regulatory barriers to directly holding Bitcoin.

- Strategy provides an SEC-regulated way to gain Bitcoin exposure without managing private keys or dealing with custodial risks.

-

Bitcoin Yield and Long-Term Growth

- Unlike ETFs, Strategy’s financial model enables it to increase Bitcoin per share over time.

- The company has generated a return of +37.52% on its Bitcoin holdings, proving the effectiveness of its strategy.

-

Tax and Portfolio Considerations

- Holding Strategy stock can be more tax-efficient than direct Bitcoin ownership for certain investors.

- It can be structured within institutional portfolios, retirement accounts, and hedge funds.

How does Strategy compare to Bitcoin Spot ETFs

Price premiums and discounts: A key difference

Unlike Bitcoin ETFs such as BlackRock’s iShares Bitcoin Trust (IBIT), Strategy’s shares can trade at a significant premium or discount relative to the underlying value of its Bitcoin holdings. This is a crucial distinction that creates both opportunities and challenges for investors considering Strategy as a Bitcoin investment vehicle.

How Bitcoin ETFs maintain price parity

The market cap of a Bitcoin spot ETF like IBIT will always remain approximately equal to the current market value of the Bitcoin it holds. This tight correlation exists because if the ETF were to trade at a premium, sophisticated market participants known as authorized participants (APs) would step in to execute a risk-free arbitrage strategy:

- APs could short the ETF while simultaneously buying an equal amount of Bitcoin at market price.

- As the price gap closes, they profit from the convergence of the ETF price to its net asset value (NAV).

- This process ensures that ETFs trade very close to their Bitcoin NAV at all times.

While individual retail investors cannot typically execute this arbitrage, large institutional players, who serve as authorized participants, have the ability to do so, ensuring that ETF prices remain tightly aligned with the underlying Bitcoin value.

Why Strategy’s stock does not follow ETF pricing mechanisms

Strategy operates under completely different market dynamics. Unlike ETFs, which allow redemptions in Bitcoin, owning shares in Strategy does not grant shareholders the right to redeem Bitcoin. There is no mechanism for investors to exchange Strategy shares for an equivalent amount of Bitcoin, meaning:

- Strategy’s stock price is not forced to track its Bitcoin holdings.

- Instead, it is influenced by investor sentiment, market speculation, and expectations of future Bitcoin accumulation.

- This allows Strategy to trade at a premium or discount depending on market conditions.

The mNAV (multiple of net asset value) effect

Strategy’s stock often trades at a multiple of its Bitcoin NAV, known as mNAV. This ratio fluctuates significantly over time:

- In 2022 and 2023, Strategy’s stock sometimes traded below its Bitcoin NAV (mNAV < 1.0x), meaning investors could effectively buy Bitcoin at a discount through Strategy shares.

- As Bitcoin entered a strong bull market in 2024, the mNAV multiplier surged, at times exceeding 3x the underlying Bitcoin value.

This dynamic means that Strategy’s valuation is not solely determined by its Bitcoin holdings, but also by market perception of its ability to accumulate more Bitcoin and amplify exposure through financial strategies.

Image from mstr-tracker.com

Image from mstr-tracker.com

Investment implications: higher potential returns with unique risks

Unlike Bitcoin ETFs, which offer stable price tracking, Strategy’s stock price can fluctuate independently of Bitcoin’s market value, making it a higher-risk, higher-reward investment. The potential for strong outperformance in bull markets is one reason investors are willing to pay a premium, but the risk of trading below NAV in bear markets is a factor to consider.

This variable premium creates both opportunities and risks that do not exist with Bitcoin ETFs, making Strategy a fundamentally different investment vehicle with potentially higher returns but also distinct risk characteristics compared to direct Bitcoin exposure.

How Strategy acquires Bitcoin

Strategy employs three primary methods to secure the capital needed for its Bitcoin acquisition strategy, each with unique characteristics and implications for the company’s financial structure:

Earnings from the legacy software business

Strategy maintains a business intelligence software division that predates its Bitcoin strategy. While this business does generate some operating cash flow, it represents only a small fraction of the capital used for Bitcoin purchases. The operating cash flow from the legacy business is relatively low in comparison to the billions used to buy Bitcoin through other financing methods. This underscores how Strategy has pivoted from primarily being a software company to becoming the world’s largest corporate holder of Bitcoin.

Debt issuance (corporate bonds)

A significant portion of Strategy’s Bitcoin acquisitions has been funded through corporate debt, particularly through convertible bonds. What makes Strategy’s approach remarkable is that they’ve managed to issue bonds with extraordinarily favorable terms, often carrying zero-percent interest rates. This means the company can borrow substantial amounts of capital without taking on the burden of regular interest payments.

These zero-coupon convertible bonds allow Strategy to deploy the borrowed capital directly into Bitcoin purchases without the ongoing cash flow drain that would typically come with traditional corporate debt. This approach gives the company breathing room to hold Bitcoin for the long term without being forced to liquidate holdings to service debt obligations.

Issuing new shares (equity financing)

Perhaps the most innovative aspect of Strategy’s capital-raising approach is its strategic use of equity financing. The company regularly issues new shares of stock through what are called At-The-Market (ATM) offerings, selling shares directly into the market at prevailing prices. These equity issuances have dramatically increased the total number of shares outstanding since 2020.

What’s particularly noteworthy about Strategy’s equity financing is that, unlike most companies that dilute shareholder value when issuing new shares, Strategy has managed to make this process accretive to shareholders. They accomplish this by selling shares at a premium to their Bitcoin net asset value (NAV) and using the proceeds to acquire more Bitcoin, effectively increasing the amount of Bitcoin backing each share despite the increased share count.

This counterintuitive approach has been possible because Strategy shares typically trade at a significant premium to their underlying Bitcoin holdings. When the company can issue new shares at, for example, 3x the value of its Bitcoin holdings and then use those funds to purchase more Bitcoin, the result is that each share ends up representing more Bitcoin than before the new issuance.

The company also uses the premium at which their stock trades to their advantage. By timing equity issuances during periods when their stock trades at high premiums to their Bitcoin holdings, they maximize the effectiveness of each capital raise, acquiring more Bitcoin per share of stock issued.

This three-pronged approach to capital acquisition has allowed Strategy to rapidly accumulate what has become the world’s largest corporate Bitcoin treasury, demonstrating a financial engineering strategy that leverages conventional capital markets to gain exposure to the emerging digital asset economy.

The strategic use of equity dilution

A contrarian approach to equity financing

Strategy’s approach to equity financing is radically different from the strategies employed by most major corporations. Companies like Apple and Nvidia typically buy back their own shares to reduce the number of shares outstanding, which increases earnings per share (EPS) and returns capital to shareholders. Strategy, however, has taken the opposite approach, aggressively increasing its shares outstanding since adopting its Bitcoin strategy in 2020.

Since the shift to this strategy, Strategy’s share count has grown from approximately 100 million in early 2020 to well over 200 million shares today. Conventional financial wisdom suggests that such a large increase in shares outstanding would severely dilute shareholder value—typically, doubling the number of shares in circulation cuts each investor’s ownership stake in half and reduces their claim on earnings and assets.

Yet, despite this dramatic dilution, Strategy’s stock price has massively outperformed even some of the most dominant tech stocks, including Apple and Nvidia, during much of 2024. This apparent contradiction can be explained by the accretive nature of Strategy’s share issuances.

How equity issuance increases Bitcoin per share

The key to understanding Strategy’s success with equity financing lies in its stock’s trading premium. Strategy trades at a multiple of its Bitcoin holdings, a concept referred to as mNAV (multiple of net asset value).

- This premium allows Strategy to issue new shares at a price significantly higher than the Bitcoin each share represents.

- The proceeds from these share issuances are then used to buy additional Bitcoin at market prices.

- As a result, the company effectively increases the amount of Bitcoin per share, despite increasing the share count.

For example:

- If Strategy’s stock trades at 3x the value of its Bitcoin holdings, it can issue new shares at this premium.

- Suppose it sells $300 worth of shares and uses the proceeds to buy $300 worth of Bitcoin.

- Before the issuance, each share may have represented only $100 worth of Bitcoin, meaning that after the transaction, each share is backed by more Bitcoin than before.

Instead of traditional dilution—where issuing more shares weakens shareholder value—this approach actually increases the Bitcoin exposure per share, creating accretive dilution that benefits existing investors.

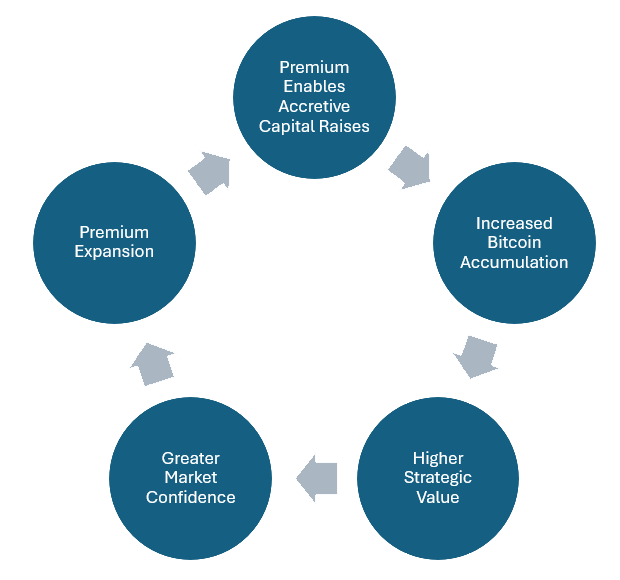

The positive feedback loop of financial engineering

This strategy creates a self-reinforcing cycle, the so called Flywheel Effect, a positive feedback loop that continuously strengthens Strategy’s financial position and stock price:

- Strategy issues new shares at a premium to its Bitcoin holdings.

- The company uses the proceeds to purchase additional Bitcoin.

- Each share represents more Bitcoin than before the issuance.

- The increased Bitcoin per share supports a higher stock price.

- A higher stock price leads to an even greater premium.

- A greater premium allows for more accretive share issuances.

This dynamic explains why Strategy’s stock has continued to rise despite massive dilution—the additional capital raised has consistently been used in a way that enhances, rather than reduces, shareholder value.

Why this model works—and its limits

As long as Strategy’s stock trades at a premium to its Bitcoin holdings, this model can theoretically continue indefinitely, allowing the company to continuously accumulate more Bitcoin through what would traditionally be considered dilutive financing.

However, there are potential risks and limitations:

- If Strategy’s stock ever trades at a discount to its Bitcoin NAV (mNAV < 1.0x), issuing new shares would no longer be accretive and could start eroding Bitcoin per share.

- If Bitcoin enters a prolonged bear market, investor sentiment could shift, potentially reducing Strategy’s trading premium and limiting its ability to use this strategy effectively.

Nonetheless, as long as investors continue valuing Strategy’s stock above the direct value of its Bitcoin holdings, the company can keep expanding its Bitcoin treasury without diminishing the BTC exposure per share, making this one of the most unique financial engineering strategies in corporate history.

Convertible bonds: A key lever in Strategy’s playbook

What are convertible bonds?

Convertible bonds represent a sophisticated financial instrument that blends characteristics of both debt and equity. They function as a hybrid security that starts its life as a corporate bond but comes with a special feature: the right to convert the bond into shares of the company’s stock under certain conditions.

These bonds operate with a defined conversion price—a predetermined stock price at which bondholders can exchange their bonds for company shares. This creates an important dynamic:

- If the company’s stock price rises above the conversion price, bondholders will likely convert their bonds into shares

- When conversion occurs, the debt obligation is completely eliminated from the company’s balance sheet

- If the stock price fails to reach the conversion threshold, the bonds remain as debt that must eventually be repaid

This hybrid nature makes convertible bonds particularly valuable for companies like Strategy that are pursuing aggressive growth strategies while managing their debt obligations.

Why Strategy issues convertible bonds

0% coupon debt

One of the most remarkable aspects of Strategy’s convertible bond offerings is that many carry a 0% coupon rate. This means the company pays no regular interest on these bonds—an extraordinary financing arrangement that would be impossible for most corporations.

For example, in November 2024, Strategy completed a $3 billion convertible notes offering with:

- 0% interest rate (no regular payments required)

- 55% premium to the reference stock price

- Implied conversion price of $672 when the reference price was approximately $433

This zero-interest financing allows Strategy to deploy 100% of the capital raised directly into Bitcoin purchases without the ongoing cash drain of interest payments. The company can essentially borrow billions of dollars for years with no regular payment obligations, a tremendous advantage for a company focused on long-term Bitcoin accumulation.

Image from (https://www.strategy.com/debt)

Image from (https://www.strategy.com/debt)

Conversion eliminates debt obligations

When Strategy’s stock price rises above the conversion price of these bonds, bondholders typically convert their debt into equity. This process magically erases the debt from Strategy’s balance sheet—they no longer have to repay the principal amount when the bonds mature.

This creates an elegant financial mechanism: if Bitcoin’s price appreciates significantly (driving up Strategy’s stock price), the debt used to purchase that Bitcoin disappears through conversion. The debt essentially self-liquidates precisely when the company’s Bitcoin strategy is most successful.

Catering to institutional investors

Strategy’s convertible bonds serve an important market function by providing a bridge between traditional financial markets and Bitcoin exposure. Many large institutional investors and funds are restricted by their mandates—they cannot directly purchase Bitcoin or even Bitcoin stocks, but they can buy convertible bonds.

For these institutional players who want Bitcoin exposure but are constrained by investment mandates, Strategy’s convertible bonds offer the only viable path. This creates significant demand from a large pool of capital that otherwise would have no way to participate in Bitcoin’s potential upside.

As one convertible bond manager put it: “You can’t buy BTC so instead you choose to buy Strategy convertible bonds.” This demand helps explain why Strategy has been able to issue billions in zero-coupon debt on such favorable terms.

The role of volatility in convertible bonds

Strategy’s ability to issue 0% coupon bonds is directly tied to Bitcoin’s inherent volatility. In options theory, volatility is one of the key components in determining option values—higher volatility translates to more expensive options.

A convertible bond can be deconstructed into two components:

- A fixed income instrument (typically a zero-coupon bond)

- An embedded out-of-the-money call option with a strike price equal to the conversion price

Bitcoin’s high volatility and subsequently Strategy’s share price, makes the embedded call option highly valuable. Strategy effectively sells this volatility through its convertible bonds, allowing it to offset what would normally be interest costs.

When Michael Saylor talks about “selling volatility,” this is precisely what he means. Strategy harnesses Bitcoin’s natural volatility by selling embedded call options within convertible bonds, then uses that capital to accumulate more Bitcoin. This creates a virtuous cycle where Bitcoin’s volatility finances its own accumulation.

Debt management and risk mitigation

Strategy has demonstrated sophisticated debt management by actively refinancing its earlier debt with more favorable terms. For example, they recently retired an older plain-vanilla bond that carried a 6% interest rate (approximately $30 million in annual interest expense) by issuing new convertible bonds with more favorable terms.

Their debt portfolio is now composed entirely of convertible senior notes with:

- Approximately USD 9.26 bln in principal value

- An extremely low average interest rate of just 0.421%

- Annual interest expense of only USD 34.6 mln

- Staggered maturities in 2027, 2028, 2030, 2031, and 2032

This careful structuring of debt maturities reduces the risk of a liquidity crisis by ensuring the company doesn’t face a “debt wall” where too many obligations come due simultaneously.

The convertible debt load of USD 9.26 bln is also quite reasonable for a company with a market capitalization of USD 92.25 bln, especially given the low interest rates. The primary risk would be if Bitcoin’s price remained severely depressed for an extended period, particularly as bond maturities approach. However, unlike highly leveraged margin positions, there’s no risk of being “blown out” by a margin call with this structure.

Strategy’s convertible bonds have performed exceptionally well for investors, with some issues up over 200% from their initial offering price. This strong performance creates demand for subsequent offerings, allowing the company to continue its Bitcoin acquisition strategy through this innovative financing mechanism.

The long-term vision: hyperbitcoinization

Bitcoin accumulation strategy

Strategy’s approach to Bitcoin goes far beyond merely holding the digital asset as a treasury reserve. The company has positioned itself as a pioneering force driving the global transition toward what many Bitcoin advocates call “hyperbitcoinization” – the hypothetical moment when Bitcoin becomes the world’s dominant form of money and store of value.

By accumulating 538.200 Bitcoin (approximately 2.56% of the total Bitcoin supply) and permanently removing it from circulation, Strategy is actively creating supply scarcity in the Bitcoin market. This reduction in available supply, coupled with increasing institutional demand, theoretically contributes to upward price pressure over time.

Strategy has made it clear they intend to hold Bitcoin indefinitely with no plans to sell, creating what is effectively a permanent removal of supply from the market. As Michael Saylor frequently states, they are “buying Bitcoin forever” with the conviction that Bitcoin represents the emergence of a new form of property – digital property – that will become increasingly valuable over time.

Becoming a Bitcoin bank

Beyond simple accumulation, Strategy is positioning itself to become what Saylor describes as “the largest Bitcoin bank” or “Bitcoin finance company.” This vision includes leveraging their substantial Bitcoin holdings to potentially offer financial services including:

- Custody solutions

- Lending services

- Bitcoin-backed financial products

- Treasury management services

- A suite of yield-generating offerings

This banking model could potentially generate significant cash flows based on the company’s Bitcoin holdings. As Strategy continues to accumulate Bitcoin and its price appreciates, the potential revenue from these banking activities could grow substantially over time.

Creating new financial instruments

The company is also pioneering a new category of financial instrument through its issuance of convertible bonds and, more recently, preferred equity shares (STRK) that offer a yield backed by Bitcoin. These innovations are creating new on-ramps for traditional capital to gain Bitcoin exposure through familiar investment vehicles.

Strategy is essentially building what Saylor calls a “Bitcoin treasury company” – an entity that creates financial products with different levels of volatility, performance, and risk to suit different types of investors. This approach is transforming Bitcoin from a purely speculative digital asset into a foundation for a sophisticated financial ecosystem.

Building a bridge to traditional finance

By “securitizing” Bitcoin and creating a variety of financial instruments backed by the digital asset, Strategy is building a bridge between Bitcoin and traditional finance. This creates pathways for capital that might be restricted (due to regulations) or reluctant (due to volatility concerns) to flow directly into Bitcoin.

The ultimate vision appears to be positioning Strategy as the premier financial institution of the emerging Bitcoin-based economy – the financial gateway through which traditional capital flows into the Bitcoin ecosystem. If Bitcoin continues its adoption trajectory toward becoming a global monetary asset, Strategy’s first-mover advantage in this space could prove extraordinarily valuable.

With its growing influence in the Bitcoin market, its sophisticated financial engineering, and its long-term vision, Strategy represents perhaps the most ambitious corporate bet on Bitcoin’s future as the foundation of a new financial system. The company is not merely investing in Bitcoin – it’s actively building the financial infrastructure that could accelerate Bitcoin’s path toward global monetary dominance.

Conclusion

Financial innovation creating a new corporate model

Strategy (formerly known as MicroStrategy) has established itself as a pioneering force in the Bitcoin ecosystem, creating an entirely new model for corporate Bitcoin adoption that extends far beyond simply holding the digital asset on its balance sheet. Through sophisticated financial engineering that leverages both equity markets and debt instruments, the company has created a self-reinforcing system that allows for continuous Bitcoin accumulation while providing shareholders with leveraged exposure to Bitcoin’s price movements.

Transforming dilution into accretion

The company’s approach — using its premium valuation to issue shares and zero-coupon convertible bonds to fund Bitcoin purchases — has transformed what would typically be dilutive financing into an accretive process that increases Bitcoin per share over time. This financial innovation has allowed Strategy to accumulate 538.200 Bitcoin, representing approximately 2.56% of the total Bitcoin supply.

Beyond Bitcoin ETFs: A dynamic investment vehicle

Unlike Bitcoin ETFs that simply track the price of Bitcoin, Strategy provides a more dynamic investment vehicle that can outperform Bitcoin during bull markets through its built-in leverage mechanisms. The company’s ability to trade at a premium to its underlying Bitcoin holdings (currently 1.840 times its Bitcoin NAV) reflects market expectations of both Bitcoin’s price appreciation and Strategy’s continued ability to execute its Bitcoin acquisition strategy.

The future: From Bitcoin treasury to Bitcoin bank

Looking ahead, Strategy appears positioned to evolve beyond a Bitcoin accumulation vehicle into a comprehensive Bitcoin financial services company—a “Bitcoin bank” that creates various financial products catering to different investor needs and risk profiles. By building bridges between traditional capital markets and the Bitcoin economy, Strategy is not merely participating in Bitcoin’s growth story but actively shaping the financial infrastructure that could accelerate Bitcoin’s global adoption.

A unique value proposition for investors

For investors, Strategy represents a unique proposition — not just exposure to Bitcoin’s price movements, but participation in a sophisticated financial engineering strategy designed to maximize Bitcoin accumulation and shareholder value over the long term. As Bitcoin continues its evolution toward mainstream financial adoption, Strategy’s first-mover advantage and innovative approach position it to potentially become one of the most significant financial institutions of the emerging Bitcoin-based economy.